What's Affecting Markets Today

China’s Economic Growth Prospects Amid Stimulus Measures

China is on the brink of not achieving its ambitious growth goals unless the government implements additional economic stimuli to bolster the nation’s faltering recovery efforts. Despite this, the economic downturn’s impact is somewhat mitigated by China’s dependence on importing iron ore from Australia, which cushions the local economy against the repercussions of China’s economic slowdown. According to a survey of 30 economists by a major financial publication, projections for China’s GDP growth for the year hover between 4.2% and 4.8%, underscoring the challenges facing the world’s second-largest economy and a key trading partner for Australia.

Delays in Santos’ Major LNG Project in Papua New Guinea

Santos’ ambitious $15 billion LNG project in Papua New Guinea has encountered additional setbacks, pushing the timeline for a final investment decision into the following year. Initial proposals from contractors revealed the project’s costs were prohibitive, leading to a pause for reevaluation. Managed by TotalEnergies in collaboration with the Papua New Guinea government, the project requires further negotiation with contractors to secure economically feasible construction agreements. This development has necessitated continued efforts to reach a satisfactory financial investment decision, as stated in a joint announcement by the French energy firm and the PNG government.

Ansell’s Strategic Expansion Through Share Placement

Ansell, a leader in the manufacturing of medical gloves, successfully completed a significant financial move by raising $400 million through a share placement. This strategic initiative was aimed at financing the acquisition of the personal protective equipment division of Kimberly-Clark Corporation. Priced at a slight discount, the placement attracted both new and returning investors, with the settlement and issuance of new shares scheduled promptly after. In addition to the placement, Ansell announced a share purchase plan for eligible shareholders, aiming to further boost its financial resources for the acquisition, demonstrating the company’s growth-focused strategy and investor confidence.

ASX Stocks

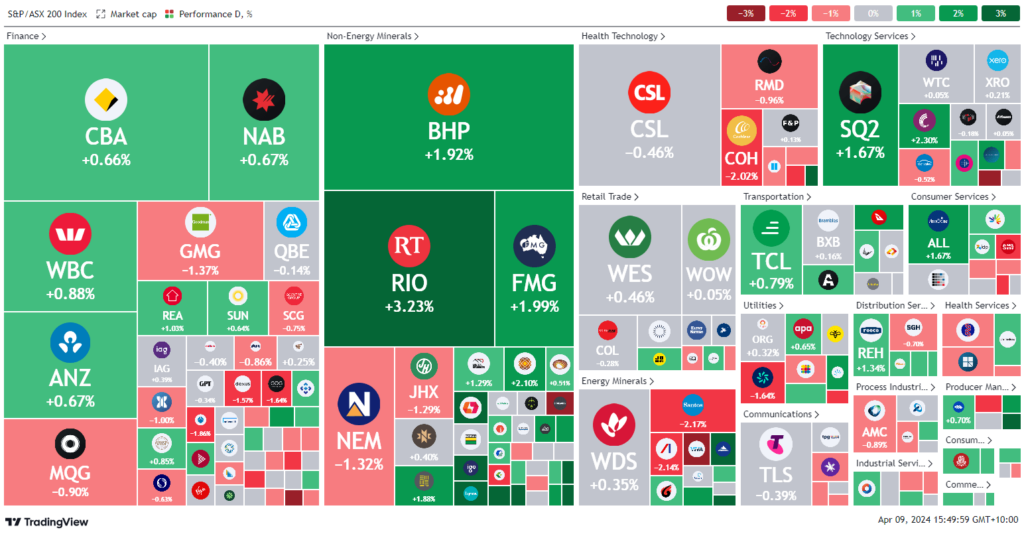

ASX 200 - 7,822.2 (+0.4%)

Key Highlights:

Australian stock market saw a notable uptick, particularly in the mining sector, fueled by optimistic speculations about iron ore demand from China. The S&P/ASX 200 index experienced a 0.5% rise, driven largely by a 1.6% increase in the materials sector, showcasing significant gains among major mining companies like Rio Tinto, BHP Group, and Fortescue Metals. This surge was linked to a rebound in iron ore prices, spurred by hopes for Beijing’s support to its ailing steel industry and anticipated post-holiday restocking by Chinese steelmakers. Additionally, positive indicators of China’s factory activity in March and a promising outlook for external demand further bolstered market sentiment. The commodity rally also lifted shares in other sectors, including copper, silver, and lithium. While the mining sector flourished, the broader market awaited US inflation data, influencing global interest rate expectations. Notably, energy firm Santos and medical glove producer Ansell were among the companies making headlines for different reasons, highlighting the diverse factors at play in the market’s dynamics.

Leaders

INR – Ioneer Ltd (+11.11%)

CHN – Chalice Mining Ltd (+9.35%)

PYC – PYC Therapeutics Ltd (+9.30%)

LTR – Liontown Resources Ltd (+8.61%)

ELD – Elders Ltd (+7.00%)

Laggards

SPR – Spartan Resources Ltd (-11.94%)

HGH – Heartland Group Holdings Ltd (-8.93%)

PEN – Peninsula Energy Ltd (-5.77%)

HTA – Hutchison Telec. Ltd (-5.13%)

AGI – Ainsworth Game Technology Ltd (-4.72%)