What's Affecting Markets Today

Asia-Pacific markets edged lower Wednesday, tracking a mixed session on Wall Street as geopolitical tensions between Ukraine and Russia weighed on sentiment.

Japan’s October trade data surprised on the upside, with exports growing 3.1% year-over-year, rebounding from September’s 1.7% decline and beating forecasts. Imports rose 0.4%, also exceeding expectations but slowing from the prior month’s 2.1% growth. Despite the data, the Nikkei 225 fell 0.45% and the Topix lost 0.46%.

Hong Kong’s Hang Seng slipped 0.09%, while Mainland China’s CSI 300 edged down 0.13%. The People’s Bank of China held its benchmark lending rates steady after an October rate cut. South Korea’s Kospi bucked the trend, gaining 0.66%, and the Kosdaq rose 0.57%.

In the U.S., the Nasdaq climbed 1.04% to 18,987.47, supported by tech strength. The S&P 500 rose 0.4% to 5,916.98, while the Dow Jones Industrial Average slipped 0.28% to 43,268.94.

Market pressure followed President Vladimir Putin’s warning of a lower nuclear-use threshold, amid reports of Ukraine striking Russia’s Bryansk region with U.S.-made missiles.

ASX Stocks

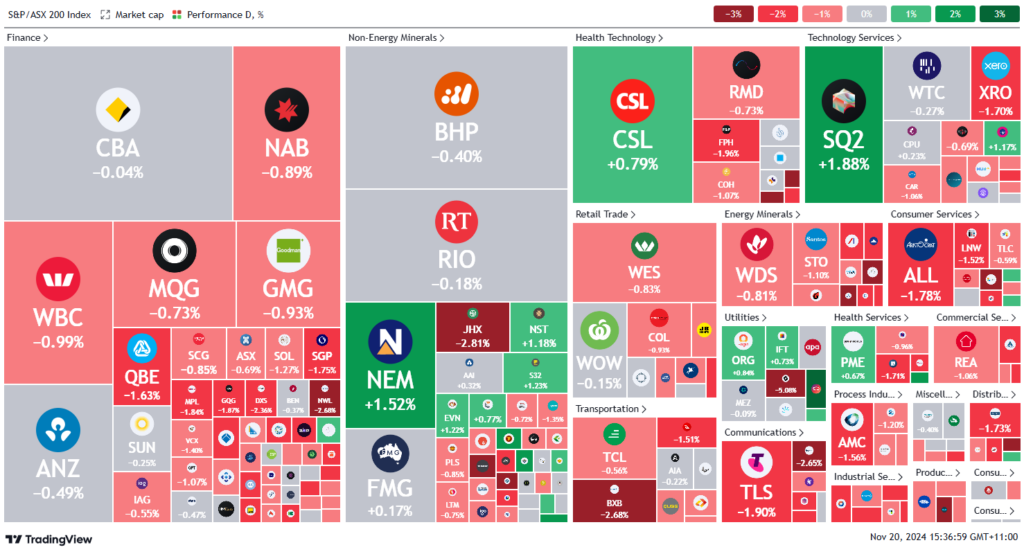

ASX 200 - 8,318.6 (-0.6%)

Key Highlights:

Australian shares retreated from record highs as geopolitical tensions dampened investor sentiment. The S&P/ASX 200 Index fell 31 points, or 0.4%, to 8351.6, with energy stocks leading declines, down 1%. Santos dropped 1%, weighing on the sector.

Packaging giant Amcor slipped 0.7% to $15.59 after announcing an $US8.4 billion ($13 billion) acquisition of Berry Group, a New York-listed packaging company. The deal underscores Amcor’s growth ambitions but pressured its share price in a choppy session.

PWR Holdings faced a steep sell-off, plummeting 30% to $6.41 after warning that its first-half FY25 profit after tax will be $3.5 million, a sharp decline from $9.8 million in the prior corresponding period.

Furniture retailer Nick Scali eased 1.3% to $14.05, citing risks to its previous guidance after one of its freight partners entered liquidation, potentially disrupting operations.

Meanwhile, Pinnacle Investment Management halted trading as it announced a $400 million equity raising to acquire strategic minority stakes in two offshore fund managers, signaling expansion efforts in global markets.

Leaders

NXG Nexgen Energy (Canada) Ltd (+7.31%)

CAT Catapult Group International Ltd (+6.06%)

IPX Iperionx Ltd (+6.02%)

CEN Contact Energy Ltd (+4.99%)

RPL Regal Partners Ltd (+4.57%)

Laggards

PWH PWR Holdings Ltd (-27.42%)

MAD Mader Group Ltd (-9.91%)

NEU Neuren Pharmaceuticals Ltd (-7.64%)

MCY Mercury NZ Ltd (-3.97%)

RDX REDOX Ltd (-3.70%)