What's Affecting Markets Today

Asian Markets Mixed

Asia-Pacific markets opened mixed on Friday as investors weighed economic data from China and Japan. China’s third-quarter GDP growth rate came in at 4.6% year-over-year, slightly surpassing economist forecasts but down from 4.7% in the previous quarter. This marked the slowest pace since mid-2023, pushing the economy further away from Beijing’s 5% annual growth target. Additionally, China’s house prices fell 5.8% in September, a steeper decline compared to August’s 5.3% drop.

Despite these figures, mainland China’s CSI 300 rose 0.7%, while Hong Kong’s Hang Seng index gained 1.3% in volatile trading as investors digested the news.

In Japan, September’s inflation rate reached 2.5%, with core CPI—excluding fresh food prices—rising 2.4%, slightly above market expectations. The Nikkei 225 increased by 0.4%, and the Topix index edged up 0.3%.

Meanwhile, South Korea’s markets saw declines, with the Kospi down 0.4% and the smaller Kosdaq dropping 1.4% as market sentiment turned cautious.

ASX Stocks

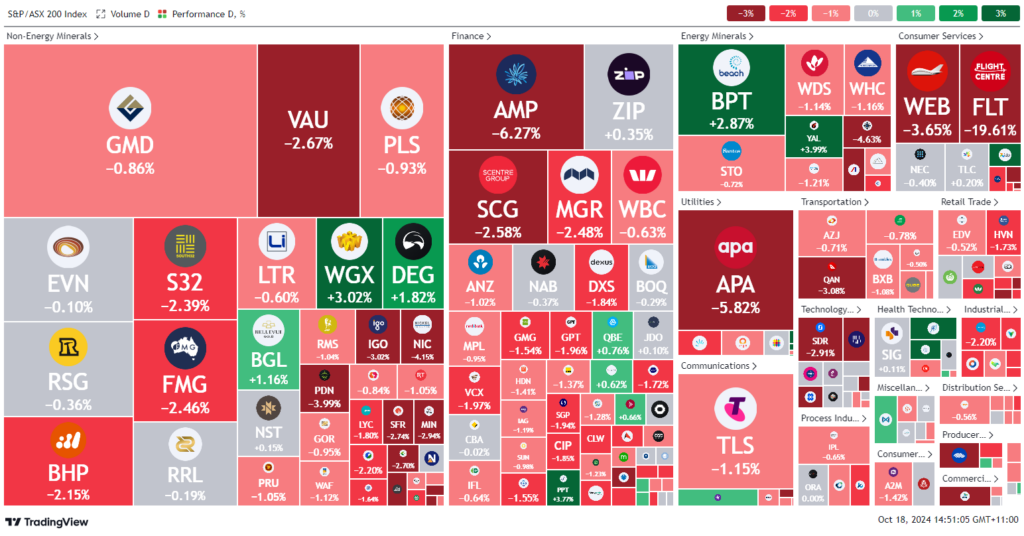

ASX 200 - 8,266.9 (-1.1%)

Key Highlights:

Australian shares extended losses into the early afternoon, as weak Chinese economic data weighed on market sentiment, hitting commodity stocks particularly hard. The S&P/ASX 200 dropped 0.9%, or 73.6 points, to 8282.3, retreating from the previous session’s record close of 8355.9. All sectors traded in the red, with Utilities leading the declines, driven by a 6% slump in APA Group after major shareholder Unisuper offloaded $500 million in shares.

Commodity stocks saw notable losses, with BHP down 1.7%, Rio Tinto 0.6%, and Fortescue 1.5%, amid falling iron ore prices. Flight Centre plunged 20% after a disappointing trading update, marking its steepest drop since the pandemic. Harvey Norman fell 1.2% after losing a legal case over misleading advertising.

Gold miners were among the few bright spots, with De Grey Mining up 2.3% and Bellevue Gold rising 1.8% following record gold prices. Meanwhile, Telix Pharmaceuticals jumped 3.4% on plans for a Nasdaq listing, and Beach Energy gained 2% after its trading update.

Leaders

CU6 Clarity Pharmaceuticals Ltd (+4.76%)

MCY Mercury NZ Ltd (+4.28%)

YAL Yancoal Australia Ltd (+4.15%)

MEZ Meridian Energy Ltd (+3.96%)

OBM Ora Banda Mining Ltd (+3.95%)

Laggards

FLT Flight Centre Travel Group Ltd (-19.75%)

AAI Alcoa Corporation (-7.76%)

CTD Corporate Travel Management Ltd (-7.63%)

APA APA Group (-5.83%)

AMP AMP Ltd (-5.49%)