What's Affecting Markets Today

Bank of Japan’s Stance on Policy Amid Yen Fluctuations

The Bank of Japan’s Governor, Kazuo Ueda, emphasized that the institution would not adjust its monetary policy based solely on fluctuations in the yen’s value. This declaration comes at a time when the financial markets are keenly anticipating US inflation data, which could potentially push the yen to a level that triggers government intervention. Despite the yen nearing a 34-year low against the dollar, the Bank of Japan remains focused on monitoring the currency’s impact on the national economy and inflation, without directly intervening in response to its movements. This approach underlines the central bank’s commitment to stability, even as it faces pressure from currency depreciation and potential speculative trading.

Reserve Bank of New Zealand Maintains Interest Rate

The Reserve Bank of New Zealand has decided to keep the cash rate steady at 5.5%, a figure that has remained unchanged since last May and represents a 15-year peak. This decision reflects the bank’s confidence that maintaining the current restrictive rate will help guide consumer price inflation back into the targeted range of 1% to 3% within the year. The move signals the bank’s deliberate approach towards managing inflation and economic growth, acknowledging the need for prolonged monetary restraint to achieve its inflationary objectives amid global economic uncertainties.

Implications of Rising Gold and Oil Prices

Recent surges in the prices of gold and oil are signaling potential turbulence for global stock markets. Gold futures have reached a new record high, while oil prices hover just below $90 per barrel, amid escalating geopolitical tensions and economic uncertainties. These commodities have traditionally served as hedges against economic instability, and their rising prices reflect a growing investor preference for tangible assets over traditional stock market investments. The uptick in gold and oil prices, predating recent geopolitical events, suggests a strategic shift among investors towards assets perceived as safer or more reliable during times of global tension and uncertainty.

ASX Stocks

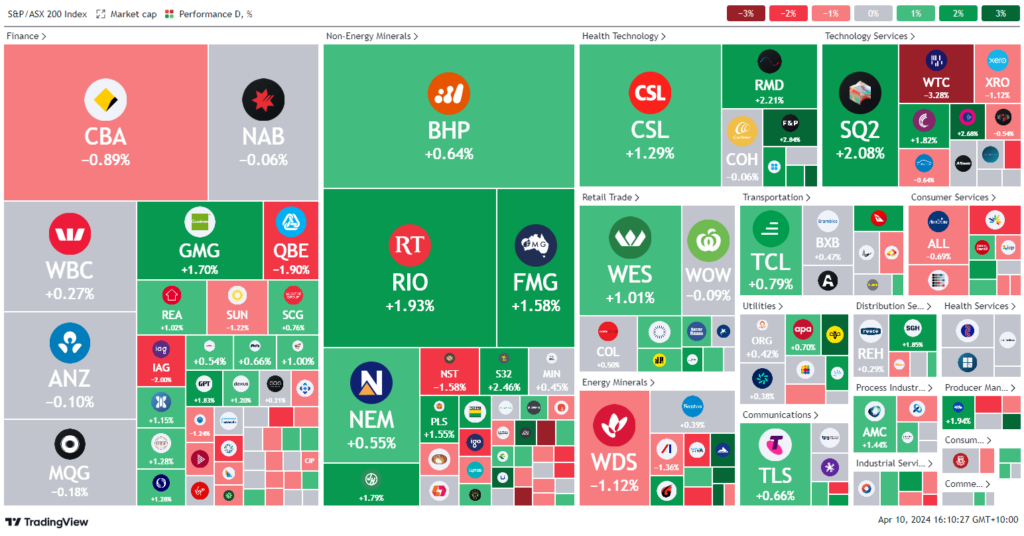

ASX 200 - 7,844.8 (+0.3%)

Key Highlights:

The Australian share market experienced a notable uplift, primarily driven by a surge in mining stocks amidst optimistic forecasts for iron ore consumption. The S&P/ASX 200 Index saw a 0.4% increase, with significant contributions from the materials sector, particularly from giants like BHP, Fortescue Metals, and Rio Tinto. This rally is attributed to the anticipated demand for iron ore during China’s peak construction period in April and May. Additionally, gold prices reached a new high, positively impacting gold producers. The healthcare sector also showcased strong performance, with major companies like CSL and Ansell making substantial gains. This overall market advance mirrors the rebound seen on Wall Street, despite investors’ cautious stance ahead of key US inflation data. The forthcoming CPI data is expected to influence the Federal Reserve’s interest rate decisions. Meanwhile, notable corporate activities included Perseus Mining’s takeover offer acceptance by Silvercorp for OreCorp, and BlueBet’s trading pause amidst merger talks, highlighting dynamic movements within the market.

Leaders

LRS – Latin Resources Ltd (+14.29%)

VUL – Vulcan Energy Resources Ltd (+13.89%)

CHN – Chalice Mining Ltd (+13.60%)

JMS – Jupiter Mines Ltd (+9.57%)

NVX – Novonix Ltd (+8.96%)

Laggards

VEE – Veem Ltd (-8.33%)

AFP – Aft Pharmaceuticals Ltd (-7.38%)

IMM – Immutep Ltd (-4.94%)

INR – Ioneer Ltd (-4.88%)

WGX – Westgold Resources Ltd (-4.57%)