What's Affecting Markets Today

Asia-Pacific markets edged higher on Monday, starting a data-intensive week with investors focused on key economic indicators from Japan, South Korea, and China.

China’s November official manufacturing PMI rose to 50.3, exceeding the 50.2 forecast by Reuters and marking its highest level since April, up from October’s 50.1. Non-manufacturing PMI declined slightly to 50.0 from 50.2, while the composite PMI remained steady at 50.8, signaling stable economic activity. S&P Global’s manufacturing PMI readings for Asia, including China’s Caixin survey, are set for release later in the day.

Australia’s retail sales surged 3.4% year-on-year in October, its strongest growth since May 2023. Indonesia is expected to release November inflation figures shortly.

South Korea’s Kospi traded near flat, while the Kosdaq inched up 0.13%. Preliminary trade data revealed export growth of 1.4% in November, missing expectations of 2.8% and slowing from October’s 4.6%.

Japan’s Nikkei 225 rose slightly, and the Topix gained 0.68%. Hong Kong’s Hang Seng Index climbed 0.21%, with mainland China’s CSI 300 up 0.26%, buoyed by a 0.5% rise in the Hang Seng Mainland Properties Index following stronger new home price growth in November.

ASX Stocks

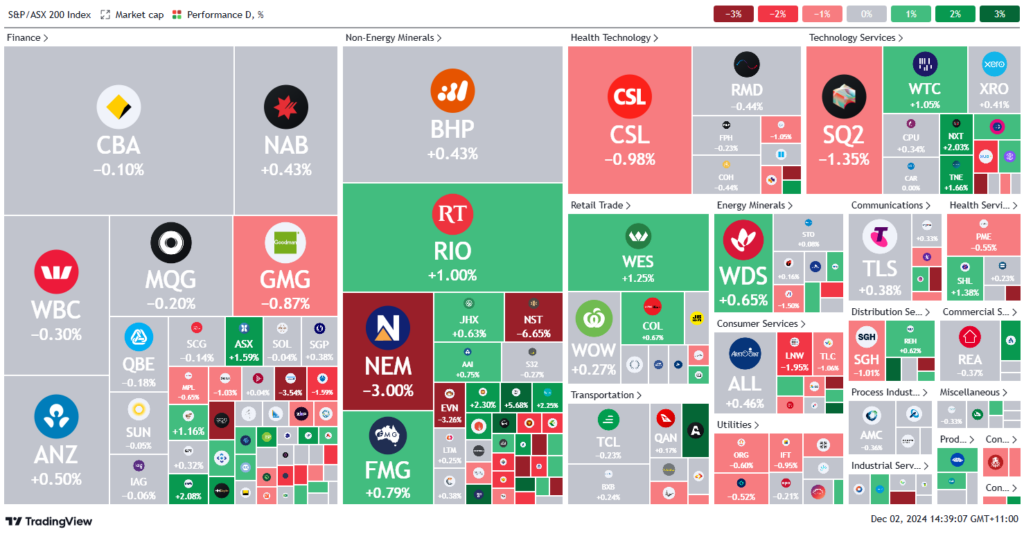

ASX 200 - 8,438.5 (+0.01%)

Key Highlights:

The Australian sharemarket is nearing its third record high this week, with the S&P/ASX 200 rising 19 points to 8455, just below the all-time high of 8477.1 set on Thursday. Gains in technology stocks, up 1.1%, are leading the advance.

Market optimism has been bolstered by US President-elect Donald Trump’s tax cut and deregulation proposals, alongside confidence in his Treasury Secretary nominee, Scott Bessent, easing tariff concerns. This optimism helped the S&P 500 reach a record high last week, with a 5.7% surge in November, its best month this year. The ASX gained 3.4% during the same period, marking its strongest return since July.

Australian retail sales rose 0.6% in October, surpassing the 0.4% consensus and improving from 0.1% in September.

Northern Star Resources announced a $5 billion acquisition of De Grey Mining, sending De Grey’s shares up 30% to $1.93. GQG Partners fell over 10% after a UBS downgrade tied to concerns about its Adani investment. Meanwhile, Netwealth, despite reaching $100 billion in FUA, dropped 3.3%. Metcash shares rose 3.5%, meeting profit expectations despite flat earnings growth.

Leaders

DEG: De Grey Mining Ltd (+27.47%)

MYR: Myer Holdings Ltd (+12.74%)

GOR: Gold Road Resources Ltd (+9.92%)

IGO: IGO Ltd (+5.46%)

MIN: Mineral Resources Ltd (+5.44%)

Laggards

GQG: GQG Partners Inc (-11.49%)

NST: Northern Star Resources Ltd (-6.85%)

VUL: Vulcan Energy Resources Ltd (-6.69%)

NXL: NUIX Ltd (-6.64%)

OBM: Ora Banda Mining Ltd (-6.21%)