What's Affecting Markets Today

Asia-Pacific markets traded mostly higher on Monday as investors assessed Japan’s fourth-quarter GDP data and awaited key central bank decisions across the region this week.

Japan’s Nikkei 225 hovered near the flatline, while the Topix rose 0.29%. South Korea’s Kospi added 0.18%, with the Kosdaq gaining 1.2%. Preliminary government data showed Japan’s economy expanded 2.8% on an annualized basis in Q4, surpassing Reuters’ forecast of 1%. The Japanese yen strengthened to 151.95 per U.S. dollar.

Hong Kong’s Hang Seng Index climbed 0.23%, while the Hang Seng Tech Index added 0.35%. Mainland China’s CSI 300 was unchanged. Thailand’s GDP grew 3.2% year-on-year in Q4, missing Reuters’ estimate of 3.9%, while annual growth stood at 2.5%.

Australia’s S&P/ASX 200 fell 0.64% ahead of the Reserve Bank of Australia’s two-day policy meeting, which could signal an interest rate cut on Tuesday. Indonesia and New Zealand are also set to announce their monetary policy decisions on Wednesday.

ASX Stocks

ASX 200 - 8,555.8 (+0.20%)

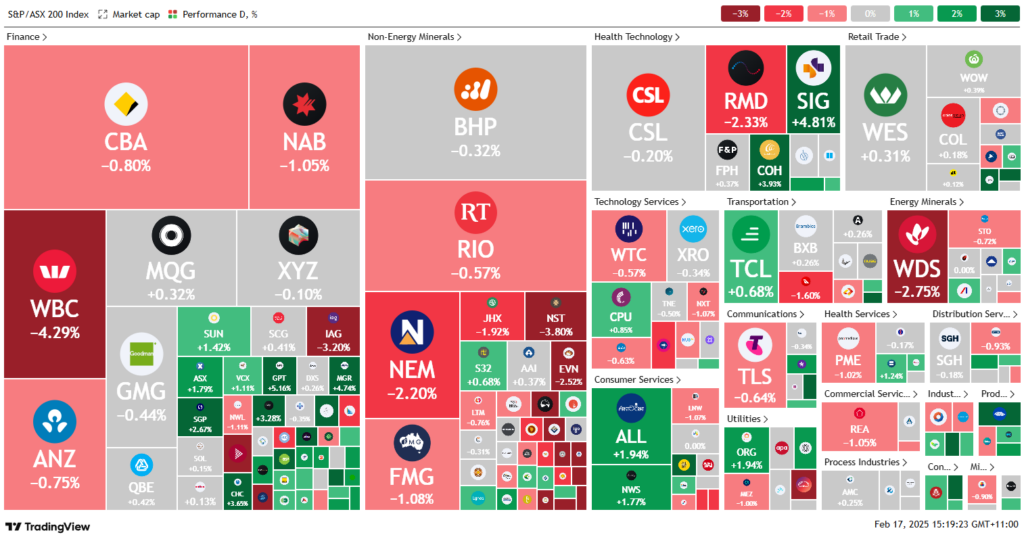

The Australian sharemarket declined on Monday, with banks leading losses after underwhelming earnings reports from Westpac and Bendigo Bank. The S&P/ASX 200 Index fell 0.6% (54.60 points), retreating from Friday’s record high of 8555.8.

Financials were the weakest sector, with Bendigo and Adelaide Bank plunging 16.5%, its worst day on record, following a lower net interest margin. Westpac dropped 5% after reporting a 9% decline in first-quarter net profit to $1.7 billion. Other major banks followed, with NAB, ANZ, and CBA losing 1.2%, 1%, and 1%, respectively. Insurers also fell after Opposition Leader Peter Dutton proposed breaking them up ahead of the federal election, sending IAG down 3.2%.

Gold miners declined as the metal corrected from overbought levels, with Northern Star Resources and Genesis Minerals losing 4.1% and 4.6%, respectively.

Conversely, BlueScope surged 11.3% on stronger U.S. steel prices, and Star Entertainment jumped 10% after securing a $650 million refinancing offer. GPT gained 5.7%, and Perpetual added 1.3% following a takeover bid from KKR.

Audinate (ASX: AD8) surged 31% to $9.92 despite weak H1 results, as investors anticipate recovery from OEM inventory overstocking by FY26.

Leaders

A2M The a2 Milk Company (+20.17%)

BSL BlueScope Steel (+12.30%)

VUL Vulcan Energy Resources (+8.93%)

ZIP ZIP Co (+8.81%)

IPX Iperionx (+7.02%)

Laggards

BEN Bendigo and Adelaide Bank (-16.47%)

VSL Vulcan Steel (-5.88%)

SPR Spartan Resources (-5.76%)

PNR Pantoro (-5.00%)

ASB Austal (-4.56%)