What's Affecting Markets Today

Asia-Pacific markets mostly gained on Wednesday as investors assessed the impact of U.S. President Donald Trump’s tariff policies on regional economies. Meanwhile, Federal Reserve Chair Jerome Powell reiterated the Fed’s commitment to controlling inflation, signaling no urgency to cut interest rates.

Australia’s S&P/ASX 200 rose 0.31%, while Japan’s Nikkei 225 added 0.21% after reopening from a holiday. However, the Topix edged 0.22% lower. South Korea’s Kospi gained 0.29%, though the Kosdaq slipped 0.36%. Hong Kong’s Hang Seng Index jumped 2.05%, and China’s CSI 300 advanced 0.16%.

India is set to release January inflation data, and SoftBank Group will report Q3 earnings later today.

On Wall Street, markets closed mixed overnight. The S&P 500 inched up 0.03% to 6,068.50, while the Nasdaq Composite fell 0.36% to 19,643.86. The Dow Jones rose 123.24 points (0.28%) to 44,593.65.

Powell’s testimony comes amid policy uncertainty in Washington, as Trump advocates tariffs on trading partners while sending mixed signals regarding the Fed’s stance on interest rates.

ASX Stocks

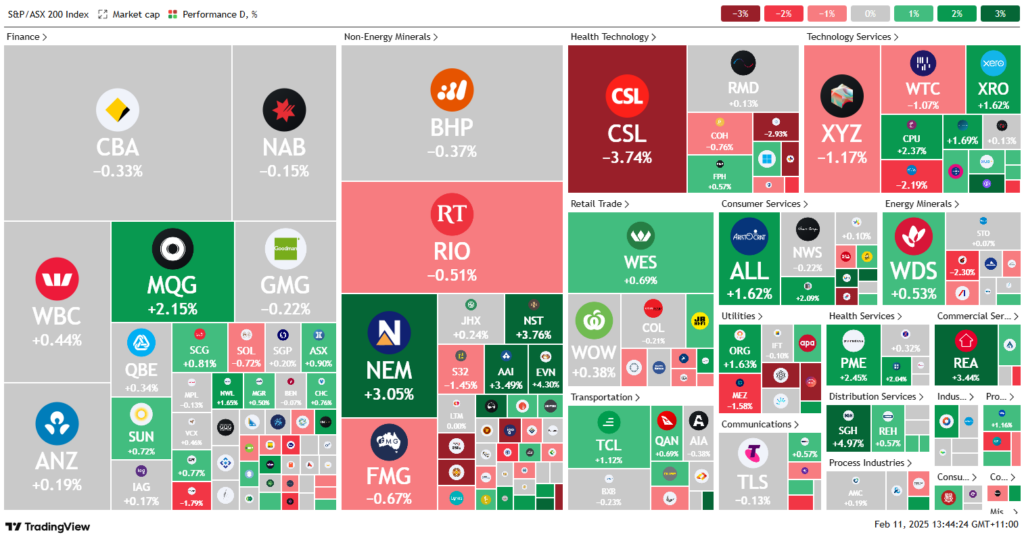

ASX 200 - 8,521.1 (+0.40%)

The Australian sharemarket advanced on Wednesday, driven by a rally in Commonwealth Bank (CBA) following stronger-than-expected earnings. The S&P/ASX 200 rose 27.5 points (0.3%) to 8511.5 by mid-afternoon, with six of eleven sectors gaining.

CBA shares climbed 1.8%, buoyed by a half-year profit of $5.13 billion, exceeding analyst forecasts. This lifted National Australia Bank (NAB) and Westpac (WBC) by over 1%, while ANZ (ANZ) added 0.3%.

Among other earnings-driven gains, Suncorp (SUN) rose 1.3% on a $1.1 billion net profit, bolstered by the sale of its banking unit. Computershare (CPU) surged 13%, after hiking its dividend 12.5% to 45¢ per share.

In resources, Brent Crude neared $US77 per barrel, supporting Woodside (WDS) (+1%) and Santos (STO) (+0.9%).

Evolution Mining (EVN) gained 1.3% on record EPS and a 277% surge in net profit, while Bravura Solutions (BVS) soared 21% after declaring a special dividend. Conversely, Amotiv (AMV) fell 7.7% after reporting a 36% profit drop.

Leaders

AOV – Amotiv Ltd (-7.44%)

WA1 – WA1 Resources Ltd (-5.57%)

PRU – Perseus Mining Ltd (-4.69%)

TAH – Tabcorp Holdings Ltd (-4.65%)

MP1 – Megaport Ltd (-4.29%)

Laggards

BVS – Bravura Solutions Ltd (+20.78%)

CPU – Computershare Ltd (+15.02%)

GDG – Generation Dev Group (+8.39%)

IMD – IMDEX Ltd (+5.85%)

BOT – Botanix Pharma (+5.05%)