What's Affecting Markets Today

Asia-Pacific markets opened mixed on Friday as investors assessed Japan’s inflation data and China’s interest rate decision.

The People’s Bank of China left its loan prime rates unchanged, with the one-year LPR at 3.1% and the five-year at 3.6%. The one-year rate guides corporate and most household loans, while the five-year serves as a benchmark for mortgages.

Japan reported a November core inflation rate of 2.7%, slightly above the 2.6% forecast by economists. Headline inflation rose to 2.9%, up from October’s 2.3%, following the Bank of Japan’s decision to keep rates at 0.25%.

In response, Japan’s Nikkei 225 advanced 0.5%, and the broader Topix gained 0.38%. South Korea’s Kospi fell 1.05%, while the Kosdaq dropped 1.1%.

Hong Kong’s Hang Seng index edged up 0.13% after China’s rate decision, whereas mainland China’s CSI 300 dipped 0.2%.

The mixed performance reflects caution among investors amid divergent monetary policy paths and economic signals from the region’s largest economies.

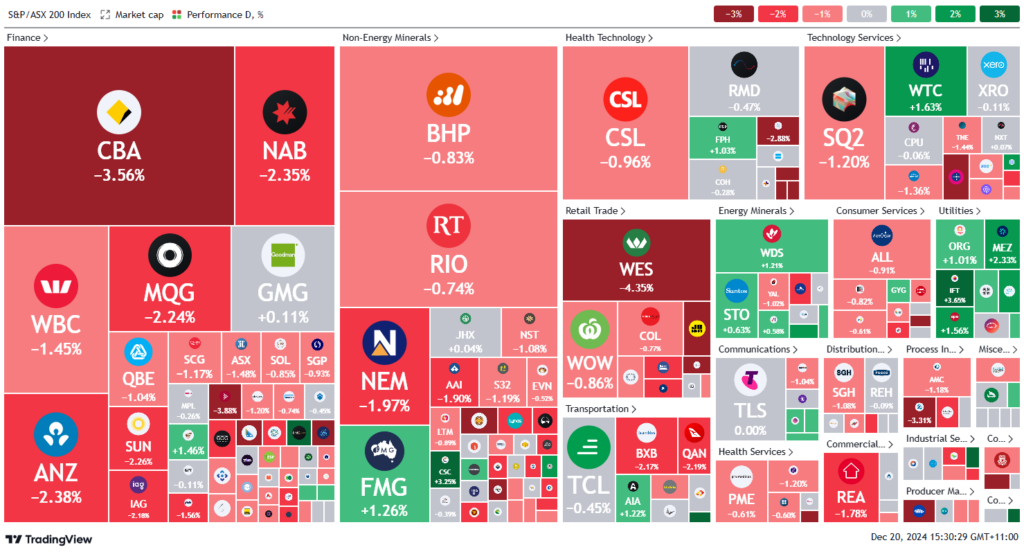

ASX Stocks

ASX 200 - 8,056.9 (-1.4%)

Key Highlights:

Australian shares hit a three-month low on Friday, with the ASX slipping 1.2% to 8067.70, its lowest since September. The index has dropped nearly 3% this week, driven by a broad sell-off led by banks and consumer discretionary stocks.

The downturn follows the US Federal Reserve’s reduced outlook for interest rate cuts in 2025, from three to two, and Chairman Jerome Powell’s caution over reinflation risks. While US markets showed some recovery, Australian investors maintained a risk-off stance.

Banking stocks declined, with Commonwealth Bank leading the drop, down 3.1%, followed by NAB and Westpac, which fell 2% and 1.3%, respectively. Bellevue Gold was the session’s biggest detractor, tumbling 5% due to weaker gold prices. Mesoblast plunged 21.5% after profit-taking on a regulatory approval boost earlier in the week.

HMC Capital rose 3.2% after a sell-off linked to DigiCo’s lackluster IPO. Integral Diagnostics gained 1% post-merger with Capitol Health, and Ventia rose 3% on a Telstra deal. Wesfarmers fell 3.7% after selling its Coregas business for $770 million.

Leaders

IPX Iperionx Ltd (+5.20%)

VSL Vulcan Steel Ltd (+4.36%)

AIZ Air New Zealand Ltd (+4.00%)

KAR Karoon Energy Ltd (+3.86%)

CSC Capstone Copper Corp (+3.57%)

Laggards

MSB Mesoblast Ltd (-21.97%)

ERA Energy Resources of Australia Ltd (-16.67%)

BGL Bellevue Gold Ltd (-5.34%)

CU6 Clarity Pharmaceuticals Ltd (-5.23%)

REG Regis Healthcare Ltd (-4.31%)