What's Affecting Markets Today

Asia-Pacific markets advanced on Thursday, diverging from Wall Street, which fell overnight after stronger-than-expected U.S. inflation data dampened expectations of Federal Reserve policy easing.

Australia’s S&P/ASX 200 gained 0.15%, reaching a record intraday high of 8,575.2, surpassing its previous peak from January 31. Japan’s Nikkei 225 climbed 1.1%, while the Topix added 0.91%. South Korea’s Kospi rose 0.71%, with the Kosdaq trading flat. Hong Kong’s Hang Seng Index gained 0.58%, while China’s CSI 300 remained unchanged.

In the U.S., the S&P 500 declined 0.27% to 6,051.97, and the Dow Jones Industrial Average fell 225.09 points (0.5%) to 44,368.56. The Nasdaq Composite edged 0.03% higher to 19,649.95. Bond yields spiked as the latest CPI report signaled that the Fed may delay rate cuts or even consider a hike.

Fed Chair Jerome Powell acknowledged progress in lowering inflation but emphasized that the 2% target remains unmet. Meanwhile, Indian PM Narendra Modi is visiting the U.S. for discussions with President Donald Trump, focusing on reciprocal tariffs and artificial intelligence policies.

ASX Stocks

ASX 200 - 8,521.1 (+0.40%)

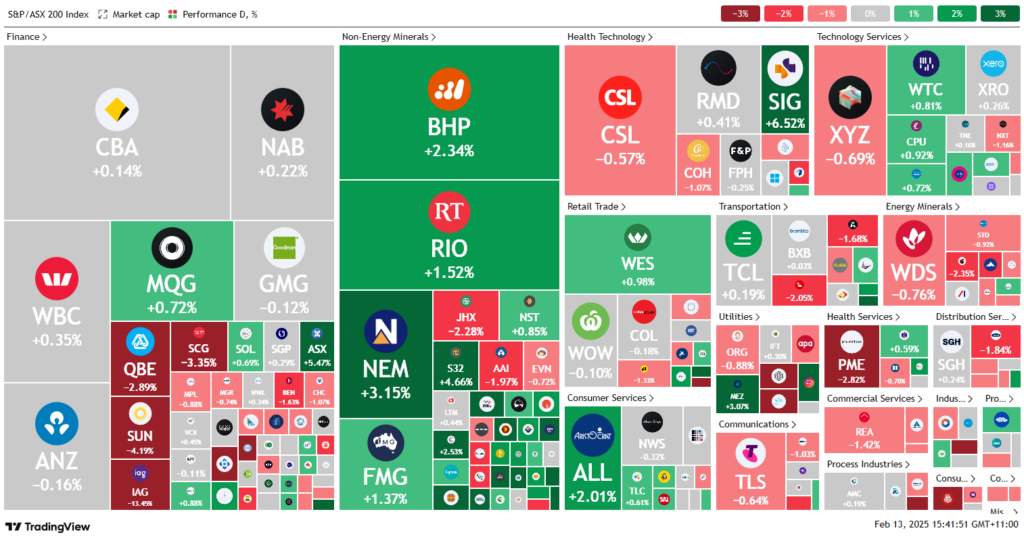

The Australian sharemarket reached a new peak on Thursday, driven by strong earnings results and the high-profile debut of Chemist Warehouse. The S&P/ASX 200 rose 0.2% to 8554.20, nearing its intraday record. Despite gains in materials stocks, only three of eleven sectors advanced. The All Ordinaries also added 0.2%.

Sigma Healthcare surged 6.3% on its first trading day as a merged entity with Chemist Warehouse. ASX Ltd climbed 4.6%, benefiting from higher trading volumes, while South32 gained 3.7%. Major miners lifted the index, with BHP up 2.4%, Fortescue gaining 1.7%, and Rio Tinto adding 1.4%. Commonwealth Bank reached a record high, rising 0.2%, while NAB advanced 0.8%.

Among movers, IAG plunged 12% following a UBS report on heightened competition. Pro Medicus fell 4% despite strong earnings, while Temple & Webster soared 13.3% on robust sales growth. Domain jumped 9.16% as former REA Group CEO Greg Ellis was appointed interim chief. Downer EDI declined 1.4% due to weaker revenue and one-off costs.

Leaders

TPW – Temple & Webster Group Ltd (+12.50%)

DHG – Domain Holdings Australia Ltd (+7.69%)

PNR – Pantoro Ltd (+7.41%)

SIG – Sigma Healthcare Ltd (+6.52%)

LTR – Liontown Resources Ltd (+6.30%)

Laggards

IAG – Insurance Australia Group Ltd (-13.00%)

GNC – Graincorp Ltd (-6.22%)

AGL – AGL Energy Ltd (-6.05%)

ORA – Orora Ltd (-5.77%)

TWE – Treasury Wine Estates Ltd (-5.61%)