What's Affecting Markets Today

Asia-Pacific markets delivered a mixed performance on Monday following Wall Street’s sharpest decline of the year last Friday, as U.S. economic data signaled slowing growth and persistent inflation.

In South Korea, the Kospi fell 0.62%, while the small-cap Kosdaq declined 0.74%. Hong Kong’s Hang Seng index edged 0.2% higher, extending gains after reaching a three-year high in the previous session. Mainland China’s CSI300 index slipped 0.13% in volatile trading. Japanese markets remained closed for a public holiday.

Singapore is set to release its January inflation data later in the day. A Reuters poll forecasts headline inflation at 2.15% year-on-year, up from 1.60% in December. The core inflation rate, which excludes accommodation and private transport costs, is expected to ease to 1.5% from 1.8% in the prior month.

Investors remain cautious amid global economic uncertainties, with attention on regional inflation trends and potential monetary policy shifts in the coming weeks.

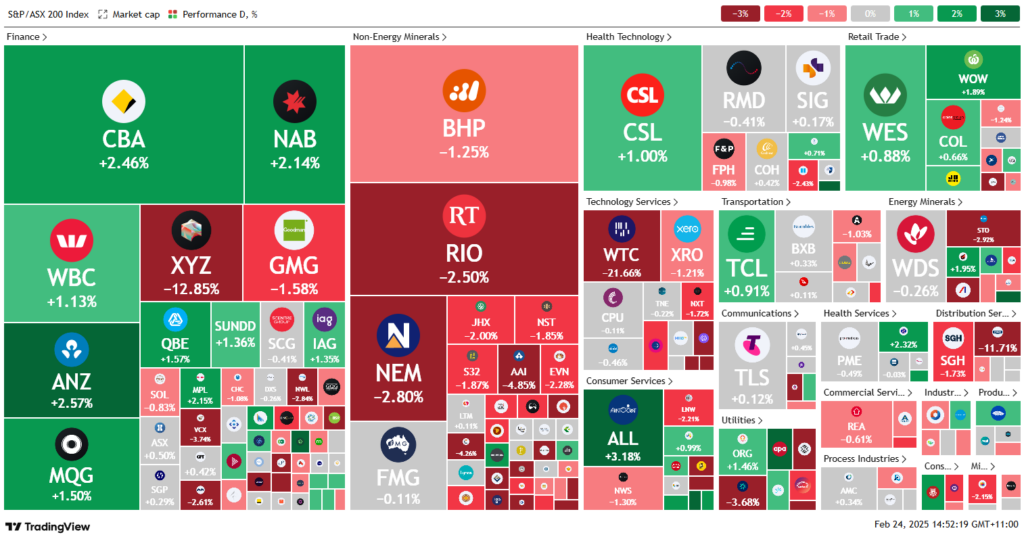

ASX Stocks

ASX 200 - 8,308.6 (+0.10%)

The S&P/ASX 200 edged 0.1% higher to 8301.80 on Monday, recovering from early losses as bargain hunters drove a rebound in financial stocks. The index opened lower amid broad selling but reversed course by early afternoon, with six of 11 sectors advancing, led by utilities.

Banking and insurance stocks led the recovery after last week’s sharp declines. The big four banks gained over 1%, with CBA rising 1.9%. Insurers IAG and QBE climbed 1.5% and 1.9%, respectively. Tech stocks underperformed, with WiseTech Global plunging 22.1% following the resignation of its chairman and three directors.

Among key movers, Domain fell 0.5% after last week’s 40% surge on a CoStar takeover bid. Perpetual lost 3.9%, confirming its deal with KKR was terminated. Ampol dropped 2.2% after a 68% profit slump, while APA Group jumped 6.8% on reaffirmed earnings. NIB Holdings surged 14.5% despite profit pressures, while Reece tumbled 11.4% on declining revenue.

Santos (-2.7%) and Vicinity Centres (-3.7%) traded ex-dividend.

Leaders

NHF – Nib Holdings Ltd (+14.23%)

EVT – EVT Ltd (+11.55%)

APA – APA Group (+7.34%)

NEU – Neuren Pharma (+5.46%)

ING – Inghams Group Ltd (+4.86%)

Laggards

WTC – WiseTech Global Ltd (-21.94%)

PRN – Perenti Ltd (-15.76%)

IRE – Iress Ltd (-15.59%)

XYZ – Block, Inc (-12.69%)

REH – Reece Ltd (-11.16%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!