What's Affecting Markets Today

Asia-Pacific markets traded mixed on Friday as investors assessed key economic data from China. The Chinese economy expanded by 5% year-on-year in 2024, with a stronger-than-expected 5.4% growth in the fourth quarter. Retail sales in December rose 3.7% year-on-year, surpassing forecasts of 3.5%, while industrial output grew 6.2%, beating expectations of 5.4%.

In equities, Hong Kong’s Hang Seng Index edged up 0.17%, and mainland China’s CSI 300 gained 0.29%. Currency markets saw the offshore yuan strengthen by 0.10% to 7.3385 against the US dollar, while the onshore yuan appreciated slightly to 7.3271.

Elsewhere in the region, Japan’s Nikkei 225 declined 1.18%, with the broader Topix index down 1.28%. South Korea’s Kospi fell 0.5%, and the tech-heavy Kosdaq slipped 0.11%.

Investors are also closely monitoring Singapore’s December non-oil exports data for further insights into regional trade activity, as markets digest signs of resilience in China’s economy amid global economic uncertainties.

ASX Stocks

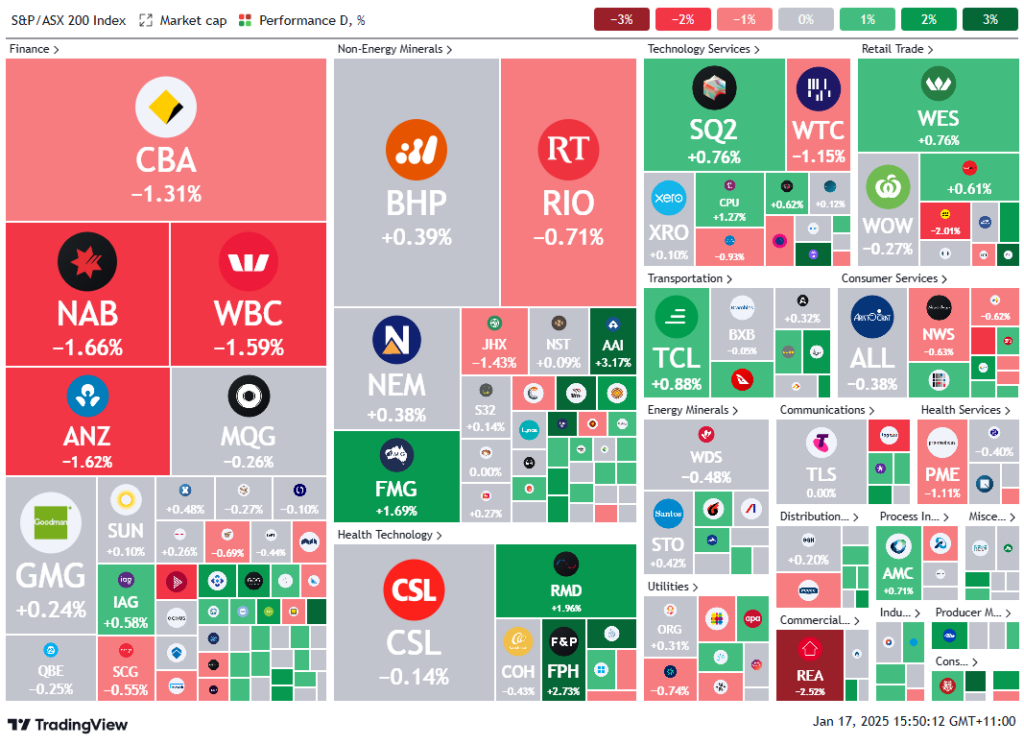

ASX 200 - 8,315.5 (-0.10%)

Key Highlights:

The Australian sharemarket edged lower on Friday afternoon, weighed down by declines in the financial and communication services sectors. The S&P/ASX 200 Index slipped 0.1% or 10.1 points to 8316.9 at mid afternoon, following a 1.4% gain on Thursday. Major banks led the losses, with Commonwealth Bank falling 1%.

On Wall Street, the major indices closed lower overnight, with the Nasdaq down 0.9%. In China, GDP growth reached 5% in 2024, meeting Beijing’s target, supported by strong exports and recent stimulus.

Key stock movements included Rio Tinto, down 0.5% amid reports of merger talks with Glencore. Insignia Financial rose 6.3% after CC Capital raised its bid to $4.60 per share, surpassing $3 billion in value. Lynas Rare Earths dropped 2.2% on slower December quarter production.

Lovisa surged 8% following a Morgan Stanley upgrade, while Aussie Broadband gained 5.8% after appointing CEO Brian Maher as group head. Telix Pharmaceuticals rallied 4.5% on European approval for its prostate cancer imaging agent, Illuccix.

Leaders

LTR Liontown Resources Ltd (+10.35%)

MP1 Megaport Ltd (+10.10%)

NEU Neuren Pharmaceuticals Ltd (+7.90%)

LOV Lovisa Holdings Ltd (+7.56%)

IFL Insignia Financial Ltd (+6.61%)

Laggards

OBM Ora Banda Mining Ltd (-4.87%)

REA REA Group Ltd (-2.52%)

JBH JB Hi-Fi Ltd (-2.39%)

TPG TPG Telecom Ltd (-2.17%)

GYG Guzman Y Gomez Ltd (-2.17%)