What's Affecting Markets Today

Asia-Pacific markets declined Thursday as investors assessed U.S. President Donald Trump’s proposed tariffs on autos, semiconductors, and pharmaceutical imports, alongside concerns that the Federal Reserve may keep interest rates elevated longer than expected. Trump indicated the tariffs could take effect as early as April 2 but did not specify whether they would be country-specific or broad-based.

Mainland China’s CSI 300 opened 0.37% lower, while Hong Kong’s Hang Seng Index dropped 1.13%. Japan’s Nikkei 225 slid 1.19%, with the broader Topix falling 1.06%.

In South Korea, the Kospi declined 0.53%, while the small-cap Kosdaq slipped 0.17%.

Australia’s S&P/ASX 200 fell 1.39%, marking its fourth consecutive daily decline. The market reaction was exacerbated by Australia’s unemployment rate rising to 4.1% in January, in line with Reuters’ estimates.

Investor sentiment across the region remained cautious, with geopolitical uncertainty and monetary policy concerns weighing on risk appetite. Markets will closely monitor developments in U.S. trade policy and central bank guidance for further direction.

ASX Stocks

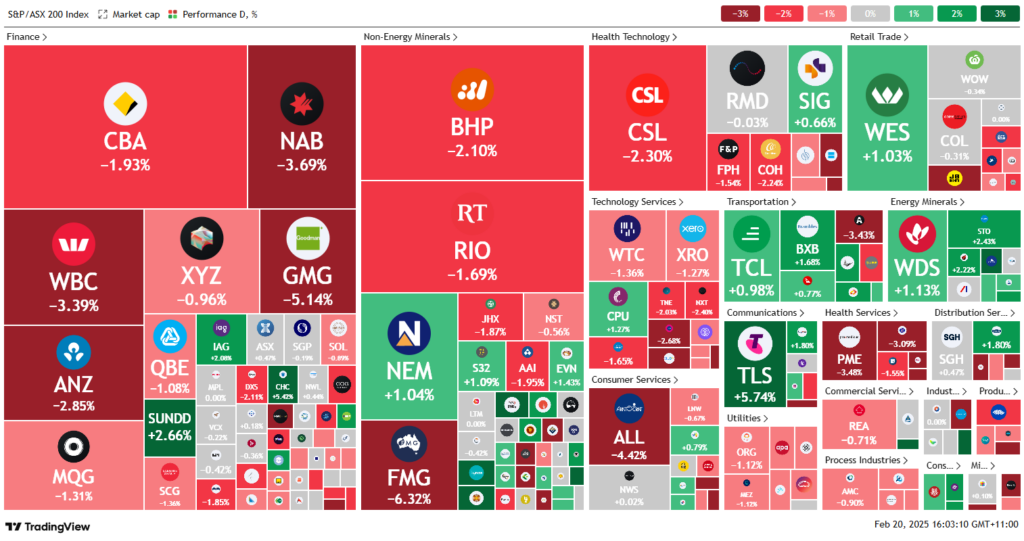

ASX 200 - 8,314.3 (-1.20%)

The Australian sharemarket extended its sell-off on Thursday, with the S&P/ASX 200 Index dropping 1.5% to 8,297, its largest intraday decline in three weeks. A stronger-than-expected 44,000 increase in January employment tempered rate cut expectations, with odds of a May cut falling from 79% to 72%.

Financial stocks led declines as ANZ fell 3.3% following a rise in impaired loans, dragging Westpac (-3.9%), NAB (-4.2%), and CBA (-1.8%) lower. Fortescue dropped 7.6% on a 50% profit decline, weighing on the materials sector. Goodman Group slid 6.3% after announcing a $4 billion capital raise for data centres.

Super Retail Group lost 12.6% amid whistleblower concerns. Magellan (-9.4%) fell on a profit decline, while Aristocrat (-4.2%) announced a $750 million buyback.

On the upside, Charter Hall gained 6% on a profit rebound, Tabcorp rose 3.8% on improved earnings, and Wesfarmers climbed 1.6% on strong retail sales.

Meanwhile, WiseTech entered a trading halt over governance issues, and Telstra surged on solid earnings and a share buyback announcement.

Leaders

NAN – Nanosonics Ltd (+22.83%)

MP1 – Megaport Ltd (+17.35%)

MAF – MA Financial Group Ltd (+8.07%)

WHC – Whitehaven Coal Ltd (+7.42%)

PLS – Pilbara Minerals Ltd (+6.25%)

Laggards

RDX – Redox Ltd (-20.53%)

SUL – Super Retail Group Ltd (-12.23%)

MGH – Maas Group Holdings Ltd (-11.22%)

SKC – Skycity Entertainment Group Ltd (-11.03%)

MFG – Magellan Financial Group Ltd (-9.85%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!