What's Affecting Markets Today

Asia-Pacific markets and currencies retreated Thursday amid a broader sell-off triggered by the U.S. Federal Reserve’s third consecutive rate cut and indications of fewer rate reductions ahead.

The Bank of Japan maintained its policy rate at 0.25% for the third straight meeting, causing the yen to weaken to 155.40 per dollar, compared to 154.60 earlier. Following the announcement, Japan’s Nikkei 225 pared earlier losses to close 0.63% lower, while the Topix index declined 0.49%.

South Korea’s Kospi and Kosdaq indices both dropped 1.65%, with the won trading near its weakest level since March 2009 at 1,450.46 per dollar. Hong Kong’s Hang Seng index fell 0.88%, while mainland China’s CSI 300 declined 0.62%.

The Hong Kong Monetary Authority cut its interest rate by 25 basis points, mirroring the Fed’s move, as its currency remains pegged to the U.S. dollar.

Meanwhile, New Zealand’s economy slid into a technical recession, with GDP contracting 1% in the September quarter, marking two consecutive quarters of decline, according to Stats NZ.

ASX Stocks

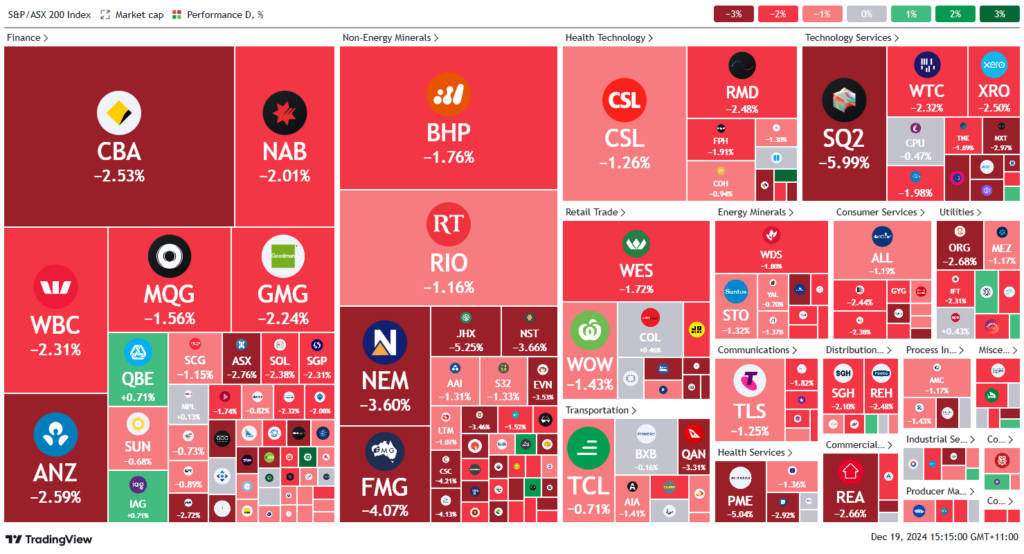

ASX 200 - 8,152.7 (-1.9%)

Key Highlights:

The Australian sharemarket hit a six-week low on Thursday, with the S&P/ASX 200 plunging 1.9% (157 points) to 8152.40 by mid afternoon, amid a global sell-off following the US Federal Reserve’s caution on interest rate cuts. The Fed reduced its forecast for 2025 cuts from three to two, leading to a spike in the US dollar and a drop in the Australian dollar to US62.25¢. Bitcoin also retreated.

Technology and utilities led losses, with BHP falling 1.7%. Megaport tumbled 10%, while Star Entertainment dropped 6.3%. Financial stocks declined, with Block Inc and Pinnacle down over 6%. Credit Corp bucked the trend, surging 7.8%.

Biotech Mesoblast soared 45% after FDA approval for Ryconcil, while Patriot Battery Metals rose 16.5% on Volkswagen’s $76.8 million investment. Woodside gained 2.2% after agreeing to exit the Wheatstone LNG project.

ANZ slid 2.6% amid shareholder backlash over executive pay. Incitec Pivot fell 4%, posting a $311 million FY24 net loss. Elders lost 1.9% after trading ex-dividend.

Leaders

MSB Mesoblast Ltd (+51.52%)

CCP Credit Corp Group Ltd (+8.11%)

IFL Insignia Financial Ltd (+3.19%)

PDN Paladin Energy Ltd (+2.14%)

PRN Perenti Ltd (+2.02%)

Laggards

DYL Deep Yellow Ltd (-10.63%)

MP1 Megaport Ltd (-9.84%)

ZIP ZIP Co Ltd (-8.33%)

SXG Southern Cross Gold Ltd (-7.09%)

SPR Spartan Resources Ltd (-6.32%)