What's Affecting Markets Today

Asia-Pacific markets exhibited mixed performance on Tuesday, following a similarly varied session on Wall Street. The Dow surged as investors shifted focus from technology stocks, causing the Nasdaq to slip.

Japan’s Nikkei 225 declined 1.29%, and the Topix fell 0.95%. South Korea’s Kospi hovered near the flatline, while the Kosdaq posted a modest 0.32% gain. Notably, Japan’s 40-year government bond yield climbed to 2.755%, its highest level since 2007, according to LSEG data.

Hong Kong’s Hang Seng Index edged up by 0.15%, and mainland China’s CSI 300 rose 0.24%. Investors are keeping a close watch on India’s rupee after it hit a record low against the U.S. dollar. December inflation data showed a year-on-year decline for a second consecutive month, coming in at 5.22%, slightly below expectations. This adds weight to the possibility of interest rate cuts in the region.

Meanwhile, Thailand is set to release its consumer confidence index for December, providing additional insights into regional economic sentiment.

ASX Stocks

ASX 200 - 8,216.2 (+0.30%)

Key Highlights:

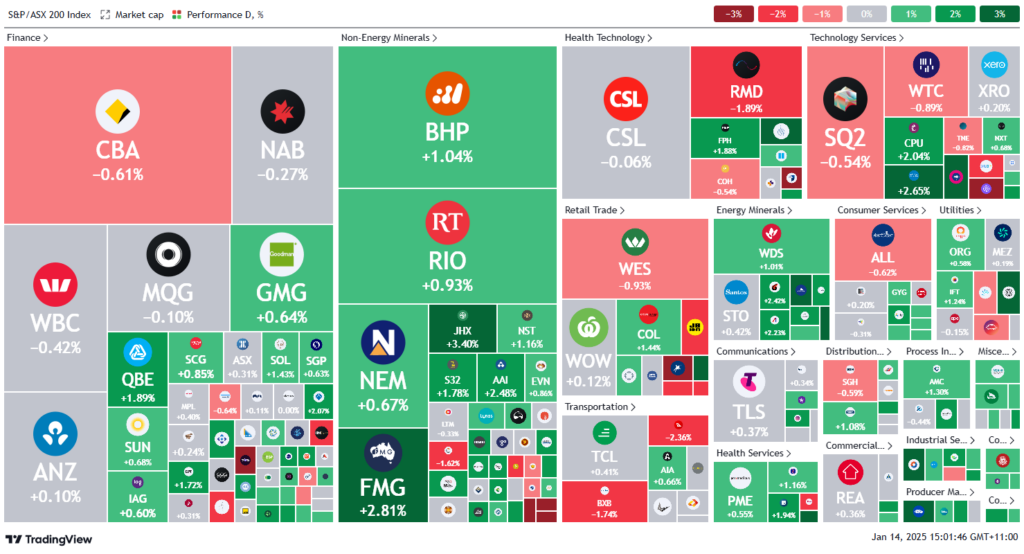

The Australian sharemarket edged higher on Tuesday, rebounding from a two-week low as bargain hunters entered the market. The S&P/ASX 200 Index rose 0.3%, or 27.2 points, to 8219 by mid-afternoon, with nine of 11 sectors posting gains. The All Ordinaries gained 0.4%. However, trading volumes remained thin.

Mining stocks led the recovery, buoyed by a higher iron ore price exceeding $US98.90 a tonne. Fortescue surged 2.9%, and BHP rose 0.7%. Coal miners also advanced, with Whitehaven Coal jumping 4.7% and Yancoal gaining 1.9%, as coal prices hit a three-year low of $US115.51 a tonne.

Conversely, bank stocks weighed on the index. Commonwealth Bank fell 1.1%, while Westpac, NAB, and ANZ saw minor losses. Consumer discretionary stocks also struggled amid signs of weaker retail demand, with Wesfarmers down 0.9% and JB Hi-Fi slipping 1.8%.

Star Entertainment soared 12% after Macau businessman Wang Xingchun increased his stake in the embattled casino operator. Meanwhile, City Chic Collective surged 16.7% on robust holiday trading, despite revenue declining 3.6% in H2 2024.

Energy Transition Minerals gained 7%, while Mesoblast fell 7.1% following its $216 million capital raise.

Leaders

OPT Opthea Ltd (+5.33%)

BOE Boss Energy Ltd (+5.17%)

PNV Polynovo Ltd (+4.93%)

WHC Whitehaven Coal Ltd (+4.71%)

SLX SILEX Systems Ltd (+4.55%)

Laggards

MSB Mesoblast Ltd (-7.12%)

IPX Iperionx Ltd (-6.77%)

SPR Spartan Resources Ltd (-5.19%)

PMV Premier Investments Ltd (-3.13%)

360 LIFE360 Inc (-2.66%)