What's Affecting Markets Today

Asia-Pacific markets opened mixed on Wednesday, following Wall Street’s ninth consecutive day of losses, with the Dow Jones Industrial Average extending its decline.

In focus was Japan’s trade data ahead of this week’s Bank of Japan policy meeting. Exports rose 3.8% year-on-year in November, surpassing economists’ forecasts of 2.8%, while imports fell 3.8%, significantly below the expected 1% growth. The trade balance registered a deficit of 117.6 billion yen ($765.2 million), exceeding the anticipated 688.9 billion yen shortfall.

Japan’s Nikkei 225 opened 0.2% lower, while the broader Topix index gained 0.2%. South Korea’s Kospi climbed 0.9%, although the Kosdaq dipped 0.5%.

In Greater China, Hong Kong’s Hang Seng Index rose 0.7% at the open, with the CSI 300 on the mainland also gaining 0.7%. Markets are anticipating the People’s Bank of China’s decision on loan prime rates (LPR) this Friday. The one-year LPR influences corporate and household loans, while the five-year LPR serves as a benchmark for mortgages.

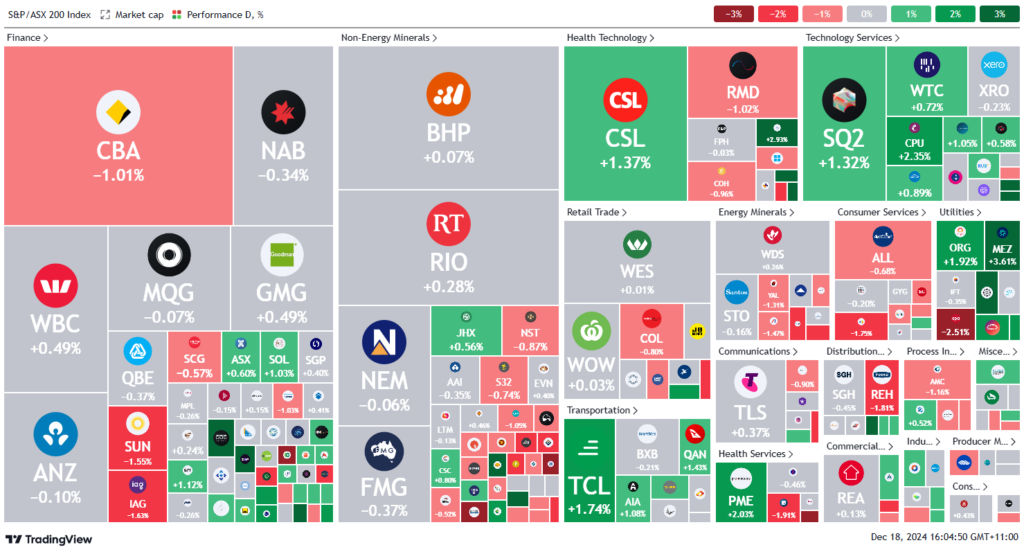

ASX Stocks

ASX 200 - 8,314.9 (+0.02%)

Key Highlights:

Australian shares edged lower on Wednesday as investors adopted a cautious stance ahead of the U.S. Federal Reserve’s final policy decision for the year. The ASX 200 fell 13.2 points, or 0.2%, to close at 8300, reversing an early-session uptick. Meanwhile, the All Ordinaries Index rose 0.3%.

Wall Street’s overnight losses weighed on sentiment as markets braced for a widely anticipated 25-basis-point rate cut from the Fed. Investors expect the central bank to signal a more restrained approach to rate adjustments in 2024. The decision will be announced Thursday AEDT.

On the ASX, four of 11 sectors advanced, led by industrials. Transurban Group gained 1.9%. Banks showed mixed performance, with Commonwealth Bank down 1.2%, while Westpac added 0.4%.

Insignia dropped 4%, leading losses, after rejecting Bain Capital’s $4-a-share takeover bid. Coronado Global Resources followed with a 4% decline.

Clarity Pharmaceuticals surged 12%, moderating from earlier gains of 18%. Vulcan Energy rose 1.6% on a €879 million loan deal for its German Lionheart Project. HMC Capital gained 1.1%, trimming its five-day loss to 15.8%.

Leaders

CU6 Clarity Pharmaceuticals Ltd (+12.15%)

CMW Cromwell Property Group (+9.46%)

RSG Resolute Mining Ltd (+7.05%)

ZIP ZIP Co Ltd (+6.87%)

MP1 Megaport Ltd (+5.59%)

Laggards

ZIM Zimplats Holdings Ltd (-5.95%)

IFL Insignia Financial Ltd (-4.58%)

CRN Coronado Global Resources Inc (-4.29%)

SXG Southern Cross Gold Ltd (-4.07%)

REG Regis Healthcare Ltd (-3.77%)