What's Affecting Markets Today

Asia-Pacific markets mostly advanced on Friday, with investors focused on Japan’s upcoming general election and key economic data. Japan released October inflation figures for Tokyo, often seen as a precursor to nationwide trends, ahead of the Bank of Japan’s monetary policy meeting on Oct. 30-31.

Tokyo’s headline inflation fell to 1.8% in October from 2.2% in September, while core inflation, excluding fresh food prices, eased to 1.8% from 2.0%. Reuters-polled economists had anticipated a slight slowdown to 1.7% for core inflation. Following the report, Japan’s Nikkei 225 fell 0.85%, and the Topix declined 0.89%, marking a fifth consecutive day of losses.

Elsewhere in the region, South Korea’s Kospi added 0.30%, while the small-cap Kosdaq lost 0.85% after an initial rally. Hong Kong’s Hang Seng index rebounded 0.65%, recovering from Thursday’s losses, and mainland China’s CSI 300 posted a marginal gain, showing resilience amid regional economic uncertainties.

ASX Stocks

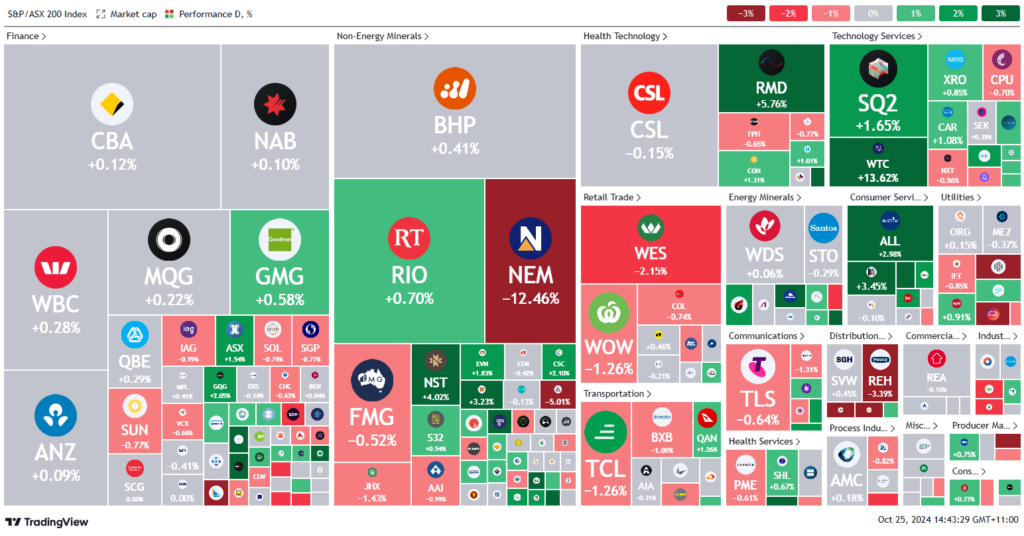

ASX 200 - 8,218.5 (+0.1%)

Key Highlights:

Australian shares rose by midday Friday, driven by a 14% surge in WiseTech following CEO Richard White’s sudden exit. The S&P/ASX 200 gained 0.4% or 35.2 points to 8241.5, bouncing back from Thursday’s 0.1% loss but set for a 0.5% weekly decline. Technology led nine advancing sectors, rising 4%.

WiseTech shares saw their best day in two months as brokers upgraded ratings overnight. White’s resignation, responding to misconduct allegations, was a “governance-positive move,” said Bell Potter’s Chris Savage. Miners Rio Tinto and BHP added 1% and 0.5%, respectively, while Mineral Resources dropped 6% following reports of executives purchasing equipment at discounts. Gold miner Newmont fell 11% after a Q3 earnings miss.

Financials recovered early losses with Westpac and ANZ up 0.8%; Bank of Queensland fell 3.6% ex-dividend. Metcash dropped 2.6% amid cost-cutting plans in its hardware unit.

Notable gains included ResMed, up 5.6% on demand for sleep devices, and Cleanaway, rising 0.2% on reiterated 2025 guidance.

Leaders

WA1: WA1 Resources Ltd (+16.44%)

WTC: Wisetech Global Ltd (+13.67%)

HMC: HMC Capital Ltd (+10.32%)

CU6: Clarity Pharmaceuticals Ltd (+7.84%)

WHC: Whitehaven Coal Ltd (+6.85%)

Laggards

NEM: Newmont Corporation (-12.17%)

MCY: Mercury NZ Ltd (-4.41%)

PYC: PYC Therapeutics Ltd (-3.85%)

MIN: Mineral Resources Ltd (-3.73%)

BOQ: Bank of Queensland Ltd (-3.41%)