What's Affecting Markets Today

Asia-Pacific markets mostly advanced on Tuesday, buoyed by Chinese President Xi Jinping’s remarks supporting the private sector.

Australia’s S&P/ASX 200 fell 0.58% after the Reserve Bank of Australia delivered a 25-basis-point rate cut to 4.1%, its first reduction in over four years. The Australian dollar strengthened 0.17% to US$0.6342. Australian 10-year government bond yields dropped nearly 20 basis points since January 13, reaching 4.45%.

Japan’s Nikkei 225 rose 0.66%, while the Topix index gained 0.61%. South Korea’s Kospi added 0.59%, and the small-cap Kosdaq edged 0.15% higher. Mainland China’s CSI 300 reversed losses to rise 0.4%.

Hong Kong’s Hang Seng Index surged 2.05%, while its tech index rebounded 3.04%, recovering from Monday’s losses following Xi’s remarks at a rare closed-door symposium.

Indian markets opened lower, with the Nifty 50 down 0.2% and the BSE Sensex slipping 0.15% after an eight-day losing streak.

Singapore will unveil its first budget under Prime Minister Lawrence Wong, with analysts anticipating measures to support households and businesses ahead of November’s general election.

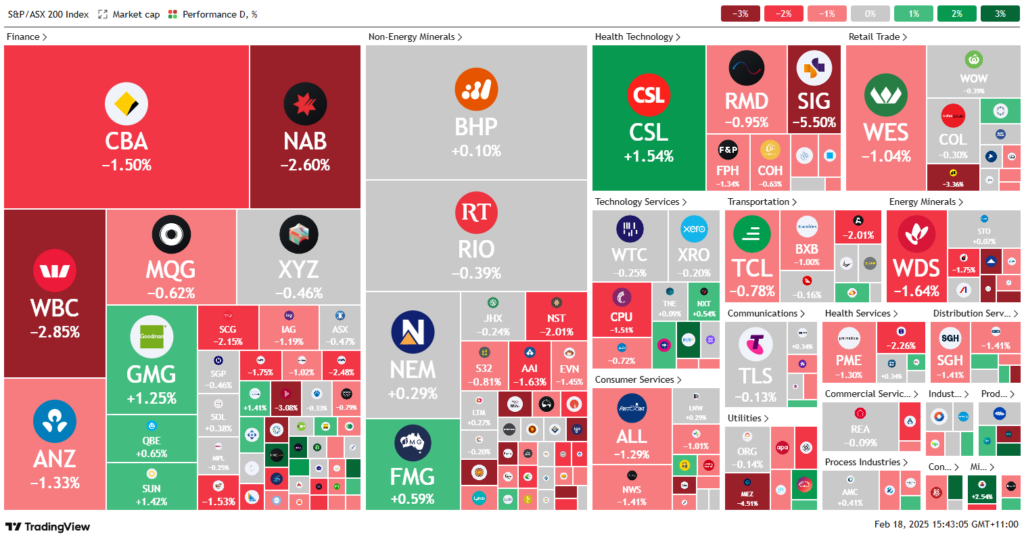

ASX Stocks

ASX 200 - 8,469.4 (-0.80%)

The Australian sharemarket extended losses on Tuesday as interest-rate-sensitive sectors sold off following the Reserve Bank of Australia’s widely expected 25-basis-point rate cut to 4.1 per cent—the first reduction since 2020.

The S&P/ASX 200 fell 0.5% (46.51 points) to 8490.60, while the Australian dollar slipped to US63.44¢ after reaching a two-month high on Monday.

Financial stocks declined as traders anticipated the RBA’s decision. Commonwealth Bank dropped 1.3%, Westpac fell 2.6%, and NAB lost 1.6%. Consumer discretionary stocks declined 0.7%, while real estate stocks pared losses but remained down 0.4%.

Woodside Energy fell 1.9% after warning its final dividend could fall short by 20%. Challenger plunged 10.4%, despite a 12% rise in net profit.

Gains moderated losses, with Hub24 rising 5.8% on a 54% profit surge. HMC Capital jumped 11.9% after reporting a 45% increase in assets under management. Judo Bank gained 9.6%, lifting margin guidance. Aurizon rose 1.6% as it reconsidered splitting its rail businesses.

Leaders

HMC – HMC Capital Ltd (+10.40%)

JDO – Judo Capital Holdings Ltd (+9.30%)

IPX – Iperionx Ltd (+7.96%)

SSM – Service Stream Ltd (+5.63%)

HUB – HUB24 Ltd (+5.21%)

Laggards

HGH – Heartland Group Holdings Ltd (-13.85%)

CGF – Challenger Ltd (-9.14%)

BAP – Bapcor Ltd (-7.55%)

MIN – Mineral Resources Ltd (-6.31%)

PLS – Pilbara Minerals Ltd (-5.86%)