What's Affecting Markets Today

Asia-Pacific markets rose Tuesday following a 25-basis-point rate cut from the U.S. Federal Reserve, fueling a postelection rally across major U.S. indexes. Investors are now closely watching China’s National People’s Congress, where anticipated fiscal stimulus is expected to boost the world’s second-largest economy.

Japan’s September household spending showed a smaller-than-expected decline, with official data indicating a 1.1% drop versus the 2.1% forecast by Reuters’ polls. Japan’s Nikkei 225 edged up 0.37%, and the Topix rose 0.14%.

South Korea’s Kospi gained 0.64%, while the Kosdaq rose 1.36%, highlighting strong performances in smaller-cap sectors. In Hong Kong, the Hang Seng index advanced 1.23%, and mainland China’s CSI 300 climbed 0.37%, reflecting optimism around potential economic support measures.

The region’s gains align with global market sentiment, buoyed by rate cuts and fiscal intervention, as Asia-Pacific economies look to steady amid global economic uncertainty and fluctuating growth indicators.

ASX Stocks

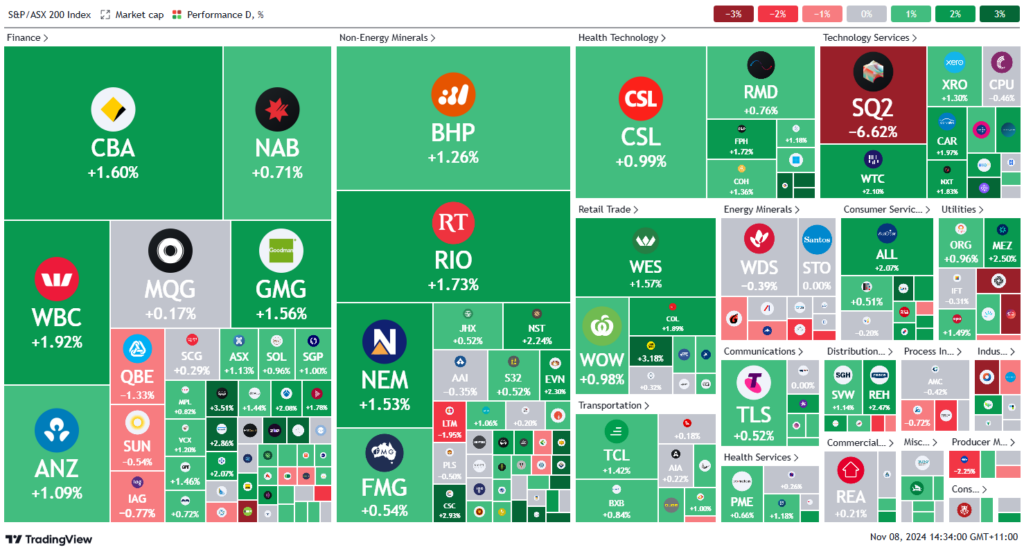

ASX 200 - 8,309.4 (+1.0)

Key Highlights:

Australian shares rose midday, tracking US gains as global rate cuts and expectations of Chinese stimulus supported markets. The S&P/ASX 200 is up 0.9% at 8298.5 points, with tech stocks leading a broad advance.

Overnight, Wall Street’s S&P 500 gained 0.9%, the Nasdaq rose 1.5%, and the Dow closed flat. Fed Chair Jerome Powell reiterated that while inflation has eased, it remains elevated, and policy remains restrictive. China’s National People’s Congress Standing Committee is anticipated to announce further stimulus, bolstering mining stocks with BHP up 1.7%.

Block Inc, Afterpay’s owner, saw a 19% profit jump to $US2.25 billion, missing forecasts; shares are down 6.7%. ANZ reported an 8% annual net profit drop to $6.54 billion amid strong competition, edging shares up 0.5%. REA Group’s quarterly revenue rose 21%, though shares dipped 0.6%. News Corp shares rose 1.2% on earnings growth and a CFO transition. Mayne Pharma shares surged over 10% amid acquisition interest, while Vulcan Energy gained 6.8% as it launched lithium production in Germany.

Leaders

NEU Neuren Pharmaceuticals Ltd (+14.79%)

IPX Iperionx Ltd (+8.01%)

SIG Sigma Healthcare Ltd (+6.79%)

SPR Spartan Resources Ltd (+6.45%)

SLX SILEX Systems Ltd (+5.62%)

Laggards

SQ2 Block Inc (-6.71%)

JIN Jumbo Interactive Ltd (-5.24%)

PGC Paragon Care Ltd (-4.69%)

BFL BSP Financial Group Ltd (-4.32%)

MCY Mercury NZ Ltd (-4.25%)