What's Affecting Markets Today

Asia-Pacific markets traded mixed on Thursday as Wall Street benchmarks hit record highs, shrugging off global political uncertainties. Investors closely watched developments in South Korea and France, where political tensions remain elevated.

In South Korea, lawmakers filed a motion to impeach President Yoon Suk Yeol following his declaration of martial law. Yoon’s office defended the move as constitutional, while the ruling People Power Party vowed to oppose the motion. The opposition plans to hold a vote on Saturday evening. Meanwhile, South Korea’s revised third-quarter GDP showed the economy grew 0.1% quarter-on-quarter and 1.5% year-on-year, aligning with earlier estimates. However, market sentiment faltered, with the Kospi falling 0.90% to 2,441.85 and the Kosdaq down 0.92% to 670.94.

Japan’s markets remained resilient, with the Nikkei 225 rising 0.30% to close at 39,395.60 and the Topix edging up 0.06% to 2,742.24. In contrast, Hong Kong’s Hang Seng Index dropped 1.1% in late trading, and mainland China’s CSI 300 index slipped 0.23% to 3,921.58, reflecting cautious investor sentiment.

ASX Stocks

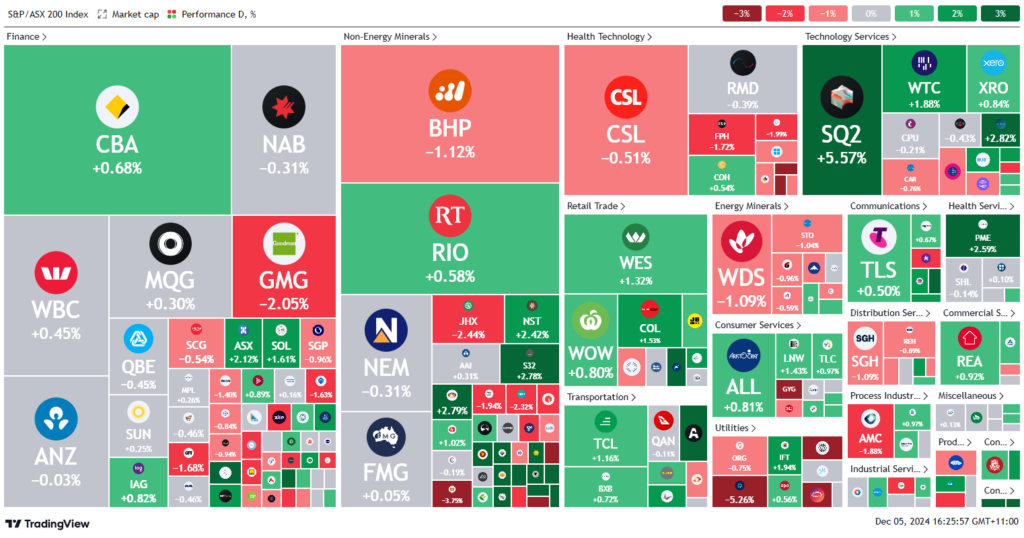

ASX 200 - 8,433.1 (-0.50%)

Key Highlights:

Australian shares retreated on Friday, tracking Wall Street’s decline as investors exercised caution ahead of a critical US jobs report that may influence the Federal Reserve’s policy stance. The S&P/ASX 200 dropped 0.5% to 8435.2 by early afternoon, positioning the index for a flat weekly close despite hitting a record high of 8514.5 on Tuesday.

Losses were broad-based, with the tech and energy sectors leading the downturn, while utilities stood out as the sole gainer. Mining heavyweights Rio Tinto, Fortescue, and BHP shed 0.7%, 0.4%, and 0.2%, respectively, despite a midday uptick in iron ore futures in Singapore, which rose 0.5% to $US104.35 per tonne.

The major banks showed mixed performance, with Westpac falling 1.1%, while Commonwealth Bank and ANZ were flat. Energy stocks declined following a three-month delay in a planned output increase by major oil producers. Woodside and Santos fell 2% and 0.9%, respectively.

In corporate moves, APA Group gained 2.2% after avoiding price regulation on a key pipeline, while Iluka Resources tumbled 13% on a cost blowout at its rare earths refinery.

Leaders

TUA Tuas Ltd (+6.51%)

BVS Bravura Solutions Ltd (+4.19%)

GDG Generation Development Group Ltd (+4.05%)

LOV Lovisa Holdings Ltd (+3.55%)

OPT Opthea Ltd (+3.19%)

Laggards

ILU Iluka Resources Ltd (-10.58%)

PYC PYC Therapeutics Ltd (-7.47%)

MFG Magellan Financial Group Ltd (-7.20%)

ZIP ZIP Co Ltd (-6.05%)

PGC Paragon Care Ltd (-6.00%)