What's Affecting Markets Today

Asia-Pacific markets mostly declined Thursday as investors focused on regional tech shares following chipmaker Nvidia’s robust but decelerating results.

Nvidia reported a 94% year-on-year revenue increase for Q3, reaching $35.08 billion, though growth slowed compared to prior quarters, which saw surges of 122%, 262%, and 265%. Net income more than doubled to $19.3 billion, up from $9.24 billion a year ago.

Indian markets turned their attention to stocks linked to Gautam Adani, as the Adani Group chairman faced bribery and fraud charges in a New York federal court.

Japan’s Nikkei 225 slipped 0.67%, while the Topix lost 0.22%. Semiconductor equipment maker Advantest, linked to Nvidia since 2023, was the biggest Nikkei loser, dropping over 3%.

South Korea’s Kospi bucked the trend, rising 0.25%, supported by gains in SK Hynix (0.41%) and Samsung Electronics (0.54%), even as the Kosdaq fell 0.46%.

Hong Kong’s Hang Seng Index declined 0.31%, and mainland China’s CSI 300 edged 0.14% lower, reflecting broader caution across the region.

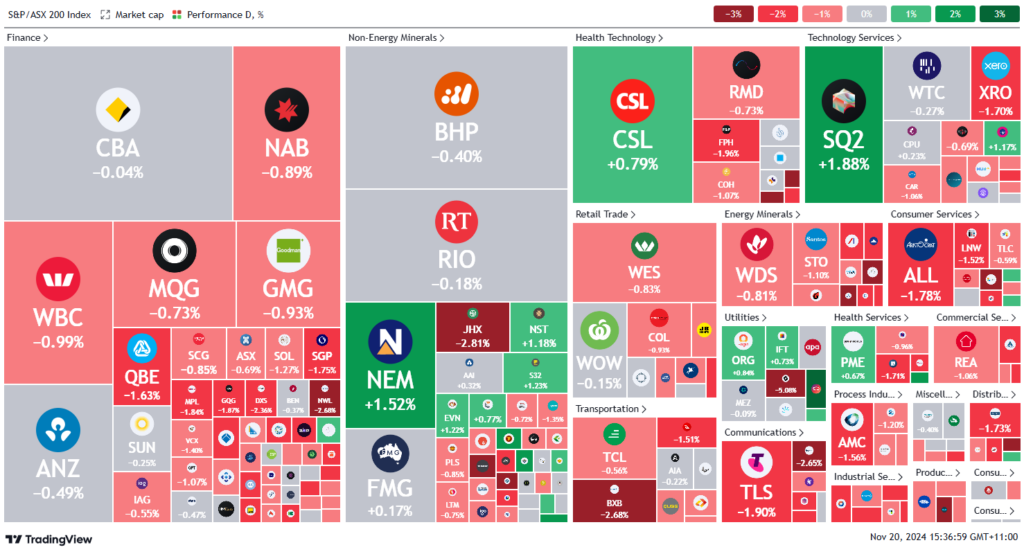

ASX Stocks

ASX 200 - 8,323.5 (0.01%)

Key Highlights:

Australian shares have reversed early gains to trade lower as the S&P/ASX 200 slipped 11 points to 8324 in late afternoon trade. After opening 0.3% higher, the index lost momentum by midday. Commonwealth Bank weighed on the market, falling 1% after briefly setting a record high above $157.

Wesfarmers dropped 2%, dragging the consumer discretionary sector down 1.4%, the weakest performer on Thursday. The technology sector also declined, shedding 0.3%. Bitcoin’s rally post-US elections remains strong, hitting $US97,000.

Mineral Resources faced a significant protest vote against its remuneration report at its AGM, with shares slipping 1.4% to $34.24. Web Travel Group, spun off from Webjet, fell 2.9% after revising its financial reporting under auditor requirements.

Accent Group plunged 13% on warnings of margin pressures due to aggressive discounting. Meanwhile, Sayona Mining dropped 7.9% to 3.5¢ after completing a $40 million equity raise at 3.2¢ per share, ahead of its planned merger with Piedmont Lithium, which fell 8.1% to 17¢.

Leaders

PGC Paragon Care Ltd (+7.78%)

WA1 WA1 Resources Ltd (+7.37%)

VUL Vulcan Energy Resources Ltd (+6.59%)

SIG Sigma Healthcare Ltd (+4.31%)

GTK Gentrack Group Ltd (+3.85%)

Laggards

GQG GQG Partners Inc (-14.02%)

AX1 Accent Group Ltd (-11.66%)

NEU Neuren Pharmaceuticals Ltd (-8.25%)

MSB Mesoblast Ltd (-5.71%)

PXA Pexa Group Ltd (-5.33%)