What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Assess China’s Tariff Response

Asia-Pacific markets traded mixed on Wednesday following Wall Street’s overnight gains, as investors weighed the impact of China’s retaliatory tariffs against the U.S. after resuming trade post-Lunar New Year.

Morningstar Asia equity analyst Kai Wang described China’s tariffs as “largely symbolic,” impacting only 12% of total U.S. imports. He noted that while immediate risks appear lower than expected, uncertainty remains due to Trump’s unpredictable trade policies, keeping volatility risks in play for the next four years.

Mainland China’s CSI 300 Index opened higher but reversed to decline 0.21%. The country’s Caixin Services PMI fell to 51.0 in January, down from 52.2 in December, indicating a slowdown in services activity.

Elsewhere, Hong Kong’s Hang Seng Index dropped 0.69%, giving up prior gains. Japan’s Nikkei 225 edged 0.18% lower, while the Topix index was flat. South Korea’s Kospi gained 1.19%, and the Kosdaq rose 1.39%, supported by stronger-than-expected January CPI data (+2.2% YoY, +0.7% MoM).

ASX Stocks

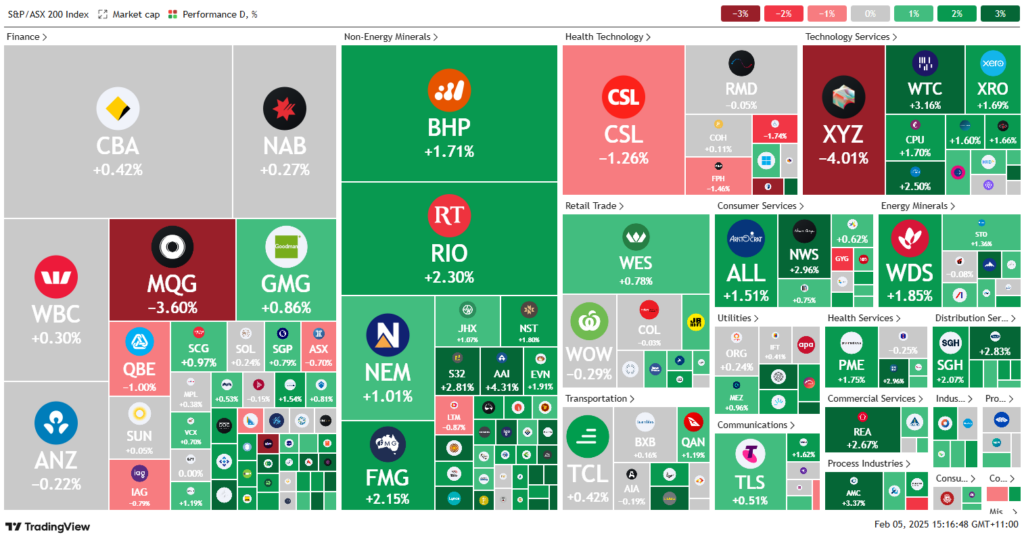

ASX 200 - 8,427.1 (+0.60%)

Australian Shares Rise as Mining Stocks Gain on China’s Tariff Response

Australian shares advanced on Wednesday as China’s measured response to U.S. tariffs lifted mining stocks. The S&P/ASX 200 gained 0.6%, or 47.6 points, to 8421.6 by mid afternoon, recovering from recent declines. The All Ordinaries Index rose 0.7%, with nine of the 11 sectors trading higher.

Investor sentiment improved after Beijing imposed tariffs of 15% on coal and LNG and 10% on oil, fueling expectations of higher prices. Coronado Global Resources rose 4.1%, Whitehaven Coal added 3%, and Stanmore Resources climbed 2.8%. Champion Iron surged 4%, while BHP gained 2% as iron ore prices held above $US104,000 per metric ton.

Brent crude rebounded to $US76.25 per barrel, boosting Woodside (+1.5%) and Santos (+1.4%).

In corporate moves, Pinnacle hit a record $27.11 (+4.3%) on strong half-year results. Amcor rose 3% after meeting earnings expectations. Insignia jumped 7.1% on a $4.60 per share bid from Brookfield. Meanwhile, Cleanaway fell 0.5% after a fire forced the closure of its St Marys facility.

Leaders

MSB – Mesoblast Ltd (-7.05%)

XYZ – Block, Inc (-4.10%)

MQG – Macquarie Group Ltd (-3.44%)

ZIP – ZIP Co Ltd (-2.58%)

VSL – Vulcan Steel Ltd (-2.47%)

Laggards

CU6 – Clarity Pharmaceuticals Ltd (+8.71%)

IFL – Insignia Financial Ltd (+6.94%)

NXL – NUIX Ltd (+5.71%)

BWP – BWP Trust (+5.32%)

WA1 – WA1 Resources Ltd (+4.58%)