What's Affecting Markets Today

Japanese and Australian equities advanced Wednesday, tracking Wall Street’s overnight recovery, while several Asia-Pacific markets remained closed for the Lunar New Year holiday.

Japan’s Nikkei 225 gained 0.41%, with the Topix up 0.42%, after prior session declines. Bank of Japan minutes revealed discussions on neutral rates and tightening policy amid persistent inflation and labor-driven wage increases. The BOJ recently raised rates 25 basis points to 0.5%, its highest level since 2008.

Australia’s S&P/ASX 200 climbed 0.87%, reversing earlier losses, after data showed inflation rose 0.2% in Q4 and 2.4% annually, below the 2.5% forecast.

In the U.S., major indices recovered from a sell-off triggered by concerns over China’s DeepSeek AI. The S&P 500 rose 0.92% to 6,067.70, led by tech gains, while the Nasdaq Composite surged 2.03%. Dow Jones added 136.77 points (0.31%). Nvidia rebounded nearly 9%, recovering part of its $600 billion loss from the previous session, while Broadcom and Oracle rose 2.6% and 3.6%, respectively.

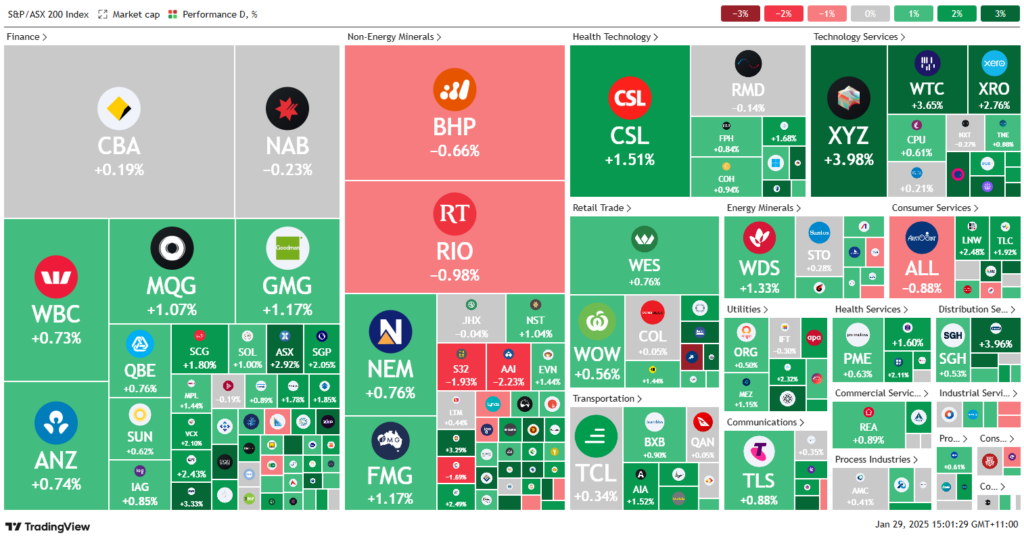

ASX Stocks

ASX 200 - 8,461.3 (+0.70%)

Key Highlights:

Australian equities gained momentum on Wednesday, with the S&P/ASX 200 climbing 0.9% to 8472.3, following softer-than-expected inflation data that bolstered expectations of a February rate cut by the RBA. Eleven of twelve sectors traded higher as major banks, including NAB and RBC, adjusted forecasts in favor of earlier monetary easing.

Technology stocks led gains, mirroring a rebound in US tech after Nvidia surged 8.8% overnight. Locally, WiseTech jumped 4.3%, Xero added 2.6%, and newly listed DigiCo rose 3.3%.

In corporate moves, Adamantem Capital withdrew its takeover bid for Close the Loop, sending shares down 31.4%. Boss Energy surged 9.5% on strong production updates, while Whitehaven Coal rose 1.5% on higher sales. Perseus Mining gained 3.9%, reporting increased gold production despite cost pressures.

Meanwhile, Star Entertainment advanced 13%, announcing the $60 million sale of its Sydney Event Centre to Foundation Theatres as part of its broader asset divestment strategy.

Leaders

BOE – Boss Energy Ltd (+9.16%)

OBM – Ora Banda Mining Ltd (+8.90%)

DYL – Deep Yellow Ltd (+8.13%)

BGL – Bellevue Gold Ltd (+7.92%)

CU6 – Clarity Pharmaceuticals Ltd (+7.41%)

Laggards

PMV – Premier Investments Ltd (-22.52%)

AX1 – Accent Group Ltd (-4.20%)

MYR – Myer Holdings Ltd (-3.91%)

CRN – Coronado Global Inc (-2.65%)

AAI – Alcoa Corporation (-2.13%)