What's Affecting Markets Today

29Metals Halts Operations Due to Severe Weather

29Metals has temporarily ceased activities at its Capricorn Copper operation in Queensland in response to recent heavy rainfall and stormy conditions. The series of tropical storms has disrupted plans to restart mining operations. CEO Peter Albert explained that the decision to suspend operations was made due to a combination of factors: high water levels from the previous wet season and continuous rainfall since January. These conditions have negated efforts to manage water levels through mechanical evaporation and controlled releases of treated water. As a result, the company anticipates a notable decrease in workforce and operations over the coming six weeks. This news has led to a 26% drop in the company’s share price.

Clarity Pharmaceuticals Seeks Funding Through Equity Raise

Clarity Pharmaceuticals has paused its share trading to initiate a substantial equity raise of $121 million. This financial maneuver includes a $101 million institutional raise complemented by a $20 million entitlement offer, fully backed by Bell Potter. This strategic move aims to bolster Clarity’s financial standing amidst a backdrop of significant mergers and acquisitions (M&A) activity and heightened interest in radiopharmaceutical assets. The capital injection is envisioned to enhance the company’s resilience and strategic positioning in the competitive pharmaceutical landscape.

Gold Remains Stable as Inflation Data Looms

Gold prices have steadied, maintaining gains from Monday as the market anticipates upcoming US inflation data. This data, particularly the core personal consumption expenditures index due on Good Friday, is expected to reveal persistent high inflation levels for February, potentially impacting the Federal Reserve’s interest rate policies. Despite a recent decrease in expectations for a June rate cut, gold continues to hover near record highs, supported by prospects of monetary easing and a slight dip in the US dollar. This situation reflects broader market anticipation and the intricate balance between inflation expectations and central bank policies.

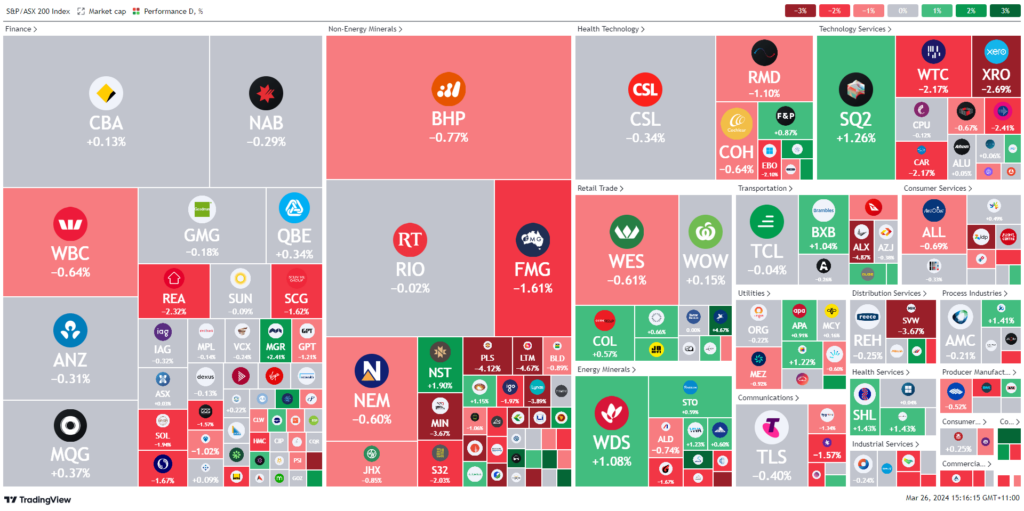

ASX Stocks

ASX 200 - 7,777.1 (-0.4%)

Key Highlights:

In the closing hours of trading, Australian shares are set to end lower, impacted by a mix of sector performances. The S&P/ASX 200 has dropped 21 points to 7790, influenced by a downturn in tech stocks, which have fallen by 1.8%, and declines in the real estate and communications sectors. This movement mirrors losses seen on Wall Street, with major indices like the Dow Jones, Nasdaq, and S&P 500 all closing around 0.3% lower. However, the energy sector is seeing notable gains, with Woodside and Santos both rising over 1.5% following a significant weekly increase in oil prices. The price of Brent crude hovered near $US87 a barrel, while West Texas Intermediate was above $US82. Conversely, iron ore prices and materials stocks have declined, affecting the overall market. Amidst this, companies like Premier Investments and Beach Energy are making moves based on corporate actions and analyst ratings, while Atlas Arteria faces a drop as it trades ex-dividend.

Leaders

MSB-Mesoblast Ltd (+51.52%)

CAT-Catapult Group International Ltd (+16.79%)

SWM-Seven West Media Ltd (+8.33%)

MAH-Macmahon Holdings Ltd (+6.98%)

VUL-Vulcan Energy Resources Ltd (+4.63%)

Laggards

29M-29METALS Ltd (-25.00%)

WC8-Wildcat Resources Ltd (-7.41%)

NVX-Novonix Ltd (-6.74%)

FDV-Frontier Digital Ventures Ltd (-6.45%)

CXL-CALIX Ltd (-6.11%)