What's Affecting Markets Today

Asia-Pacific markets mostly advanced on Tuesday, taking cues from Wall Street as investors anticipated strong results from megacap technology firms to support the Nasdaq Composite’s upward momentum.

Japan’s Nikkei 225 rose 0.77% to close at 38,903.68, while the Topix gained 0.91% to finish at 2,682.02. These gains followed a significant shift in Japan’s political landscape, as the ruling Liberal Democratic Party lost its parliamentary majority for the first time since 2009. Additionally, Japan’s jobless rate fell slightly to 2.4% in September, beating Reuters’ forecast of 2.5%.

South Korea’s Kospi reversed early losses to close up 0.21% at 2,617.8, while the Kosdaq added 0.5% to 744.18. Australia’s S&P/ASX 200 increased 0.34% to 8,249.2, marking its third consecutive day of gains.

In China, the Hang Seng Index in Hong Kong rose 0.35% as the session neared its end, but mainland China’s CSI 300 dipped 1% to close at 3,924.65.

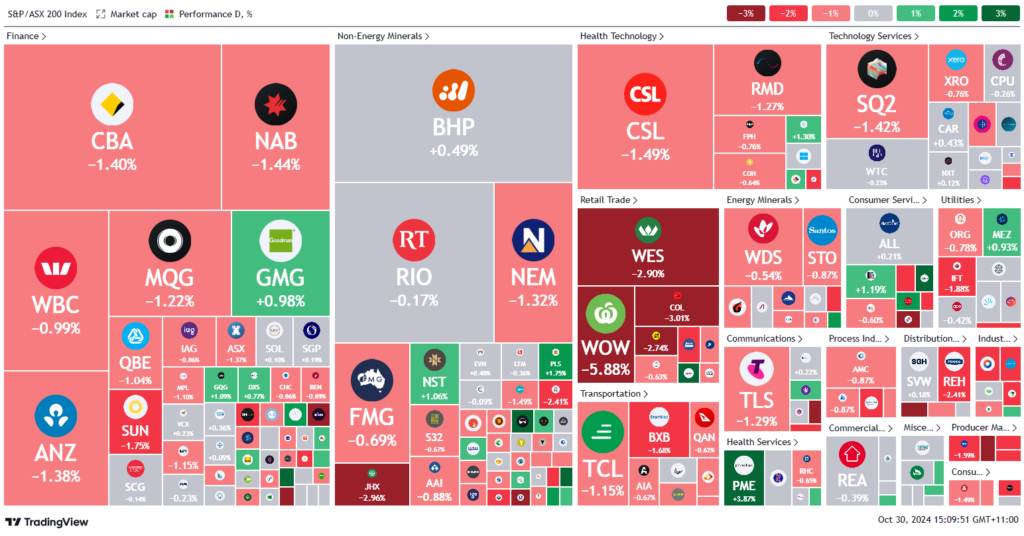

ASX Stocks

ASX 200 - 8,174.7 (-0.9%)

Key Highlights:

The Australian sharemarket advanced, following Wall Street’s gains, as consumer discretionary and mining stocks led the rally. By early afternoon, the S&P/ASX 200 Index was up 0.5 percent, adding 41.6 points to reach 8263.1.

Consumer sector gains were fueled by Myer’s agreement to acquire Premier Investments’ apparel brands across Australia and New Zealand, with Premier shares soaring 11 percent, the ASX 200’s top performer, while Myer’s shares steadied after an initial 7 percent rise.

In mining, Mineral Resources surged 8.3 percent, paring its monthly loss to 28 percent, amid founder Chris Ellison’s tax investigation. Energy stocks saw limited gains after Brent crude dropped 6 percent to $71 a barrel following an Israeli military strike on Iranian targets.

Among other notable moves, BlueScope Steel fell 0.5 percent after trimming its profit forecast due to cost inflation, while online retailer Cettire slid 13 percent on weaker-than-expected earnings, with adjusted EBITDA at $2 million.

Leaders

DTL Data#3 Ltd (+6.74%)

ZIM Zimplats Holdings Ltd (+5.56%)

DEG De Grey Mining Ltd (+3.97%)

PME Pro Medicus Ltd (+3.80%)

LOV Lovisa Holdings Ltd (+3.70%)

Laggards

SGR The Star Entertainment Group Ltd (-14.15%)

WOW Woolworths Group Ltd (-6.00%)

MYR Myer Holdings Ltd (-5.76%)

LTR Liontown Resources Ltd (-5.62%)

ANN Ansell Ltd (-4.54%)