What's Affecting Markets Today

Asia-Pacific markets traded mixed on Friday as investors awaited India’s interest rate decision and assessed Japan’s household spending data.

Australia’s S&P/ASX 200 traded flat, while Japan’s Nikkei 225 fell 0.44% and the Topix lost 0.39%. Japan’s household spending surged 2.7% year-on-year in December, significantly exceeding Reuters’ 0.2% forecast.

South Korea’s Kospi dipped 0.17%, while the Kosdaq was flat. Hong Kong’s Hang Seng Index gained 0.6%, and China’s CSI 300 advanced 0.77%. Investors are watching the Reserve Bank of India, which is expected to cut its benchmark repo rate by 25 basis points to 6.25%.

U.S. markets posted gains overnight. The S&P 500 rose 0.36% to 6,083.57, marking a third consecutive session of gains, while the Nasdaq climbed 0.51% to 19,791.99. The Dow Jones fell 0.28%, closing at 44,747.63.

Investors are focused on January’s U.S. jobs report, due tonight, with Dow Jones economists forecasting 169,000 new jobs, down from December’s 256,000.

ASX Stocks

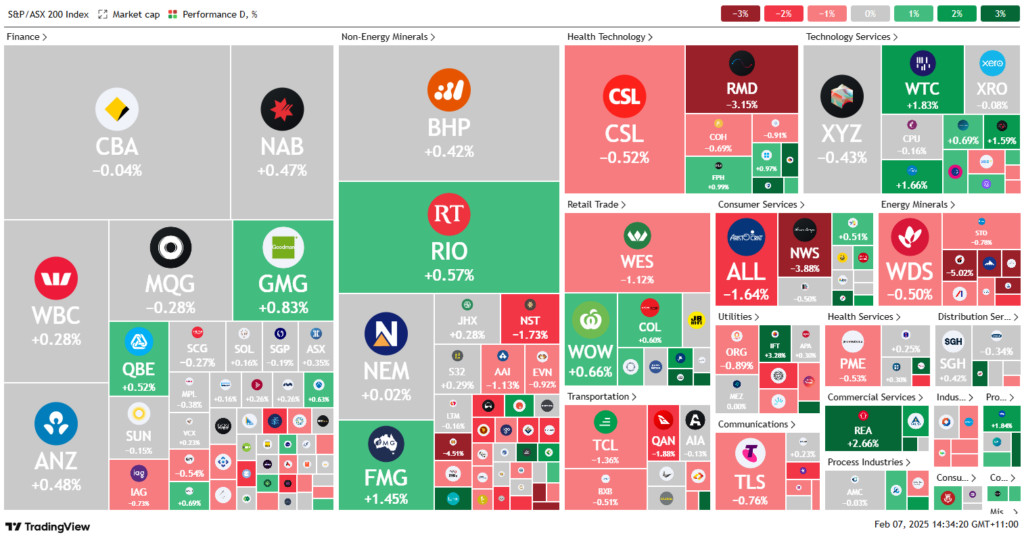

ASX 200 - 8,517.6 (-0.01%)

The S&P/ASX 200 hovered around 8519.3 on Friday afternoon, down 1.4 points, after a volatile session as traders awaited the US January jobs report to gauge the Federal Reserve’s rate cut trajectory. The index remains within 25 points of a record high, with six of 11 sectors gaining, while energy stocks led declines.

Banks initially retreated but pared losses, with Commonwealth Bank hitting a record for the second consecutive day before slipping 0.1%. NAB and Westpac gained 0.4% and 0.3%, respectively. Energy stocks declined, tracking Brent crude below $US75 per barrel, with Santos down 0.7% and Woodside 0.6%. Coal miners fell, with Yancoal down 3.8% and Whitehaven Coal 4.3%.

Corporate updates drove sharp stock moves: Domino’s Pizza surged 22.2% after announcing the closure of 205 underperforming stores in Japan. Nick Scali jumped 15.3% on a strong earnings beat, and Sigma Healthcare soared 54.6% after upgrading guidance ahead of its Chemist Warehouse merger. News Corp fell 3.8% on profit-taking, despite a bullish Morgan Stanley call.

Leaders

DMP – Domino’s Pizza Enterprises Ltd (+22.22%)

NCK – Nick Scali Ltd (+16.27%)

CKF – Collins Foods Ltd (+14.71%)

SNZ – Summerset Group Holdings Ltd (+5.93%)

MSB – Mesoblast Ltd (+5.82%)

Laggards

MMS – McMillan Shakespeare Ltd (-9.21%)

LTR – Liontown Resources Ltd (-4.75%)

PLS – Pilbara Minerals Ltd (-4.72%)

BPT – Beach Energy Ltd (-4.51%)

KAR – Karoon Energy Ltd (-4.13%)