What's Affecting Markets Today

Asian stocks traded mixed on Thursday as several major markets resumed activity post-New Year’s Day. China led the declines, with the CSI 300 falling over 3% after the Caixin/S&P Global manufacturing PMI for December dropped to 50.5, missing forecasts of 51.7. The figure indicates marginal growth, pressured by weak exports and global trade uncertainties, according to Caixin Insight Group. The official PMI also fell short at 50.1.

Hong Kong’s Hang Seng Index slid 2.4%, with Sun Art Retail Group shares plunging over 23% following Alibaba’s decision to sell its majority stake. Alibaba shares dipped over 1%. The offshore yuan gained 0.14% to 7.3224 against the dollar, recovering from its lowest level since October 2022.

South Korea’s Kospi edged lower to 2,398.94, while the Kosdaq rose 1.24% to 686.63. The Bank of Korea pledged flexible monetary management amid uncertainties, with its next rate decision expected later this month.

Singapore’s economy grew 4% in 2024, up from 1.1% in 2023, although Q4 GDP slowed to 4.3% year-on-year.

ASX Stocks

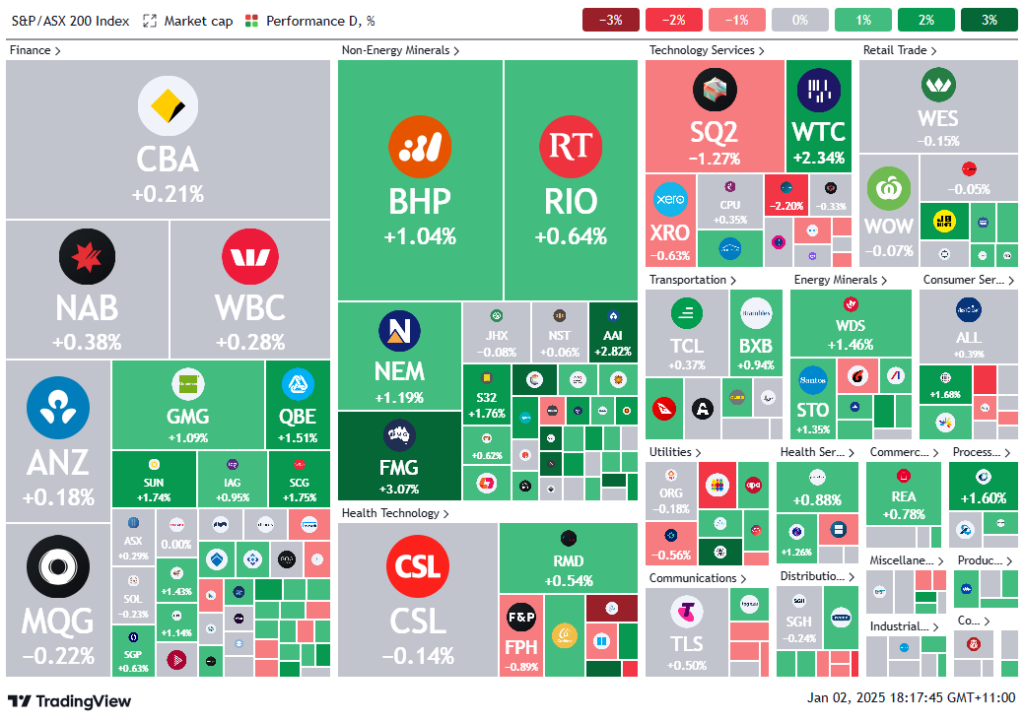

ASX 200 - 8,201.6 (+0.5%)

Key Highlights:

The Australian sharemarket commenced 2025 with gains, driven by momentum trading and a rally in energy stocks. The S&P/ASX 200 climbed 0.5% to close at 8201.2, recovering from a volatile morning session that briefly dipped into negative territory. Ten of the 11 sectors advanced, led by energy, materials, and real estate, each gaining over 1%, while consumer staples ended slightly lower.

Energy stocks surged as crude oil hit a two-month high, trading at $US74.64 per barrel before settling at $US71.92. Liontown Resources, 2024’s worst performer, rebounded 8.6% to 57¢. Paladin Energy and Lifestyle Communities also posted gains, rising 4.4% and 3%, respectively. However, Strike Energy and Telix Pharmaceuticals extended losses, down 2.4% and 3.1%.

The Australian dollar remained weak at US61.88¢, reflecting a slowing Chinese economy and US interest rate differentials. Bitcoin edged higher to $US95,445.90, while gold rose 0.7% to $US2624.50 per tonne, and iron ore held steady at $US100.97 per tonne.

Leaders

BRN Brainchip Holdings Ltd (+11.54%)

LTR Liontown Resources Ltd (+8.57%)

MSB Mesoblast Ltd (+8.07%)

SPR Spartan Resources Ltd (+4.61%)

PDN Paladin Energy Ltd (+4.37%)

Laggards

OPT Opthea Ltd (-5.56%)

RPL Regal Partners Ltd (-4.80%)

MAF MA Financial Group Ltd (-4.74%)

CAT Catapult Group (-3.50%)

NGI Navigator Global (-3.20%)