What's Affecting Markets Today

Australian Labor Market: A Tepid Start to the Year

In January, the Australian job market showed modest growth, with a net addition of 500 jobs, a slight recovery from a significant drop the previous month. Despite this, the unemployment rate edged up to 4.1%, surpassing expectations and leaving 22,300 more individuals jobless. This development has reignited speculation about potential rate cuts by the Reserve Bank of Australia (RBA), especially as the labor market’s softening could be instrumental in achieving the inflation target of 2-3%.

Altium’s Lucrative Takeover Bid

In corporate news, Altium, a software company based in San Diego and listed on the ASX, has received a generous takeover offer from Japanese conglomerate Renesas. The bid, valued at $9.1 billion or $68.50 per share, represents a 39% premium over Altium’s recent average share price. This move comes after Altium previously rejected a lower bid from Autodesk, highlighting the company’s increased valuation and strategic importance in the tech sector.

Recession Hits Japan, Economic Outlook Uncertain

Japan’s economy has entered a technical recession, contracting for two consecutive quarters amid poor domestic demand. This downturn has led to Japan being surpassed by Germany as the world’s third-largest economy. The unexpected shrinkage raises questions about the Bank of Japan’s (BOJ) future policy direction, especially concerning its long-standing ultra-easy monetary stance. With the economy underperforming and the risk of further contraction in the near term, the BOJ faces increased pressure to adjust its approach to stimulate growth and avoid deeper

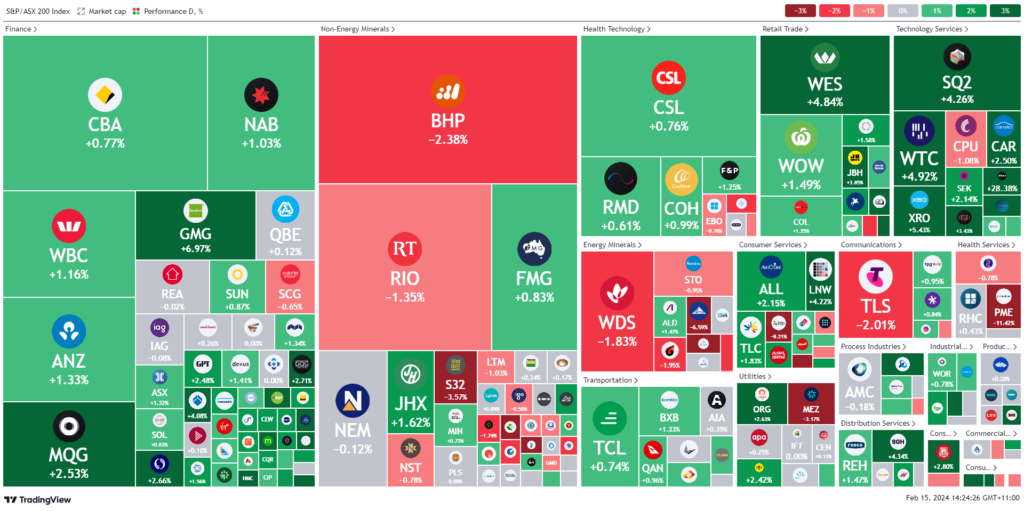

ASX Stocks

ASX 200 - 7,603 (0.7%)

Key Highlights:

Today’s ASX market showed notable gains, with the S&P/ASX 200 increasing by 0.9% by midday, led by a 5.9% surge in the tech sector and a 2.6% rise in consumer discretionary, amid a flurry of corporate profit reports. The jobless rate for January unexpectedly rose to 4.1%, prompting slight adjustments in rate cut expectations, as it signals a potential slowdown aligning with inflation cooling predictions.

Highlighting the day’s activities, Altium’s shares soared following a $9.1 billion takeover offer, marking a significant premium of nearly 39%. This move, indicative of a strong endorsement of Altium’s strategic direction, also positively impacted its tech peers, Wisetech and Xero, with nearly 4% gains each.

In the resources sector, BHP announced substantial exceptional charges due to impairments and increased provisions related to its operations and past disasters. Wesfarmers and Magellan also reported strong profit results, contributing to the market’s upbeat mood.

Leaders

ALU-Altium Ltd (+28.40%)

IPX-Iperionx Ltd (+12.95%)

SYA-Sayona Mining Ltd (+11.11%)

MSB-Mesoblast Ltd (+8.18%)

GMG-Goodman Group (+7.24%)

Laggards

DTL-Data#3 Ltd (-15.54%)

PME-Pro Medicus Ltd (-11.48%)

MGH-Maas Group Holdings Ltd (-8.51%)

IEL-Idp Education Ltd (-8.03%)

WHC-Whitehaven Coal Ltd (-7.72%)