What's Affecting Markets Today

Decline in Gold Mining Stocks Amid Reduced Safe Haven Demand

Shares of gold mining companies like Regis Resources, St Barbara, and Ramelius plummeted nearly 5% as gold’s allure as a safe haven diminished with easing tensions in the Middle East. The drop in share prices was reflected in the retreat of gold to its lowest level in over two weeks, underscoring reduced fears of a wider regional conflict. Gold’s price fall to $US2305.99 from an all-time high earlier in the month illustrates a significant cooling in market nerves, despite a 13% rise in value year-to-date.

Copper Approaches Milestone Amid Supply-Demand Crunch

Copper prices are on the brink of reaching $US10,000 per tonne, driven by escalating concerns over the ability of miners to meet the surging demand for the metal. This rally elevated shares of Sandfire Resources to record highs, with copper peaking at $US9988 per tonne. The demand is buoyed by robust manufacturing activity in the US and China, alongside multiple supply interruptions at key mines globally. This surge is seen as a sign of a broader upturn in the global industrial cycle, indicating a robust comeback in metals demand.

Crown Resorts Authorized to Operate Sydney Casino

After overcoming severe regulatory hurdles, Crown Resorts has been granted permission to fully operate its Sydney casino. This approval comes three years after an inquiry deemed Crown unsuitable due to violations including money laundering activities at its other casinos. The NSW Independent Casino Commission now recognizes Crown as a reformed entity prepared to move forward, reflecting significant internal changes and compliance with stricter regulatory standards. This marks a pivotal shift for Crown, aiming to restore trust and integrity in its operations.

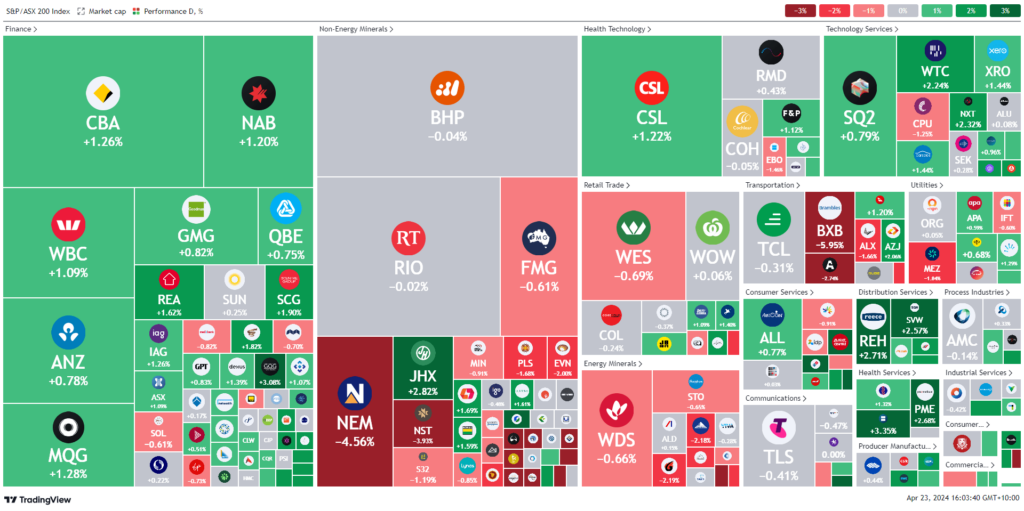

ASX Stocks

ASX 200 - 7,679.2 (+0.4%)

Key Highlights:

The Australian S&P/ASX 200 Index saw an uptick of 0.4% on Tuesday, propelled by a tech-led rally and optimistic sentiment ahead of U.S. corporate earnings and critical Australian inflation data, potentially influencing the Reserve Bank’s interest rate decisions. Despite the overall positive trend with Monday’s 1.1% rise, sectors like energy, materials, and industrials dipped, while technology stocks surged. Gold mining companies experienced notable declines, with spot gold prices dropping 0.9% due to reduced demand for the metal as a safe haven amid diminishing Middle Eastern tensions. Transportation and logistics group Brambles also fell sharply by 5.4% after disappointing trading updates. The market is keenly awaiting Wednesday’s inflation data, which could offer insights into future monetary policy, with expectations of an annual inflation slow down to 3.4% from 4.1%. Meanwhile, various stocks like Seven Group Holdings and Boral saw gains, whereas Lifestyle Communities and Select Harvests faced significant drops.

Leaders

MSB-Mesoblast Ltd (+11.01%)

SVM-Sovereign Metals Ltd (+8.25%)

HCW-Healthco REIT (+8.00%)

TBN-Tamboran Resources Corp (+6.06%)

IMM-Immutep Ltd (+5.63%)

Laggards

HTA-Hutchison Telecom Australia Ltd (-22.22%)

LIC-Lifestyle Communities Ltd (-13.33%)

SHV-Select Harvests Ltd (-9.90%)

EMR-Emerald Resources NL (-7.04%)

OBM-Ora Banda Mining Ltd (-6.82%)