What's Affecting Markets Today

At today’s Reserve Bank of Australia (RBA) meeting, Governor Michele Bullock stated that a rate cut was “not considered,” although the board remained “alert” to some upside risks. While the possibility of a rate increase was discussed, the decision was made to hold the cash rate steady at 4.35%, a 12-year high. Bullock emphasized that the board is not ruling out any future rate changes and is focused on bringing inflation back within the target range.

Bullock noted that recent data, such as the higher-than-expected April CPI and mixed signals from consumption, have kept the board vigilant. The RBA’s statement highlighted persistent service price inflation and uncertainties around economic growth. Despite holding rates, the RBA remains “firmly hawkish,” according to State Street Global Advisors APAC economist Krishna Bhimavarapu, who expects only one rate cut later this year and views further rate hikes as potential policy errors due to Australia’s high household debt service ratio.

The federal budget’s outcomes might temporarily reduce headline inflation, but the RBA’s priority remains achieving sustainable inflation targets. The market’s reaction to the RBA’s decision was initially dovish, with slight dips in the Australian dollar, sharemarket, and bond yields before reversing. Insight Investment’s Harvey Bradley suggested that the RBA is likely to remain in a holding pattern for the foreseeable future, contrasting with other central banks’ dovish moves. The RBA will continue to rely on data to guide future rate decisions.

ASX Stocks

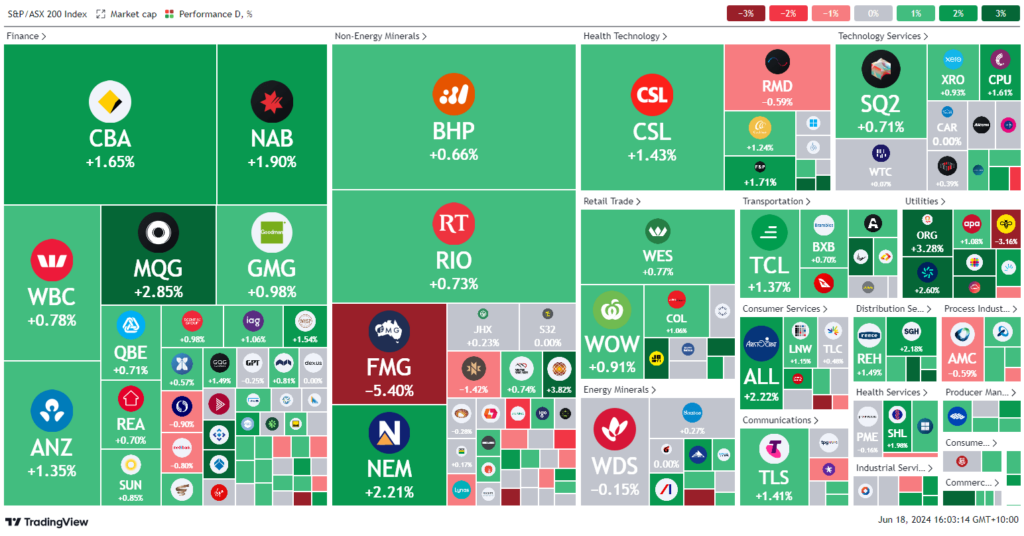

ASX 200 - 7,770.8 (+0.9%)

Key Highlights:

Today, the Australian share market saw a broad rally, pushing the S&P/ASX 200 Index up by 0.9%, or 68.2 points, to 7768.5 by midday. All 11 sectors were in the green, with investors eagerly awaiting the Reserve Bank of Australia’s (RBA) cash rate decision at 2.30pm AEST.

The financial sector performed notably well, rising by 1.2%. Major banks contributed to this surge: Commonwealth Bank increased by 1.6%, National Australia Bank by 1.2%, ANZ by 1%, and Westpac by 0.8%.

Overnight gains on Wall Street also influenced the ASX. The S&P 500 rose by 0.8% to 5473.23, while the Nasdaq Composite added 1% to 17,857.02, led by a 5.3% rise in Tesla and a 2% gain in Apple. However, some strategists, like Tim Hayes from Ned Davis Research, warned that record highs in U.S. indices might not indicate strong market health, as market breadth has weakened.

Fortescue Metals saw a significant drop of 4.5% following a $1.1 billion block trade at a discount. Beach Energy shares fell by 2.6% after announcing cuts in spending, operating costs, and jobs. Tamboran Resources revealed plans for a $265.3 million IPO on the New York Stock Exchange, offering 6.5 million shares priced between $US24 and $US27 each. Investors remain focused on the upcoming RBA decision and subsequent press conference.

Leaders

RAC – Race Oncology Ltd (+13.43%)

CAJ – Capitol Health Ltd (+10.19%)

BLX – Beacon Lighting Group Ltd (+7.79%)

WA1 – WA1 Resources Ltd (+7.52%)

CHN – Chalice Mining Ltd (+7.48%)

Laggards

KSL – Kina Securities Ltd (-7.90%)

DXB – Dimerix Ltd (-6.50%)

SXG – Southern Cross Gold Ltd (-6.47%)

HSN – Hansen Technologies Ltd (-6.29%)

IMM – Immutep Ltd (-5.95%)