What's Affecting Markets Today

Asia-Pacific markets opened higher on Tuesday, tracking Wall Street gains bolstered by a Tesla rally and investor focus on Chinese financial policy discussions at a Hong Kong investment summit.

Australia’s S&P/ASX 200 rose 0.53%, Japan’s Nikkei 225 gained 0.68%, and the Topix added 0.65%. South Korea’s Kospi and Kosdaq traded near flat, while Hong Kong’s Hang Seng Index climbed 0.71%, and China’s CSI 300 edged up 0.31%.

The Reserve Bank of Australia reaffirmed its “forward-looking” stance at its recent meeting, signaling readiness to adjust interest rates as economic conditions evolve, despite no immediate need for action.

At the Hong Kong summit, Chinese Vice Premier He Lifeng emphasized Beijing’s commitment to supporting Hong Kong’s innovation and financial reform, aiming to strengthen the city’s global financial competitiveness. He Lifeng, who chairs a top economic policy-making body, is set to deliver the keynote address.

Other notable speakers include Li Yunze, head of the National Financial Regulatory Administration, and Wu Qing, Chair of the China Securities Regulatory Commission, discussing China’s financial advancements.

ASX Stocks

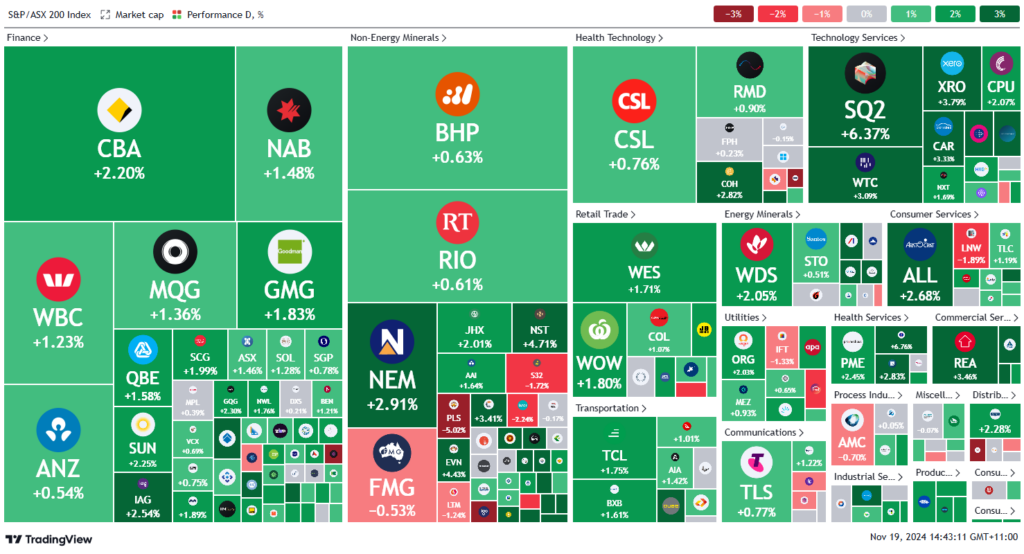

ASX 200 - 8,425.7 (+1.5%)

Key Highlights:

The Australian sharemarket reached a new high on Tuesday, as the S&P/ASX 200 Index climbed 1.3%, or 108.9 points, to 8409.1 by mid afternoon, breaking above the 8400 threshold for the first time. All 11 sectors traded higher, led by strong performances in technology and energy stocks.

The tech sector surged 3.7%, driven by an 11% jump in TechnologyOne shares. The enterprise software company reported a 15% rise in full-year net profit to $118 million and a 17% revenue increase, declaring a 22.45¢ full-year dividend.

Energy stocks also advanced, fueled by higher oil prices amid geopolitical tensions and a weaker US dollar. Brent crude rose above $US73 per barrel. Woodside Energy gained 2%, while Santos edged up 0.7%. Santos announced plans to boost shareholder returns from 2026, raising its payout target to 60% of free cash flow.

Newmont rose 2.4% after agreeing to sell its Musselwhite mine for up to $US850 million. Meanwhile, KMD Brands fell 1.3%, citing cautious consumer sentiment after lower quarterly sales.

Leaders

RSG Resolute Mining Ltd (+12.50%)

TNE Technology One Ltd (+10.87%)

SPR Spartan Resources Ltd (+9.19%)

MYR Myer Holdings Ltd (+7.77%)

SHL Sonic Healthcare Ltd (+6.64%)

Laggards

ELD Elders Ltd (-9.83%)

PLS Pilbara Minerals Ltd (-5.02%)

NEU Neuren Pharmaceuticals Ltd (-3.46%)

SUL Super Retail Group Ltd (-3.43%)

MAD Mader Group Ltd (-2.99%)