What's Affecting Markets Today

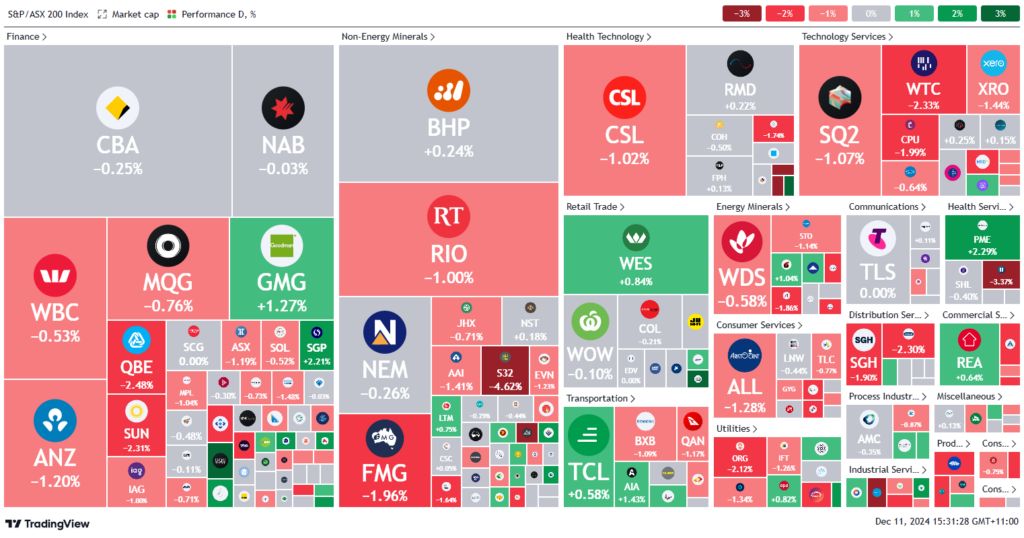

Australian shares dipped in early trading, extending losses from the previous session as profit-taking persisted. The S&P/ASX 200 fell 17 points, or 0.2%, to 8376 points by midday, with tech stocks leading the decline after a 4% drop on Tuesday. WiseTech and Xero slid 2.7% and 1.6%, respectively.

The Australian dollar weakened overnight, shedding nearly 1% against the greenback, amid renewed expectations of an imminent Reserve Bank interest rate cut.

In the US, Wall Street indices edged lower ahead of the November CPI report, projected to show a 0.3% monthly rise. The probability of a Federal Reserve rate cut sits at 86.1%, per CME’s FedWatch.

South32 dropped 4.8% due to supply chain disruptions from Mozambique’s civil unrest. Cettire saw a block trade at $1.10 per share, with its stock recovering slightly to $1.22, down 0.7%. Sigma Healthcare rose 0.5% to $2.84 as it advanced merger plans with Chemist Warehouse. Vulcan Energy Resources paused trading to secure $164 million in funding.

ASX Stocks

ASX 200 - 8,355.9 (-0.40%)

Key Highlights:

Australian shares dipped in early trading, extending losses from the previous session as profit-taking persisted. The S&P/ASX 200 fell 17 points, or 0.2%, to 8376 points by mid afternoon, with tech stocks leading the decline after a 4% drop on Tuesday. WiseTech and Xero slid 2.7% and 1.6%, respectively.

The Australian dollar weakened overnight, shedding nearly 1% against the greenback, amid renewed expectations of an imminent Reserve Bank interest rate cut.

In the US, Wall Street indices edged lower ahead of the November CPI report, projected to show a 0.3% monthly rise. The probability of a Federal Reserve rate cut sits at 86.1%, per CME’s FedWatch.

South32 dropped 4.8% due to supply chain disruptions from Mozambique’s civil unrest. Cettire saw a block trade at $1.10 per share, with its stock recovering slightly to $1.22, down 0.7%. Sigma Healthcare rose 0.5% to $2.84 as it advanced merger plans with Chemist Warehouse. Vulcan Energy Resources paused trading to secure $164 million in funding.

Integral Diagnostics (ASX: IDX), a leading provider of diagnostic imaging services across Australia and New Zealand, has received conditional approval from the Australian Competition and Consumer Commission (ACCC) for its proposed acquisition of Capitol Health (ASX: CAJ). The clearance is contingent on the divestment of a key clinic located in Melton, Victoria.

Leaders

WA1 WA1 Resources Ltd (+11.43%)

SLX SILEX Systems Ltd (+9.98%)

OBM Ora Banda Mining Ltd (+8.59%)

APE Eagers Automotive Ltd (+4.96%)

CRN Coronado Global (+4.82%)

Laggards

NGI Navigator Global (-5.16%)

IMD IMDEX Ltd (-4.90%)

NAN Nanosonics Ltd (-4.14%)

S32 SOUTH32 Ltd (-4.08%)

IPH IPH Ltd (-4.04%)