What's Affecting Markets Today

Asian Markets Mostly Rise as Investors Assess Big Tech Earnings

Asian markets traded higher on Friday, tracking Wall Street’s overnight gains amid ongoing assessments of Big Tech earnings.

Japan’s Nikkei 225 edged up 0.14%, while the Topix index remained flat. Tokyo’s core consumer price index (ex-fresh food) rose 2.5% YoY in January, in line with expectations. The December unemployment rate fell to 2.4%, missing forecasts of 2.5%. Meanwhile, retail sales climbed 3.7% YoY, and industrial output grew 0.3% MoM, rebounding from a 2.2% decline.

South Korea’s Kospi dropped 1.04%, and the Kosdaq fell 0.58%, as markets reopened after a four-day break.

Australia’s S&P/ASX 200 advanced 0.56%. The producer price index rose 3.7% YoY in the December 2024 quarter, according to the Australian Bureau of Statistics.

Hong Kong and China’s markets remained closed for the Lunar New Year holiday.

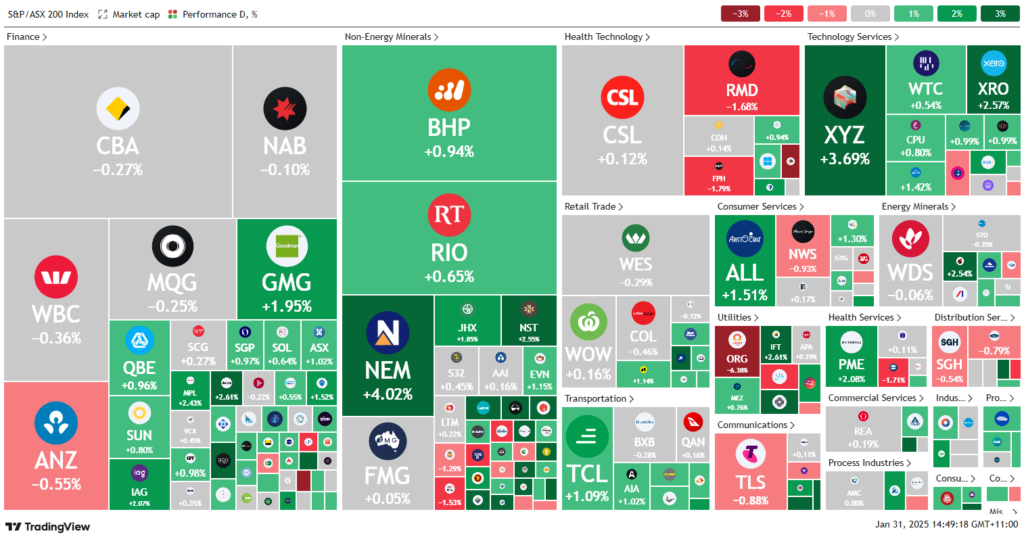

ASX Stocks

ASX 200 - 8,524.8 (+0.40%)

Key Highlights:

ASX Gains on Mining, Real Estate, and Tech Rally

The Australian share market extended its rally on Friday, with the S&P/ASX 200 rising 0.3% and the All Ordinaries Index up 0.4%, marking the biggest weekly gain in a month. The Australian dollar softened to US62.23¢.

Mining stocks rebounded as investor concerns over China tariffs eased. Bargain hunting in the materials sector, down 9.6% over the past year, drove strong buying. BHP climbed 1.1%, Rio Tinto gained 0.7%, and Sandfire Resources surged 5%, leading the ASX 200.

Real estate stocks advanced on expectations of a potential February rate cut, with Goodman Group rising 2%. In technology, WiseTech added 0.8%, while Xero gained 2.4%.

Sector movers:

- Utilities fell 3.3%, led by Origin Energy, down 5.5%, after cutting its FY25 APLNG production forecast.

- Simonds Group soared 47% after acquiring Dennis Family Homes for $10M.

- PointsBet slumped 13.3% on a profit downgrade.

- Lendlease rose 2% after selling Capella Capital for $235M.

- Magellan fell 8% amid a senior leadership shake-up.

Leaders

OPT – Opthea Ltd (+6.49%)

IMD – IMDEX Ltd (+6.15%)

NXL – NUIX Ltd (+5.49%)

VAU – Vault Minerals Ltd (+5.48%)

A4N – Alpha Hpa Ltd (+5.46%)

Laggards

MFG – Magellan Financial Group Ltd (-8.44%)

ORG – Origin Energy Ltd (-5.89%)

SIG – Sigma Healthcare Ltd (-4.28%)

NAN – Nanosonics Ltd (-3.09%)

GNE – Genesis Energy Ltd (-2.45%)