What's Affecting Markets Today

Asia-Pacific markets advanced on Tuesday, buoyed by gains in Chinese equities following Beijing’s announcement of “more proactive” fiscal measures and “moderately looser” monetary policy for the coming year to stimulate domestic consumption. This offset Wall Street’s overnight retreat, where the S&P 500 and Nasdaq Composite pulled back from record highs ahead of key inflation data.

Mainland China’s CSI 300 index climbed 2.1%, while Hong Kong’s Hang Seng index rose 1.2%, building on a nearly 3% spike in after-hours trading Monday. The market rally followed a policy update from China’s politburo, signaling a shift to support economic growth.

South Korea’s Kospi surged over 2%, with the Kosdaq jumping 5% amid continued scrutiny of the nation’s political developments. Local news reported that opposition leader Lee Jae Myung plans to push a downsized budget bill through parliament later today.

Elsewhere, Japan’s Nikkei 225 edged 0.1% higher, with the broader Topix gaining 0.15%, as investors remained cautious ahead of global inflation readings and U.S. monetary policy signals.

ASX Stocks

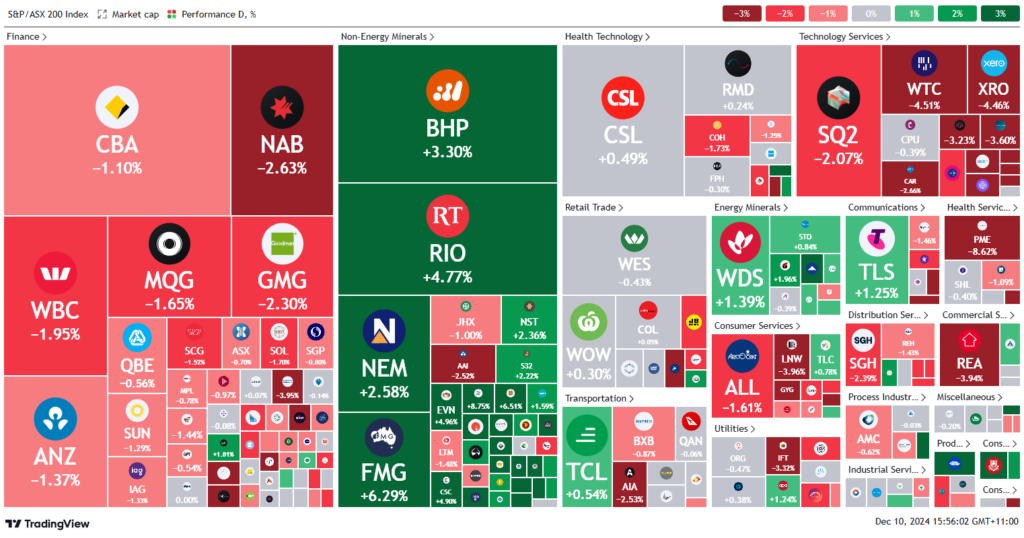

ASX 200 - 8,398.7 (-0.30%)

Key Highlights:

The ASX has recovered some losses following a dovish stance from the Reserve Bank of Australia (RBA), which left the cash rate unchanged at 4.35%. The central bank expressed growing confidence that inflationary pressures are easing, citing softer-than-expected economic and wage growth since November. The S&P/ASX 200 is 0.2% lower, improving from a 0.6% decline earlier in the session.

Banking and technology sectors remain under pressure, down 2% and 4.7%, respectively. Losses in high-performing stocks, including Pro Medicus, Megaport, and WiseTech, were partly driven by Wall Street’s overnight sell-off after news of China’s probe into Nvidia.

Mining stocks, however, rallied 3.4%, buoyed by China’s plans for “moderately loose” monetary policy next year. Lithium and iron ore miners led the gains, with Mineral Resources up 8% to $37.06, Pilbara Minerals 5.5% higher at $2.27, and Fortescue 5.4% higher at $20.30.

In corporate news, Perpetual shares sank 5.8% amid a potential $500 million tax bill. Meanwhile, IAG fell 1.7% as it prepared to defend a class action, and Platinum Asset Management declined another 1.7% after a failed takeover deal.

Penfolds owner Treasury Wine Estates has acquired the Stone & Moon winery in north-eastern China for $27.5 million, spreading its bets that Chinese wine will eventually be held in the same regard as the world’s prestige wine growing regions.

Leaders

MIN Mineral Resources Ltd (+8.98%)

VUL Vulcan Energy Resources Ltd (+6.34%)

PLS Pilbara Minerals Ltd (+6.28%)

FMG Fortescue Ltd (+5.69%)

MAC MAC Copper Ltd (+5.68%)

Laggards

PPT Perpetual Ltd (-8.76%)

PME Pro Medicus Ltd (-8.34%)

TUA Tuas Ltd (-6.54%)

MP1 Megaport Ltd (-5.73%)

PNI Pinnacle Investment (-5.51%)