What's Affecting Markets Today

Asia-Pacific markets were mostly down on Friday, following Wall Street’s steepest decline in nearly two months due to weak earnings forecasts from Microsoft and Meta.

Investors in the region assessed recent economic data, with the Caixin China Manufacturing PMI for October coming in at 50.3, surpassing the 49.7 estimate from a Reuters poll and rebounding from September’s 49.3. This reading indicates a return to expansion in manufacturing.

China’s CSI 300 gained 0.16%, and Hong Kong’s Hang Seng index advanced 0.74%.

In Japan, the Nikkei 225 fell over 2% and the Topix index dropped 1.33%, as the Bank of Japan maintained its benchmark rate at 0.25% on Thursday.

South Korea’s Kospi edged down 0.19%, with the tech-heavy Kosdaq falling 1.47%.

Taiwan’s Weighted Index saw a 1.51% decline, as Typhoon Kong-rey, the most severe storm in nearly three decades, impacted the island.

Overall, mixed regional data and adverse weather conditions added pressure to Asian markets amidst global market turbulence.

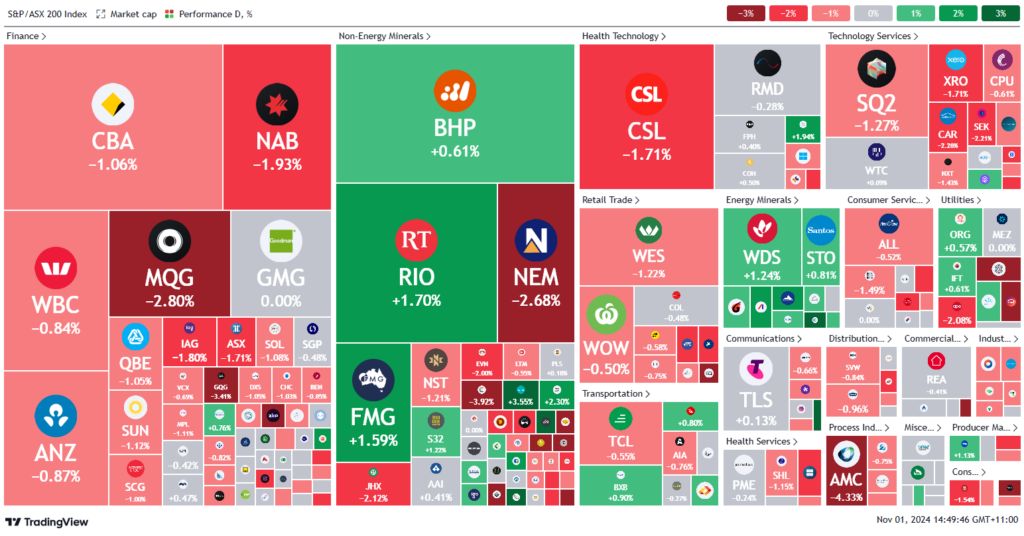

ASX Stocks

ASX 200 - 8,106.6 (-0.6%)

Key Highlights:

Australian shares fell to a seven-week low on Friday, with the S&P/ASX 200 down 0.9% or 75 points to 8085 by early afternoon, after declines earlier this week. Financials led the downturn as Macquarie Group dropped 4.3%, hitting a one-month low due to disappointing first-half FY25 profits and a dividend cut. The big four banks all declined over 1%, with National Australia Bank down 2.2%.

Materials limited losses despite lower iron ore prices; BHP was unchanged, while Rio Tinto and Fortescue rose 1.1% and 0.8%, respectively. December iron ore futures in Singapore dropped 1.1% to $US102.55 per tonne.

Energy stocks gained as oil prices surged amid renewed Middle East tensions. Woodside added 0.8% and Santos rose 0.4%.

Fletcher Building gained 0.7% despite legal action against its unit. Amcor fell 4.7% despite reaffirming its FY25 outlook. Tower dropped 3.7% after its CEO announced his departure. Pengana Capital plunged 6.4% following its buyback limit proposal, while Capricorn Metals gained 1.2% after a $200 million share placement.

Leaders

CIA Champion Iron Ltd (+4.18%)

SMR Stanmore Resources Ltd (+3.98%)

IPX Iperionx Ltd (+3.03%)

MAQ Macquarie Technology Group Ltd (+2.85%)

HLI Helia Group Ltd (+2.46%)

Laggards

MCY Mercury NZ Ltd (-5.29%)

WGX Westgold Resources Ltd (-4.97%)

CSC Capstone Copper Corp (-4.56%)

CTD Corporate Travel Management Ltd (-4.44%)

AMC Amcor Plc (-4.27%)