What's Affecting Markets Today

Asia-Pacific markets traded mixed on Thursday, as investors digested record highs on Wall Street amid ongoing global political uncertainties.

In South Korea, the Kospi fell 0.44%, while the Kosdaq edged higher, as political turmoil weighed on sentiment. Lawmakers filed a motion to impeach President Yoon Suk Yeol following his declaration of martial law, with a vote expected as early as Friday. Yoon’s administration has defended the action as constitutional, while the ruling People Power Party vowed to oppose the motion.

Meanwhile, South Korea’s third-quarter GDP growth was confirmed at 0.1% quarter-on-quarter and 1.5% annually, in line with earlier estimates. Analysts warned of a potential long-term political risk premium for South Korea, though liquidity assurances from the Bank of Korea and finance ministry have provided immediate market stability.

In Japan, the Nikkei 225 rose 0.54% and the Topix gained 0.18%, while Hong Kong’s Hang Seng futures dropped over 1%, and China’s CSI 300 slipped 0.1%.

Bitcoin surged past $100,000, hitting a record $103,844 amid the uncertainty.

ASX Stocks

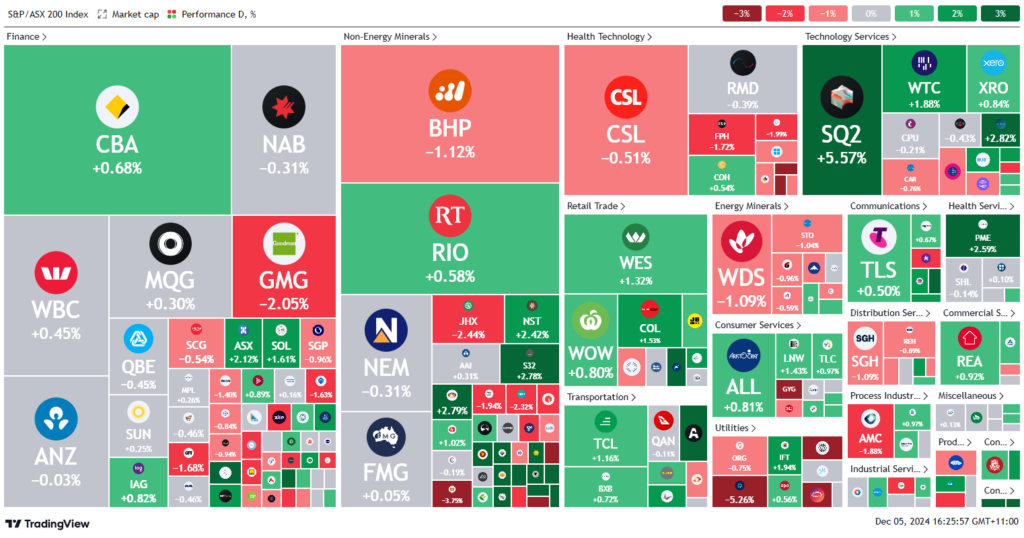

ASX 200 - 8,474.9 (-0.40%)

Key Highlights:

The Australian sharemarket edged higher on Thursday, driven by gains in technology shares following a strong Wall Street performance. By mid afternoon, the S&P/ASX 200 Index rose 0.2% (19.1 points) to 8481.7, with the Australian dollar trading at US64.38¢. The information technology sector led the gains, with WiseTech and TechnologyOne each up 3.2%.

Wall Street saw all major indices close in positive territory overnight. The Dow Jones rose 0.7%, the S&P 500 gained 0.6%, and the Nasdaq rallied 1.3%.

Bitcoin surged past $US100,000 for the first time, spurred by news of President-elect Donald Trump appointing cryptocurrency advocate Paul Atkins as the SEC’s new head.

In commodities, iron ore futures declined 1% to $US104 per tonne in Singapore trading, weighing on BHP, which fell 1.1%.

HMC Capital rose 1.6% after agreeing to acquire Neoen’s Victorian renewable energy assets for $950 million. Rio Tinto outlined plans to grow copper production by 18% in 2025 and 40% by 2030, with shares slipping 0.5%.

Leaders

BVS Bravura Solutions Ltd (+8.00%)

GMD Genesis Minerals Ltd (+7.68%)

RMS Ramelius Resources Ltd (+7.58%)

SPR Spartan Resources Ltd (+7.22%)

CMM Capricorn Metals Ltd (+6.97%)

Laggards

MSB Mesoblast Ltd (-7.10%)

LTR Liontown Resources Ltd (-6.48%)

WA1 WA1 Resources Ltd (-5.24%)

CRN Coronado Global Resources Inc (-4.65%)

PLS Pilbara Minerals Ltd (-4.17%)