What's Affecting Markets Today

Asian markets advanced on Thursday, diverging from Wall Street’s overnight decline as the Federal Reserve held interest rates steady. Several Asia-Pacific markets were closed for the Lunar New Year holiday.

Japan’s Nikkei 225 rose 0.42%, while the Topix gained 0.28% in volatile trading. SoftBank Group fell 0.5% following reports of a potential $25 billion investment in OpenAI. Meanwhile, Japanese tech stocks rallied, with Advantest (+5.12%) and Tokyo Electron (+2.03%) posting strong gains.

Australia’s S&P/ASX 200 climbed 0.7%, extending its rally. Data from the Australian Bureau of Statistics showed export prices rose 3.6% in Q4 2024 but declined 8.6% annually, while import prices edged up 0.2% for the quarter and dropped 1.9% year-on-year.

India’s Nifty 50 rose 0.19%, while the BSE Sensex opened flat.

On Wall Street, the S&P 500 (-0.47%), Nasdaq (-0.51%), and Dow Jones (-0.31%) declined. Nvidia (-4.1%) tumbled after reports surfaced that U.S. officials discussed new restrictions on its chip sales to China.

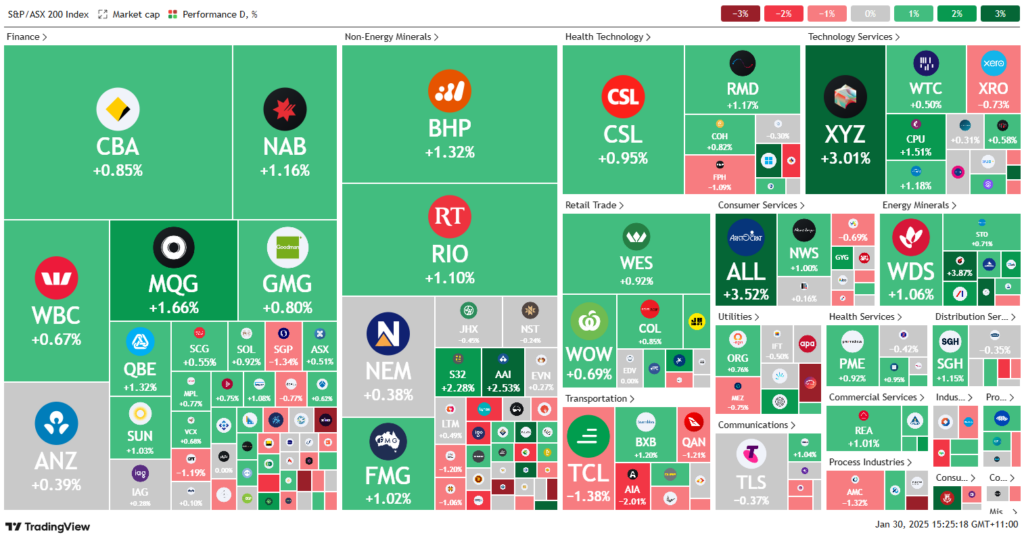

ASX Stocks

ASX 200 - 8,502.4 (+0.70%)

Key Highlights:

The S&P/ASX 200 surged to a record high on Thursday, climbing 0.8% to 8,510.7 by mid afternoon, as investors priced in expectations of an imminent rate cut by the Reserve Bank of Australia. All 11 ASX sectors advanced, led by energy and consumer discretionary stocks.

Despite the Federal Reserve keeping rates unchanged and maintaining a cautious stance on inflation, softer-than-expected Australian inflation data prompted major banks to forecast an RBA rate cut in February. The Australian dollar weakened to US62.36¢.

Energy and mining stocks outperformed: Woodside (+1.1%), Yancoal (+4.0%), and Ampol (+1.8%). Karoon Energy led gains, soaring 7.2% after announcing a $75 million share buyback. Consumer discretionary stocks rose, with Aristocrat Leisure (+3.6%), Harvey Norman (+2.1%), and Wesfarmers (+1.2%) benefiting from rate-cut optimism.

On the downside, Credit Corp Group plunged 11.6% after weaker-than-expected U.S. growth. Magellan (-5.2%) fell on an executive departure, while IGO (-3.4%) and Mineral Resources (-2.4%) declined on weaker earnings.

Leaders

KAR – Karoon Energy Ltd (+7.72%)

NXG – Nexgen Energy (+6.80%)

EMR – Emerald Resources NL (+6.68%)

BOE – Boss Energy Ltd (+4.83%)

PDN – Paladin Energy Ltd (+4.68%)

Laggards

ZIP – ZIP Co Ltd (-24.31%)

CCP – Credit Corp Group Ltd (-10.72%)

CYL – Catalyst Metals Ltd (-7.63%)

MFG – Magellan Financial (-6.77%)

CU6 – Clarity Pharma (-6.67%)