What's Affecting Markets Today

Asia-Pacific markets traded mixed on Tuesday as investors assessed the impact of U.S. President Donald Trump’s latest tariff measures. On Monday, Trump signed an order imposing 25% tariffs on steel and aluminum imports into the U.S., adding to global trade tensions.

Australia’s S&P/ASX 200 hovered around the flatline, while South Korea’s Kospi advanced 0.72%, with the small-cap Kosdaq up 0.35%. Hong Kong’s Hang Seng Index declined 0.56%, and China’s CSI 300 slipped 0.36%, reflecting cautious sentiment in mainland markets.

Japan’s markets were closed for a holiday. In Southeast Asia, Singapore’s Straits Times Index fell 0.44%, retracing after hitting an all-time intraday high of 3,910.12 on Monday.

In India, the Nifty 50 declined 0.32%, while the BSE Sensex traded near the flatline. Market participants continued to weigh the potential economic ramifications of heightened U.S. trade restrictions, which could disrupt supply chains and impact export-driven economies in the region.

ASX Stocks

ASX 200 - 8,489.5 (+0.10%)

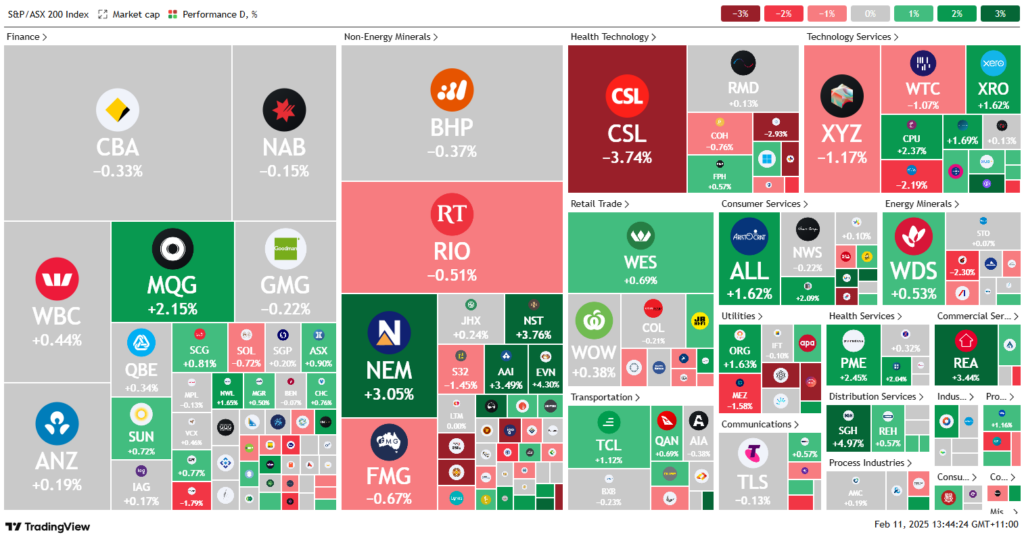

The Australian sharemarket turned lower on Tuesday afternoon as gains from upbeat earnings were offset by a sharp sell-off in CSL. The S&P/ASX 200 was flat at 8483.50 by mid afternoon, while the All Ordinaries Index edged 0.05% higher. Industrials and technology stocks led gains, with nine of the ASX 200’s eleven sectors in positive territory.

Macquarie Group rose 1.8% after reaffirming its full-year guidance, while Seven West Media jumped 7.3%, despite a 66% drop in half-year profit, as it forecast a recovery in the advertising market. The bullish outlook lifted Nine Entertainment 12.5%.

Ramsay Health Care climbed 2.2%, even as it flagged a £151 million ($305 million) impairment. However, the healthcare sector dragged on the index as CSL slumped 4.7%, citing weaker US immunisation rates.

Gold miners surged as the metal hit new highs, with Evolution Mining up 6.1% and De Grey Mining gaining 4.9%. SGH added 5.2% after a dividend hike, while Charter Hall Social Infrastructure REIT soared 8% on upgraded distribution guidance.

Leaders

NEC – Nine Ent (+11.48%)

CQE – Charter Hall Social Infra (+7.75%)

PNR – Pantoro Ltd (+7.69%)

EVN – Evolution Mining Ltd (+6.24%)

DEG – De Grey Mining Ltd (+5.83%)

Laggards

LTR – Liontown Resources Ltd (-6.82%)

ASB – Austal Ltd (-6.36%)

CU6 – Clarity Pharmaceuticals Ltd (-5.50%)

CEN – Contact Energy Ltd (-5.13%)

WA1 – WA1 Resources Ltd (-4.83%)