What's Affecting Markets Today

Asian markets drift lower

Asia-Pacific markets mostly traded lower Wednesday, led by Japan’s Nikkei, which fell up to 2%, following Wall Street’s declines. Investors remain focused on potential stimulus measures to support China’s real estate sector ahead of a press briefing by the housing minister scheduled for Thursday.

Hong Kong’s Hang Seng Index gained 0.5%, bolstered by a 5.7% rise in the Hang Seng Mainland Properties Index, while attention shifts to Chief Executive John Lee’s policy address at 11 a.m. local time, expected to prioritize economic recovery.

In economic updates, New Zealand’s Q3 consumer price index rose 2.2% year-on-year, aligning with expectations, and edged up 0.6% quarter-on-quarter, slightly below forecasts. South Korea’s unemployment rate ticked up to 2.5% in September from 2.4% in August.

Mainland China’s CSI index slipped 0.9%, extending the previous session’s 2.7% loss, while Taiwan’s Weighted Index fell 1.04%, pressured by weakness in the technology sector.

ASX Stocks

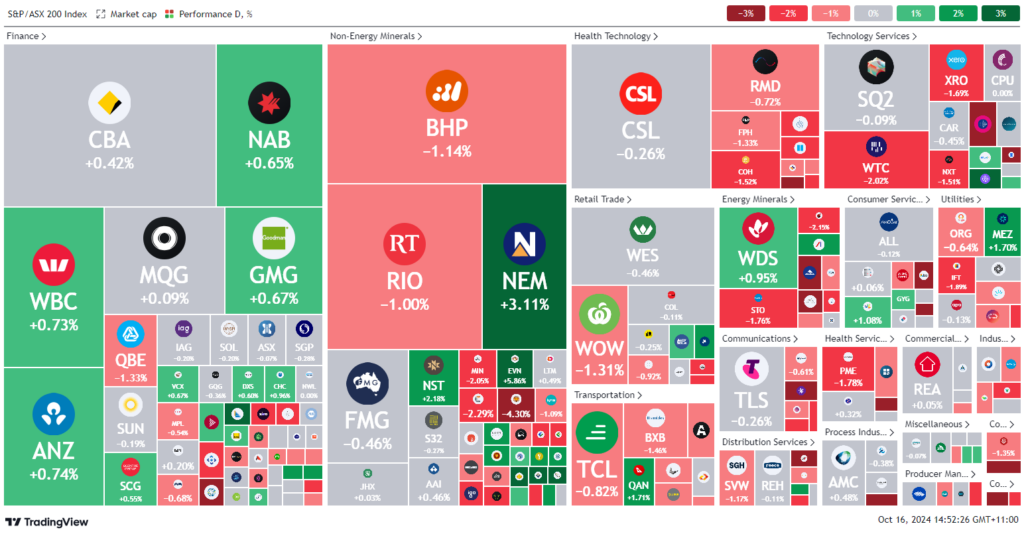

ASX 200 - 8,284.7 (-0.4%)

Key Highlights:

Australian shares trimmed losses but remained down in early afternoon trade on Wednesday, driven by a tech sector slump after a surprise report from Dutch chipmaker ASML raised concerns over the global AI boom. The S&P/ASX 200 fell 0.1% to 8309, retreating from Tuesday’s record close of 8318.4.

Commodity stocks weakened as a 4% overnight drop in oil prices hit sentiment. Brent crude and WTI both recovered 0.4% in Asia, yet Beach Energy fell 1.5%, Origin dipped 0.6%, and Santos lost 1.8%. Woodside gained 1.1% after raising full-year production guidance.

Gold miners Evolution Mining and Regis surged over 5% as prices neared record highs, while Rio Tinto, BHP, and Fortescue slipped despite stronger iron ore prices.

Financials led gains, with Bank of Queensland up 6% on a 130% annual profit jump. Pro Medicus declined 1.9%, and Orora dropped 3.5% amid ongoing volume weakness in Europe.

Leaders

SLC Superloop Ltd (+8.74%)

BOQ Bank of Queensland Ltd (+5.74%)

EVN Evolution Mining Ltd (+5.65%)

RRL Regis Resources Ltd (+5.42%)

GMD Genesis Minerals Ltd (+5.29%)

Laggards

DRO Droneshield Ltd (-7.05%)

NCK Nick Scali Ltd (-6.06%)

PNR Pantoro Ltd (-6.00%)

IEL Idp Education Ltd (-5.63%)

IPX Iperionx Ltd (-5.54%)