What's Affecting Markets Today

Easing Middle East Tensions Impact Gold Prices

Gold prices saw a decline as tensions in the Middle East began to ease, reducing the demand for the metal as a safe haven. Despite the recent conflict between Israel and Iran, Tehran has downplayed the significance of the attacks, leading to a lessened market panic. This shift comes after gold reached a record high during a five-week rally, trading just below $2364 an ounce. Looking ahead, traders are turning their focus to upcoming U.S. economic data which could influence Federal Reserve’s monetary policy decisions, potentially delaying expected rate cuts which typically affect gold’s appeal.

Copper’s Price Surge Amid Economic Optimism

Copper prices are approaching $10,000 a tonne, driven by optimistic forecasts about the global economic recovery which is expected to boost demand for industrial materials. This surge is supported by an April rally and an uptick in manufacturing activity in major economies like the U.S. and China. The price of copper reached a two-year high early in the week, further fueled by persistent inflation and adjustments in the Federal Reserve’s interest rate strategies, as indicated by Fed Chair Jerome Powell’s recent remarks.

Stability in China’s Loan Rates Amid Economic Recovery

China has maintained its one- and five-year loan rates steady, marking the second consecutive meeting without changes. This decision comes amid China’s ongoing efforts to stabilize its economy post-pandemic, with recent data suggesting a stronger-than-anticipated economic performance in the first quarter. The one-year loan rate remains at 3.45%, and the five-year rate, primarily impacting mortgages, is held at 3.95%. This rate stability is seen as part of a broader strategy to ensure economic stability and prioritize currency stabilization, reflecting cautious optimism about the economic outlook.

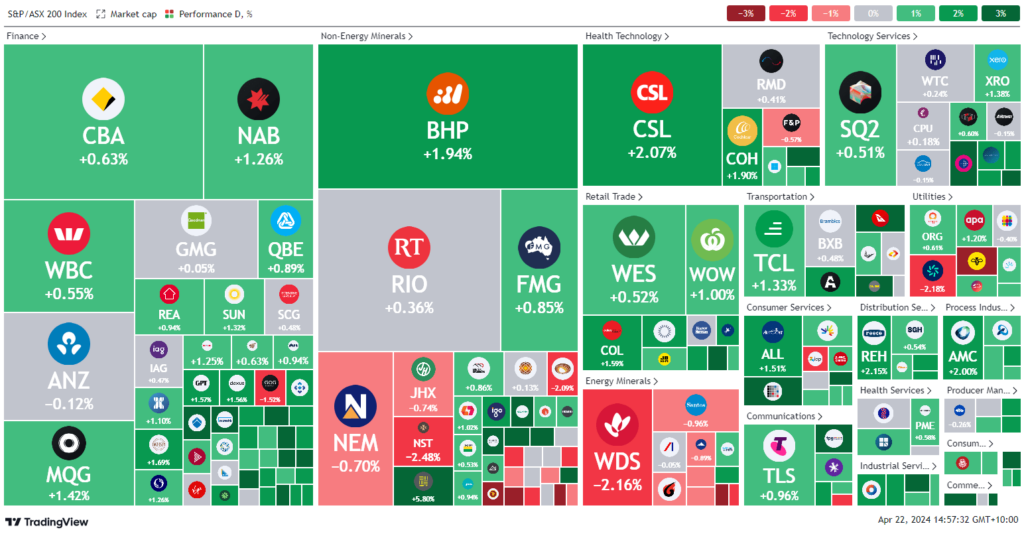

ASX Stocks

ASX 200 - 7,638.4 (+0.9%)

Key Highlights:

The Australian share market experienced a notable uplift today, influenced by easing tensions between Israel and Iran, which restored investor confidence. The S&P/ASX 200 Index climbed 0.9 percent to 7632.1, regaining some ground after last week’s 2.8 percent downturn. Most sectors showed gains, particularly healthcare and financials, although energy stocks fell by 1.5 percent. The recovery was triggered after the market’s initial drop in response to Israel’s airstrike on Iran, which was later mitigated by reassurances that Iran’s key nuclear facilities were unharmed and Iranian officials’ subdued reactions. Additionally, China’s decision to keep its one- and five-year loan rates steady for a second consecutive meeting reflects ongoing efforts to stabilize its economy, with rates at 3.45 percent and 3.95 percent, respectively. Meanwhile, individual stocks showed varied movements; South32’s shares rose by 5.3 percent, Cettire’s fell by 5.8 percent, and Star Entertainment Group’s shares dropped by 2.4 percent.

Leaders

IMU-Imugene Ltd (+16.20%)

SVM-Sovereign Metals Ltd (+11.96%)

JMS-Jupiter Mines Ltd (+10.38%)

AMI-Aurelia Metals Ltd (+9.72%)

29M-29METALS Ltd (+8.62%)

Laggards

DRO-Droneshield Ltd (-17.86%)

PDI-Predictive Discovery Ltd (-7.14%)

BGL-Bellevue Gold Ltd (-6.56%)

MCY-Mercury NZ Ltd (-6.10%)

EBR-EBR Systems Inc (-6.04%)