What's Affecting Markets Today

Aristocrat’s Profits and Dividends Jump

Aristocrat Leisure reported a net profit of $723.3 million for the six months ending March 31, a 16.8% increase driven by strong performance in the US market. The company’s group revenue rose 6% to $3.3 billion, with a significant contribution from popular slot machines such as NFL-themed Bank Buster and Where’s the Gold Jackpots. EBITDA increased by 18% to $1.2 billion. CEO Trevor Croker highlighted Aristocrat’s resilience and strategic opportunities, including the integration of NeoGames. A fully franked interim dividend of 36¢ per share was announced. Aristocrat shares closed at $40.74.

Employment Jumps 38,500 in April, Jobless Rate Rises to 4.1%

Australian employment increased by 38,500 in April, following a loss of 6,600 jobs the previous month. The unemployment rate rose to 4.1%, up from 3.9% in March. The rise in unemployment reflects more people looking for work and a higher number indicating they had a job waiting to start. The labour market remains strong, complicating efforts to reduce inflation to the Reserve Bank’s target. Despite inflation slowing, services remain sticky. The Reserve Bank revised its jobless rate projections to 4% by June. Upcoming reports include retail sales on May 28 and the monthly inflation indicator the next day.

Jupiter Mines’ Surge Post-South32’s Manganese Mine Disaster

Jupiter Mines’ shares have doubled since South32 closed its Groote Eylandt manganese mine due to Cyclone Megan on March 16. The Groote Eylandt mine, co-owned by South32 and Anglo American, is the world’s largest single manganese producer, accounting for 10-15% of global supply. The closure led to a price surge for manganese, benefiting Jupiter Mines. CEO Brad Rogers noted that prices for their manganese grade rose significantly due to the supply shortfall, reversing the previous year’s low prices which had driven many mines out of production.

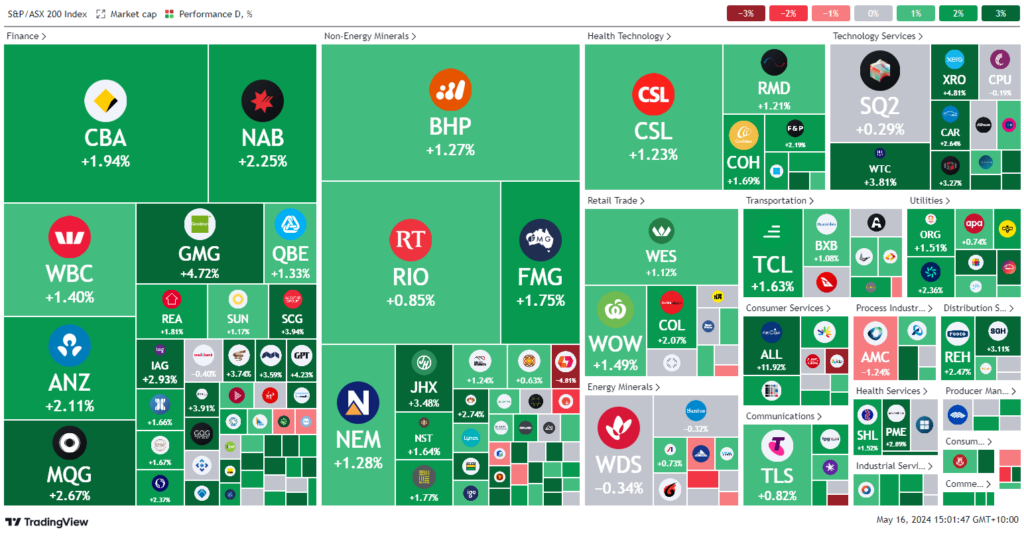

ASX Stocks

ASX 200 - 7,888.6 (+1.7%)

Key Highlights:

The S&P/ASX 200 surged on Thursday as the jobless rate rose faster than expected to 4.1%, indicating an economic slowdown aligning with Reserve Bank forecasts. The market climbed 1.6% to 7876.4 points by lunchtime, nearing its record closing high of 7896.9 from March 28. Gold miners, tech, retail, and property stocks drove the gains. Post-jobs data, the 1-year Australian government bond yield dropped 4 basis points to 4.22%, below the cash rate of 4.35%. The Australian dollar fell to $US66.8¢.

Aristocrat Leisure shares rose 8% following strong profits, while Incitec Pivot gained 3% to $2.91 on its earnings report. Wall Street hit record highs after US inflation data increased hopes for a September Federal Reserve rate cut. The S&P 500 closed at 5308.15, up 1.2%, and the Nasdaq advanced 1.4%. US CPI data matched expectations, alleviating market concerns. The yield on the US 10-year government note fell 10 basis points to 4.34% after core CPI rose 0.3% from March, with the annual measure at its slowest pace in three years.

Leaders

ALL – Aristocrat Leisure Ltd (+11.87%)

PNR – Pantoro Ltd (+8.64%)

AIS – Aeris Resources Ltd (+8.62%)

PMT – Patriot Battery Metals Inc (+8.44%)

OBM – Ora Banda Mining Ltd (+8.20%)

Laggards

RNU – Renascor Resources Ltd (-9.62%)

STX – Strike Energy Ltd (-7.14%)

LRS – Latin Resources Ltd (-7.00%)

ASG – Autosports Group Ltd (-5.81%)

FCL – Fineos Corporation Holdings Plc (-4.96%)