What's Affecting Markets Today

Asia-Pacific markets showed mixed performance on Tuesday as investors anticipated the U.S. presidential election and a potential rate cut by the Federal Reserve later in the week. Japan’s Nikkei 225 climbed 1.11%, with the Topix up 0.73%. South Korea’s Kospi dipped 0.17%, while the Kosdaq edged up 0.2% after consumer inflation in October rose 1.3% year-on-year, slightly below the 1.4% expected by Reuters.

Hong Kong’s Hang Seng Index gained 0.98%, and China’s CSI 300 advanced 1.53%.

In the U.S., major indexes declined overnight. The Dow Jones Industrial Average fell 257.59 points, or 0.61%, to close at 41,794.60. The S&P 500 slipped 0.28% to 5,712.69, and the Nasdaq Composite dropped 0.33% to 18,179.98. The dip came as U.S. Treasurys rallied, indicating risk reduction by investors ahead of the election.

Market attention remains on the Federal Reserve’s upcoming rate decision on Thursday, with CME Group’s FedWatch Tool showing a 99% probability of a quarter-point cut, following September’s half-point reduction.

ASX Stocks

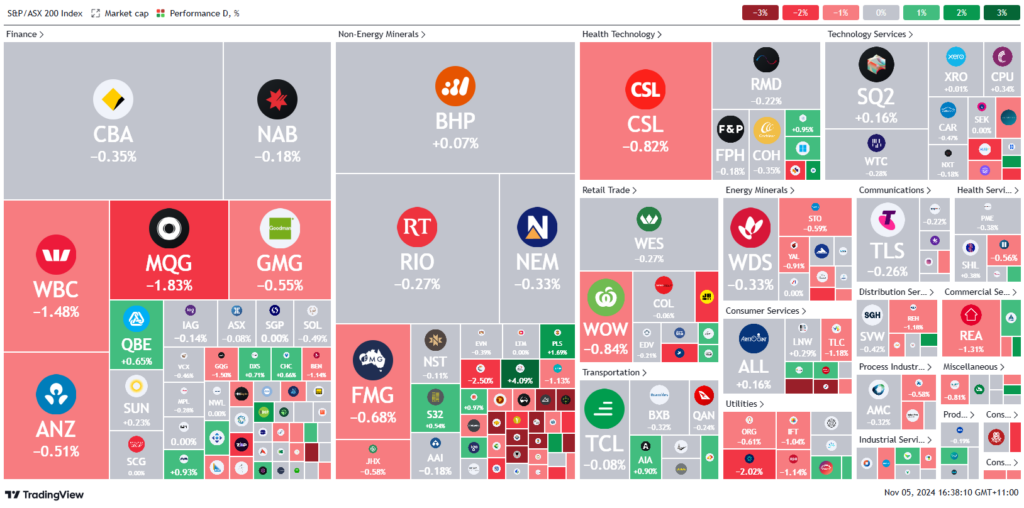

ASX 200 - 8,131.8 (-0.4%)

Key Highlights:

Australian shares slipped as voting in the pivotal US presidential election commenced, widely seen as the year’s most significant market event. The S&P/ASX 200 Index fell 32.8 points, or 0.4%, to close at 8131.8. This followed declines in US equities, a rise in Treasuries, and a dip in the dollar amid indications that Kamala Harris was leading in a key battleground state, unsettling bets on a Trump comeback.

Banking stocks dropped 0.9% after the RBA held rates steady at 4.35%, citing persistent inflation concerns. Westpac fell 1.5% to $31.92 despite reporting a $7 billion net profit.

Energy stocks eased after oil prices stabilized. Domino’s Pizza sank 6.3% to $31.60 as CEO Don Meij announced his departure. Mineral Resources rebounded 4.1% to $38.20 after news of founder Chris Ellison’s planned exit.

Lifestyle Communities rose 7.7% on HMC Capital’s stake acquisition, while Star Entertainment gained 7.1% following a major share offload by Perpetual. Sigma Healthcare slipped 2.2% as regulatory review loomed.

Leaders

LIC Lifestyle Communities Ltd (+7.69%)

MIN Mineral Resources Ltd (+4.09%)

JLG Johns Lyng Group Ltd (+2.97%)

SKC Skycity Entertainment Group Ltd (+2.80%)

WA1 WA1 Resources Ltd (+2.69%)

Laggards

DMP Domino’s Pizza Enterprises Ltd (-6.26%)

CMM Capricorn Metals Ltd (-4.19%)

OBM Ora Banda Mining Ltd (-3.37%)

CAT Catapult Group International Ltd (-3.29%)

CBO Cobram Estate Olives Ltd (-3.16%)