What's Affecting Markets Today

China stocks lead Asian markets lower

China stocks led losses in Asia-Pacific markets on Friday, as investors reacted to a U.S. inflation report that weighed on Wall Street overnight. The CSI 300 index fell 2.77% to 3,887.17, closing the week 3.25% lower as stimulus-fueled momentum continued to fade.

China’s Ministry of Finance will hold a press conference on Saturday to unveil a new fiscal stimulus package aimed at revitalizing the economy. While it will be a working day in China, markets will be closed.

In South Korea, the Bank of Korea cut its benchmark interest rate by 25 basis points to 3.25%, marking the end of a multi-year tightening cycle. This follows inflation cooling to 1.6% in September, below the central bank’s 2% target.

Oil prices retreated after surging over 3% on Thursday due to increased fuel demand and rising geopolitical risks. Brent crude slipped 0.35% to $79.11 a barrel, while WTI fell 0.34% to $75.60.

Japan’s Nikkei 225 gained 0.57%, driven by financials and healthcare, while South Korea’s Kospi closed slightly lower at 2,596.91.

ASX Stocks

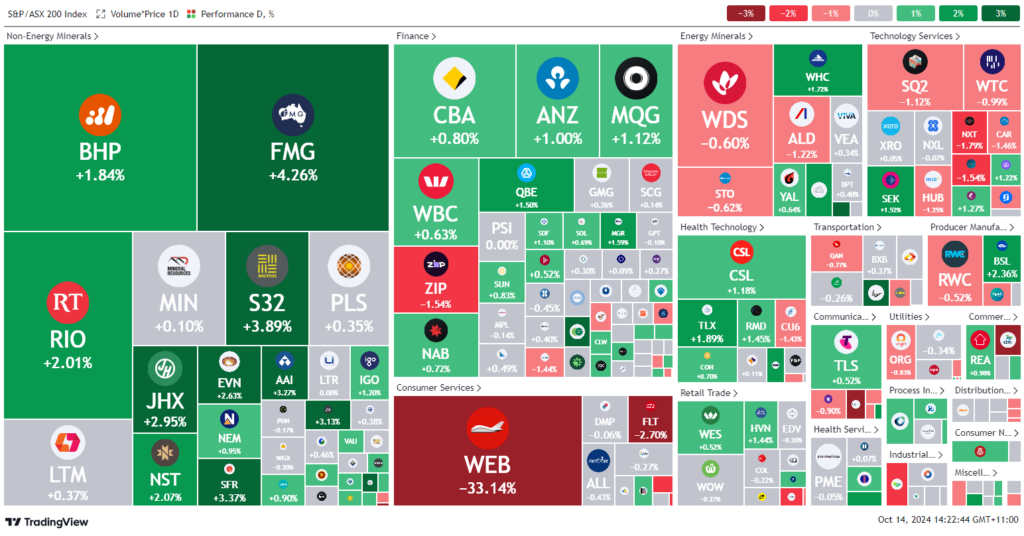

ASX 200 - 8,264.4 (+0.6%)

Key Highlights:

Mining stocks have driven a late rally on the ASX, pushing the index closer to its record high set last month. In late afternoon trading, the S&P/ASX 200 was up 44.3 points, or 0.5%, at 8240, nearing its previous high of 8269.85 from September 30. Mining shares led the way, rising 1.5% after being flat for much of the session.

China’s Ministry of Finance announced further economic stimulus measures over the weekend, while weaker-than-expected inflation data, including a 2.8% year-on-year drop in the Producer Price Index, strengthened the case for more government intervention.

Iron ore prices rebounded with futures in Singapore climbing 0.6% to $US106.80, boosting BHP and Rio Tinto by 1% each, and lifting Fortescue 3.8% to $20.20.

Gold miners, including Regis Resources, Bellevue Gold, and West African Resources, gained around 3%, following a 1% rise in gold prices last week.

Meanwhile, Web Travel Group dropped 29.5% to $4.96 after a results update revealed continued margin pressure in its European WebBeds division.

Leaders

VUL: Vulcan Energy Resources Ltd (+8.84%)

RRL: Regis Resources Ltd (+5.56%)

OBM: Ora Banda Mining Ltd (+5.56%)

BGL: Bellevue Gold Ltd (+4.78%)

FMG: Fortescue Ltd (+4.16%)

Laggards

WEB: WEB Travel Group Ltd (-33.29%)

CMW: Cromwell Property Group (-4.60%)

TAH: Tabcorp Holdings Ltd (-4.55%)

SGR: The Star Entertainment Group Ltd (-3.70%)

SNL: Supply Network Ltd (-3.44%)