What's Affecting Markets Today

Asia-Pacific markets advanced on Friday, tracking record highs in the S&P 500 after U.S. President Donald Trump urged lower interest rates and cheaper oil prices.

The Bank of Japan raised its policy rate by 25 basis points to 0.5%, the highest since 2008, aligning with economists’ forecasts. Following the decision, the Japanese yen weakened slightly, trading at 155.75 against the dollar. Japan also reported a 16-month high in core inflation at 3% year-on-year for December.

Japan’s Nikkei 225 rose 0.74%, and the Topix gained 0.63%. In Hong Kong, the Hang Seng index climbed 1.63%, while China’s CS1300 index advanced 1.06%. South Korea’s Kospi added 0.64%, and the Kosdaq rose 0.75%.

Singapore’s central bank eased monetary policy as expected, addressing the December increase in core inflation.

Investor sentiment across the region was buoyed by easing monetary signals and favorable global equity trends, with significant gains seen in Hong Kong and Japan’s equity benchmarks. Economic updates reinforced optimism for sustained market performance

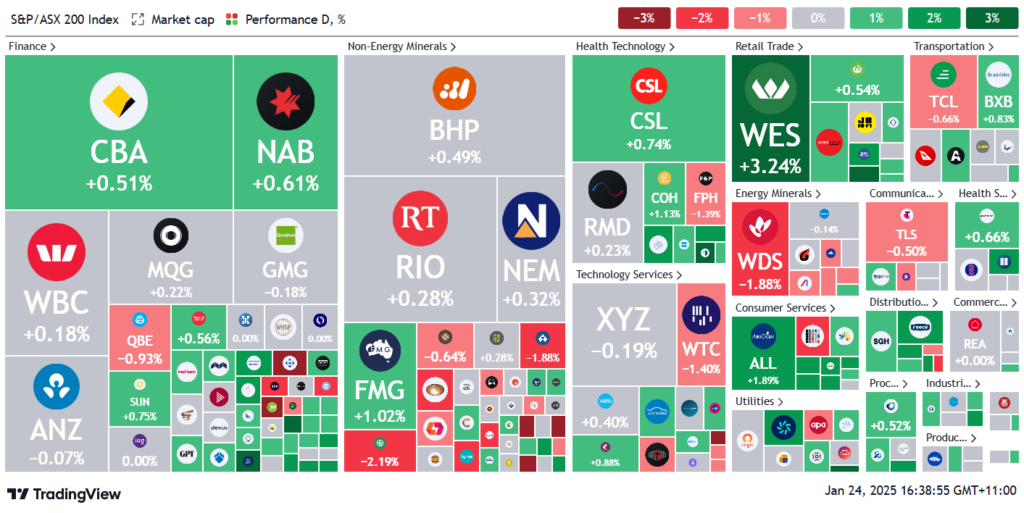

ASX Stocks

ASX 200 - 8,408.9 (+0.35%)

Key Highlights:

Australian shares advanced on Friday, driven by gains in domestic retailers. The S&P/ASX 200 index rose 0.4% (30.1 points) to 8408.8, with nine of the 11 sectors posting gains, led by consumer discretionary stocks. The All Ordinaries index also climbed 0.4%.

Consumer discretionary stocks outperformed, with Wesfarmers rising 3.3% after a Goldman Sachs upgrade to “buy.” Harvey Norman added 3.1%, Aristocrat Leisure gained 1.2%, and Premier Investments surged 5.3%. The major banks also advanced, with Commonwealth Bank and NAB up 0.7%, while Westpac and ANZ saw smaller increases.

Oil producers lagged, tracking weaker crude prices. Woodside fell 1.9%, Santos declined 0.6%, and Beach Energy dropped 1.2%.

In corporate news, Monadelphous Group rose 5% on profit forecasts exceeding expectations. Supply Network added 2.7%, while 4DMedical jumped 7.1% following a supply agreement with Qscan Radiology Clinics. Synlait Milk soared 26.8% after upgraded H2 guidance and a return-to-profit outlook. However, Kogan.com shares fell 14.1%, despite reporting 9.9% revenue growth.

The Australian dollar rose 0.4% to US63.10¢.

Leaders

PMV: Premier Investments Ltd (+6.95%)

MND: Monadelphous Group Ltd (+5.83%)

AMP: AMP Ltd (+5.29%)

GNE: Genesis Energy Ltd (+5.10%)

CAT: Catapult Group (+5.00%)

Laggards

RRL: Regis Resources Ltd (-5.92%)

CRN: Coronado Global (-5.63%)

VAU: Vault Minerals Ltd (-5.26%)

MAD: Mader Group Ltd (-4.38%)

IPX: Iperionx Ltd (-4.37%)