What's Affecting Markets Today

Droneshield Delivers Maiden Profit

Droneshield, a Sydney-based company, saw a 14% increase in its shares after reporting its first-ever profit, driven by a series of defense contracts. The company’s revenue surged to $55.1 million, with a net profit after tax of $9.3 million for the year ended December 31. Its flagship product, the DroneGun, disrupts drone communication, effectively neutralizing them. Benefiting from increased defense spending amid drone use in conflicts across Ukraine, the Middle East, and the Red Sea, Droneshield has expanded its market to include airports, stadiums, and prisons, growing into a $500 million enterprise.

RBNZ Keeps Cash Rate at 5.5%; $NZ Drops

The Reserve Bank of New Zealand (RBNZ) held the cash rate steady at 5.5%, meeting market expectations but maintaining a hawkish stance due to persistent inflation above its target. Following the announcement, the New Zealand dollar dropped by 0.8% to US61.21¢, a one-week low. Despite market speculation and ANZ’s prediction of possible rate hikes, the RBNZ emphasized the need for the cash rate to remain restrictive to curb demand and align inflation with its 1 to 3% target. Inflation currently stands at more than twice the central bank’s 2% midpoint target, with the RBNZ being the only major central bank where a rate increase is anticipated before any easing of monetary policy.

Inflation Steady at 3.4% in January

Australia’s consumer price index (CPI) rose by 3.4% in January on an annual basis, slightly below the expected 3.6%, mirroring the December figure. This steady inflation rate comes as the Reserve Bank of Australia (RBA) keeps the cash rate at 4.35% in its effort to manage inflation within the target range. The report highlights a notable increase in wages, exceeding expectations. The RBA is scheduled to make its next cash rate decision on March 19, with its last rate increase occurring in October. This steady inflation amidst wage growth indicates the RBA’s ongoing challenge in balancing economic growth with inflation control.

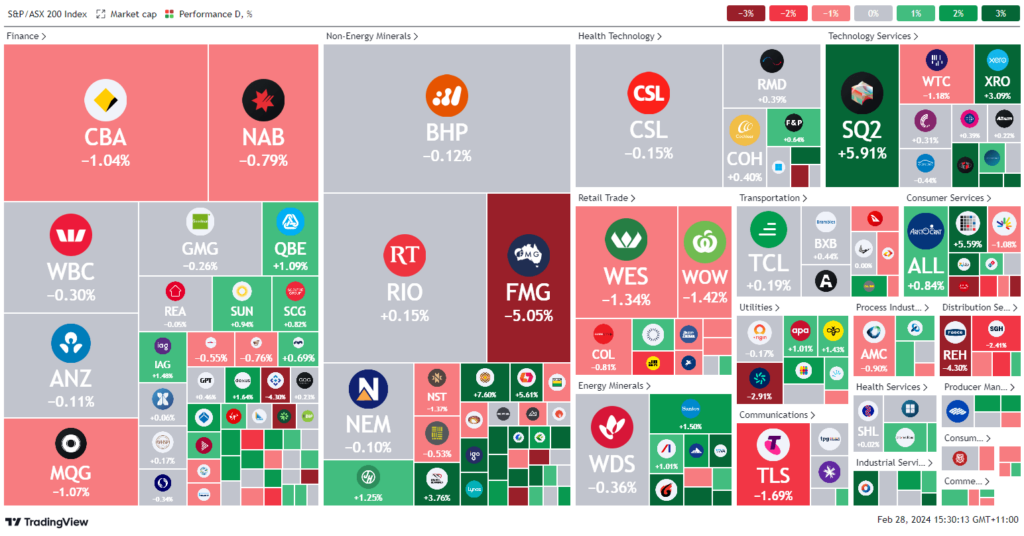

ASX Stocks

ASX 200 - 7,653.3 (-0.1%)

Key Highlights:

The Australian Securities Exchange (ASX) showed mixed performance today, remaining relatively flat around midday. Despite modest declines across much of the index, a notable rally in tech stocks, driven by a significant 9% rise in NextDC, kept the market buoyant. NextDC’s revenue surge of 31% to $209.1 million in the first half bolstered the tech sector, which was the only sector to see an increase of more than 1%. Lithium miners also saw substantial gains, with Pilbara Minerals, Liontown, and IGO all climbing more than 5%.

Conversely, communications stocks lagged, primarily due to a 2% fall in Telstra. Among the notable movers, Neuren Pharmaceuticals experienced a significant drop of 13% following disappointing U.S. sales of its Daybue drug. Kelsian and Flight Centre also faced declines, with Flight Centre’s transaction volumes falling short of expectations. On a positive note, Light & Wonder saw a 5% jump after turning a profit in 2023, while Healius and Perpetual faced losses, with Healius reporting a significant $636 million loss and Perpetual slipping 3.3% despite a profit jump and a declared dividend.

The broader economic context includes steady inflation in Australia at 3.4% for January, below the forecasted 3.6%, suggesting a disinflationary trend. This environment supports the Reserve Bank of Australia’s (RBA) potential to cut interest rates later in the year. Meanwhile, the Reserve Bank of New Zealand held its cash rate steady at 5.5%, despite inflation remaining above target, affecting the New Zealand dollar’s value.

Leaders

CHN-Chalice Mining Ltd (+23.27%)

BRN-Brainchip Holdings Ltd (+20.31%)

DRO-Droneshield Ltd (+18.54%)

EOS-Electro Optic Systems (+16.88%)

LRS-Latin Resources Ltd (+15.79%)

Laggards

HTA-Hutchison Telco. Ltd (-15.63%)

KLS-Kelsian Group Ltd (-12.37%)

NEU-Neuren Pharmaceuticals Ltd (-12.34%)

ZIM-Zimplats Holdings Ltd (-10.47%)

ACL-Australian Clinical Labs Ltd (-8.05%)