What's Affecting Markets Today

Asia-Pacific markets opened higher Thursday, mirroring Wall Street’s gains as investors brushed off trade concerns and weak U.S. tech earnings.

Australia’s S&P/ASX 200 rose 0.9%, while Japan’s Nikkei 225 and Topix gained 0.39% and 0.33%, respectively. South Korea’s Kospi climbed 0.45%, and the Kosdaq advanced 0.8%. Hong Kong’s Hang Seng Index edged up 0.31%, while China’s CSI 300 added 0.14%. Meanwhile, India’s central bank is expected to cut interest rates on Friday to support economic growth.

U.S. markets extended gains for a second session. The Dow Jones Industrial Average rose 317.24 points (0.71%) to 44,873.28, driven by a surge in Nvidia. The S&P 500 climbed 0.39% to 6,061.48, while the Nasdaq Composite edged up 0.19% to 19,692.33.

Nvidia jumped over 5% after Super Micro Computer announced full production of its AI data center powered by Nvidia’s Blackwell platform. Super Micro shares gained 8% following the news, boosting broader sentiment in the technology sector.

ASX Stocks

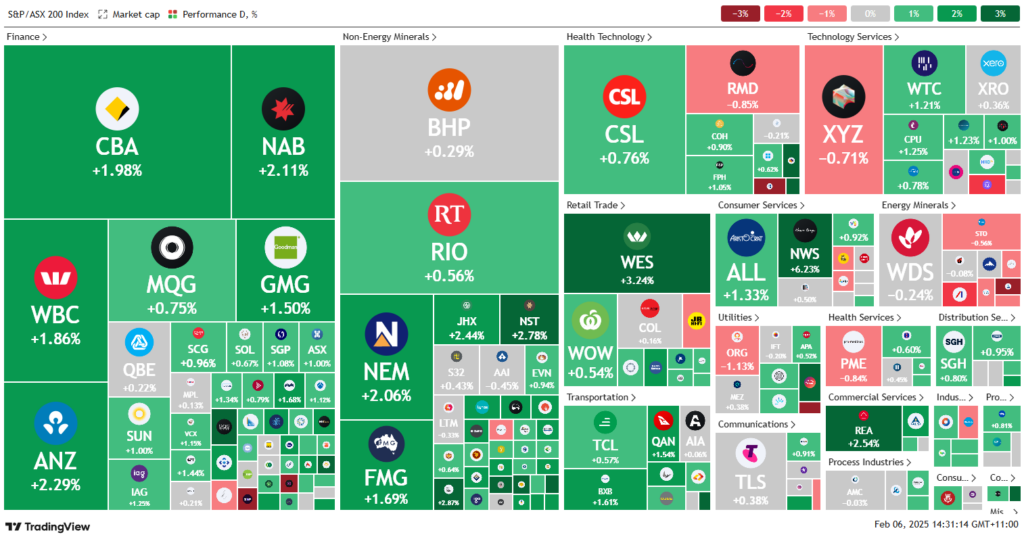

ASX 200 - 8,512.9 (+1.10%)

The S&P/ASX 200 gained 1.1%, or 91 points, to 8,507.9 by mid afternoon, approaching its all-time high of 8,532.3, as nine of eleven sectors advanced. Investors welcomed a pause in U.S. tariff discussions, with President Donald Trump shifting focus to Middle East policy.

Brent crude dipped below $75 per barrel before stabilizing, impacting energy stocks. Woodside fell 0.3%, while Santos declined 0.6%, pressured by a surge in U.S. crude stockpiles.

Consumer discretionary and financial stocks led gains. Wesfarmers surged 3.3% after a UBS upgrade. The big four banks rallied: Commonwealth Bank rose 1.9%, NAB gained 2.1%, ANZ added 2.3%, and Westpac climbed 1.9%.

In corporate news, News Corp jumped 6.3% on record real estate revenues. PEXA slumped 4.4% after revising its impairment forecast. Magellan advanced 1.9% following stable fund flows. Beach Energy slid 3.3% after narrowing guidance. Computershare rose 1.2% as Morgan Stanley upgraded its price target on improved earnings outlook.

Leaders

MYR – Myer Holdings Ltd (-5.06%)

PXA – Pexa Group Ltd (-3.89%)

GNE – Genesis Energy Ltd (-3.62%)

CU6 – Clarity Pharmaceuticals Ltd (-3.57%)

BPT – Beach Energy Ltd (-3.47%)

Laggards

NWS – News Corporation (+6.29%)

WA1 – WA1 Resources Ltd (+5.70%)

OPT – Opthea Ltd (+5.46%)

GDG – Generation Development (+4.92%)

SPR – Spartan Resources Ltd (+4.61%)