What's Affecting Markets Today

Asia-Pacific markets were mixed on Tuesday as investors maintained a cautious approach despite the Dow Jones Industrial Average’s record high, driven by post-election momentum. Australia’s S&P/ASX 200 declined 0.33%, while Japan’s Nikkei 225 and Topix saw gains of 0.23% and 0.68%, respectively. South Korea’s Kospi fell 1.25% with the Kosdaq dropping 2.04%. Hong Kong’s Hang Seng rose 0.21% in early trade, and the CSI 300 was up 0.22%.

Investors in the region are eyeing key economic data, including Australia’s NAB business survey, Indonesia’s September retail sales, and India’s October consumer price index. OPEC’s monthly oil market report is also due.

In the U.S., the Dow climbed 304 points, or 0.69%, closing at 44,293.69, marking its first close above 44,000. The S&P 500 edged up 0.1% to a record 6,001.35, while the Nasdaq was nearly flat, up 0.06% at 19,298.76. Bitcoin soared past $87,000 amid deregulation hopes, fueling rallies in crypto stocks like Coinbase and Mara Holdings, up 20% and 30%, respectively.

ASX Stocks

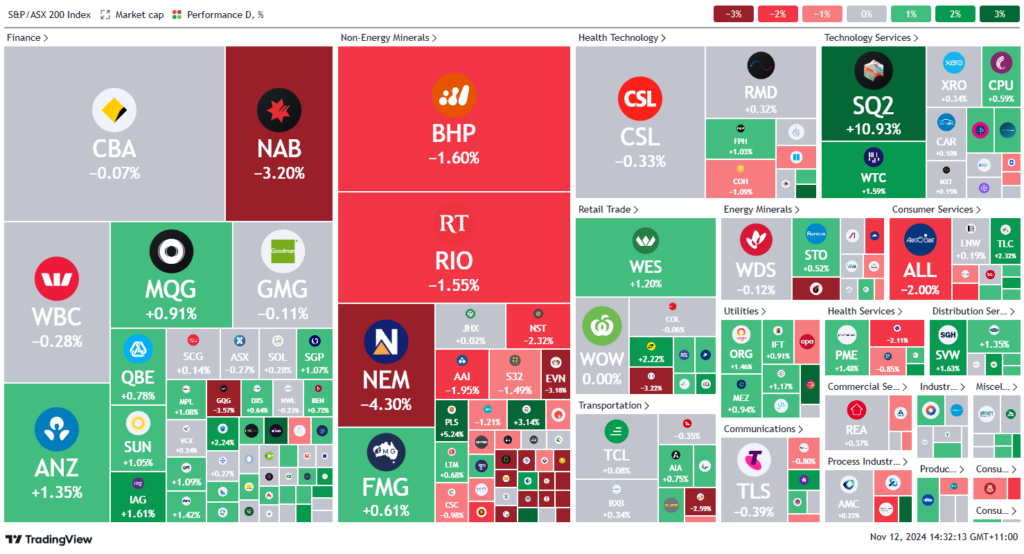

ASX 200 - 8,244.7 (-0.3%)

Key Highlights:

The S&P/ASX 200 is down 0.6% or 47 points at 8218 near midday AEDT, extending Monday’s 0.4% decline. Mining stocks dropped 2%, with BHP down 2.1% to $40.77 after iron ore prices slipped 1.7% to around $US100 per tonne. Gold miners faced sharp losses as spot gold fell 2.3% to $US2622.62, prompting a sell-off in West African Resources, Emerald Resources, and Bellevue Gold, each down over 5%. Energy stocks also declined by 1%.

Liontown Resources rose 3.6% to 87¢ despite a Citi downgrade to “sell,” while Afterpay-owner Block surged 10.6% to $126.14 after a positive analyst note. Coles shares edged down 0.6% to $17.64, with chairman James Graham addressing the “politicisation” of cost-of-living concerns.

Meanwhile, Nib shares fell 0.8% to $5.99 after lowering guidance. Paladin Energy slumped 24.3% to $7.32 following reduced production guidance. Aristocrat Leisure’s shares dipped 1% to $64.96 as it announced the $US620 million sale of Plarium Global.

Leaders

SQ2 Block Inc: +10.77%

VUL Vulcan Energy Resources Ltd: +5.78%

LTR Liontown Resources Ltd: +4.76%

AX1 Accent Group Ltd: +4.70%

MP1 Megaport Ltd: +4.42%

Laggards

PDN Paladin Energy Ltd (-27.58%)

SPR Spartan Resources Ltd (-8.17%)

OBM Ora Banda Mining Ltd (-7.45%)

DYL Deep Yellow Ltd (-6.95%)

VAU Vault Minerals Ltd (-6.34%)