What's Affecting Markets Today

Asia-Pacific markets mostly declined Thursday, following a sharp drop in U.S. stocks, with the Dow Jones posting its worst performance in over a month.

South Korea narrowly avoided a technical recession, with third-quarter GDP growth of 0.1%, missing Reuters’ forecast of 0.5%. The economy grew 1.5% year-on-year, below the expected 2% rise.

South Korea’s Kospi slipped 0.15%, while the Kosdaq fell 0.65%. Japan’s Nikkei 225 gained 0.13%, despite earlier losses, while the Topix lost 0.21%. Hong Kong’s Hang Seng dropped 0.63%, and China’s CSI 300 declined 0.93%.

ASX Stocks

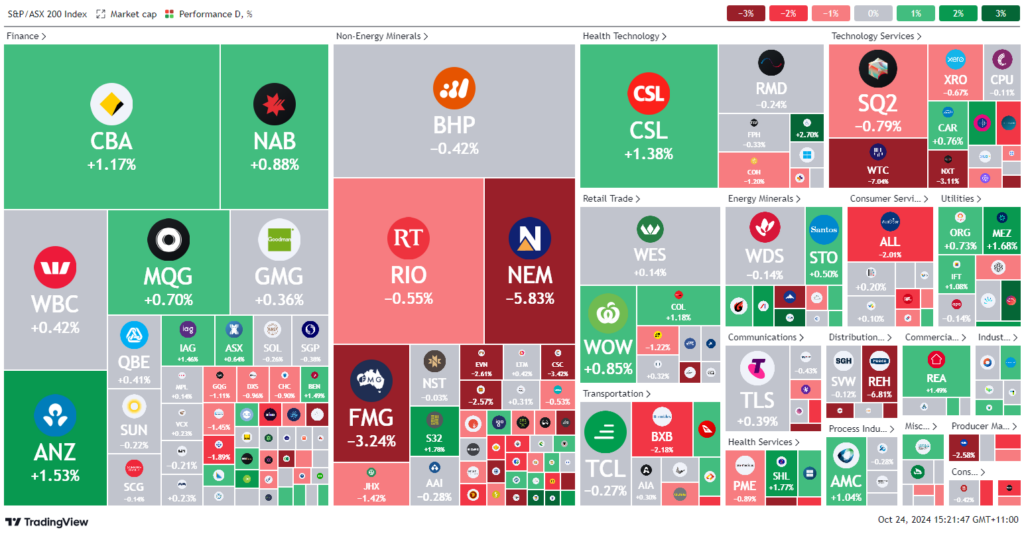

ASX 200 - 8,220.8 (+0.1%)

Key Highlights:

Australian shares edged higher at midday, with the S&P/ASX 200 up 10 points to 8233 after a weak start. A recovery in the banking sector, particularly Commonwealth Bank’s 1.2% rise, offset broader market declines. Technology stocks dropped 2%, following the overnight fall of US mega-caps like Nvidia and Apple.

Gold miner Newmont plunged 7.5% after its quarterly earnings missed Wall Street estimates. Fortescue fell 1.6% despite record iron ore shipments, as rising costs raised investor concerns. Meanwhile, Super Retail shares dropped 2.2% despite sales growth, with the company warning of consumer uncertainty.

In corporate updates, HMC Capital halted trading as it prepares to raise $300 million for its $1.93 billion acquisition of Sydney-based Global Switch Australia. Bathroom supplier Reece and pallet maker Brambles are among the worst performing after all disappointing the market with updates

Leaders

WAF West African Resources Ltd (+4.15%)

BCI BCI Minerals Ltd (+3.33%)

ZIM Zimplats Holdings Ltd (+3.12%)

CEN Contact Energy Ltd (+3.01%)

TLX TELIX Pharmaceuticals Ltd (+2.82%)

Laggards

CTT Cettire Ltd (-8.44%)

WA1 WA1 Resources Ltd (-6.84%)

REH Reece Ltd (-6.44%)

NEM Newmont Corporation (-5.70%)

WTC Wisetech Global Ltd (-5.09%)