What's Affecting Markets Today

Nvidia’s Rout Has Traders Scouring Charts for Support

Nvidia’s three-day, $US430 billion ($646.1 billion) sell-off has traders turning to technical analysis to find the bottom. The stock, having fallen 13% since surpassing Microsoft as the world’s most valuable company, is in a technical correction. Buff Dormeier, chief technical analyst at Kingsview Partners, notes signs of capitulation despite recent good news, including a 10-for-one stock split. Dormeier identifies short-term support around $US115 and significant support at $US100. This $115 area aligns with a key Fibonacci retracement level, a tool for identifying support or resistance lines. Despite the drop, Nvidia remains up 139% this year.

Traders on Alert for Yen Intervention

Traders are vigilant for potential intervention by Japanese authorities to support the weakening yen. The US dollar surged to 159.94 against the yen, nearing levels that previously prompted the Bank of Japan (BOJ) to spend about 10 trillion yen ($9.4 billion) to lift the yen. The yen has been under pressure due to the BOJ’s delay in reducing its bond-buying stimulus until July. This year, the yen has tumbled 12% against the US dollar and over 10% against the Australian dollar, hitting a 17-year low. National Australia Bank’s Rodrigo Catril attributes this to a slow BOJ and a firm US Fed.

Consumer Sentiment Edges Up, but Still Deeply Pessimistic

The Westpac–Melbourne Institute Consumer Sentiment Index rose 1.7% to 83.6 in June from 82.2 but remains in deeply pessimistic territory. Matthew Hassan, a senior economist at Westpac, explains that at 83.6, pessimists outnumber optimists by nearly 20 percentage points. Positives from fiscal support measures are being overshadowed by concerns about inflation and interest rates. The survey indicates that half of the consumers expect mortgage rates to rise over the next 12 months, reflecting persistent economic worries despite the slight uptick in sentiment.

ASX Stocks

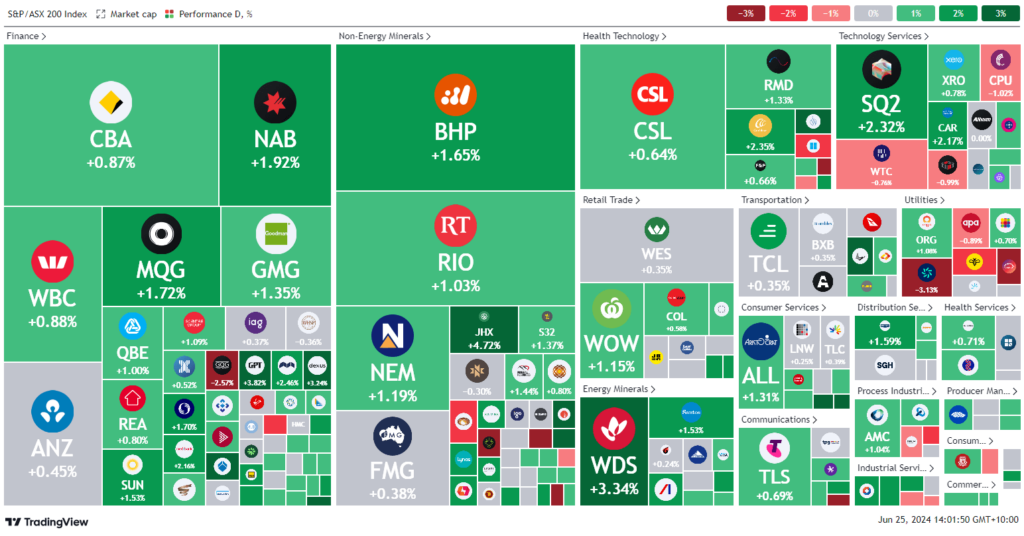

ASX 200 - 7,812.6 (+1.00%)

Key Highlights:

Australian shares experienced a broad rise by midday on Tuesday, with the S&P/ASX 200 Index rebounding 0.8% to 7796.2, recovering from Monday’s loss. The index is on track for a 1.2% gain in June. The All Ordinaries also advanced by 0.7%. All 11 sectors were positive, led by the energy sector due to stronger oil prices. Key energy stocks such as Woodside, Santos, and Origin saw gains. Brent crude rose to $US85.98, marking an over 8% increase for the month.

The big four banks performed well, with Commonwealth Bank reaching an all-time high of $128.68, and National Australia Bank climbing to a nine-year peak of $36.37. Mining giants BHP, Rio Tinto, and Fortescue also saw modest gains.

However, Paladin Energy dropped 7.7% following news of its takeover bid for Fission Uranium to bring a Canadian mine into production by 2029. Collins Foods, the operator of KFC stores, surged 6.4% after reporting record revenue and a six-fold increase in net profit for fiscal 2024. Online fashion retailer Cettire overcame early losses to close up 1.8%.

Leaders

SPR – Spartan Resources Ltd (+10.06%)

NVX – Novonix Ltd (+8.76%)

BRE – Brazilian Rare EARTHS Ltd (+7.97%)

CHN – Chalice Mining Ltd (+7.61%)

CKF – Collins Foods Ltd (+6.55%)

Laggards

RED – RED 5 Ltd (-7.32%)

ENR – Encounter Resources Ltd (-6.45%)

3PL – 3P Learning Ltd (-5.46%)

PDN – Paladin Energy Ltd (-5.44%)

MAU – Magnetic Resources NL (-5.19%)