What's Affecting Markets Today

China falls during volatile session

Chinese stocks experienced another volatile session on Wednesday, with the CSI 300 tumbling 5.3% and Hong Kong’s Hang Seng Index falling 1.4%. The HSI extended Tuesday’s steep decline, which saw its worst drop in 16 years, closing down 9.41%.

Japan’s markets moved higher, with the Nikkei 225 up 0.78% and the Topix advancing 0.18%. Investors focused on policy updates from the Reserve Bank of New Zealand (RBNZ) and Reserve Bank of India (RBI). The RBNZ cut its policy rate by 50 basis points to 4.75%, while the RBI is expected to maintain its rate at 6.5%. South Korean markets remained closed for a public holiday.

U.S. markets gained overnight as oil prices retreated. The S&P 500 rose 0.97%, the Nasdaq Composite increased 1.45%, and the Dow Jones Industrial Average added 0.3%. West Texas Intermediate oil futures dropped 4.6% amid concerns over Israel’s anticipated response to Iran missile attacks and U.S. efforts to prevent broader regional conflict.

ASX Stocks

ASX 200 - 8,187.2 (+0.1%)

Key Highlights:

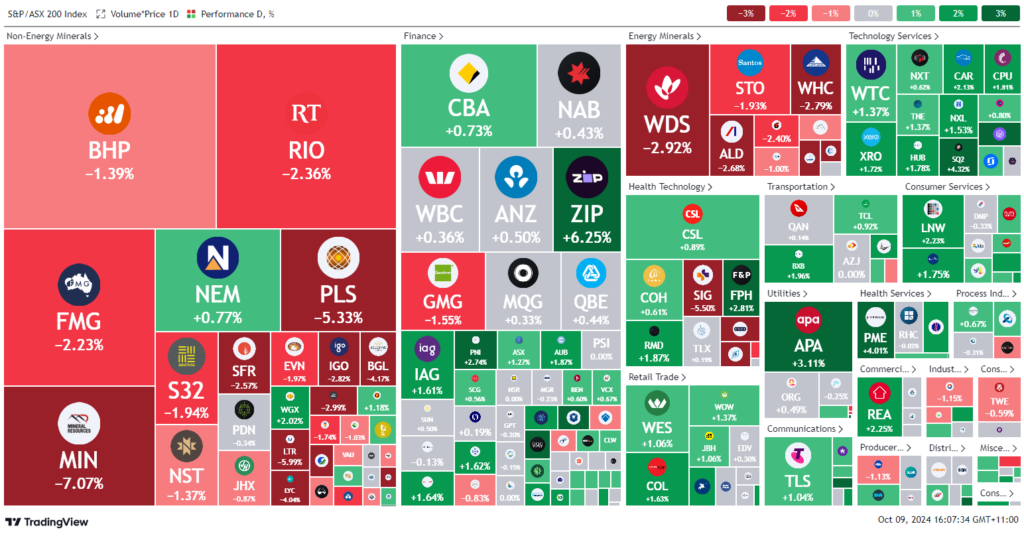

Australian shares edged higher on Wednesday afternoon, as gains in consumer discretionary and utilities stocks outweighed weaker performance in the commodities sector. The S&P/ASX 200 Index rose 0.1%, or 5 points, to 8181.9 by early afternoon, supported by eight of the 11 sectors. A Wall Street rally, driven by a 4.1% gain in Nvidia, also lifted market sentiment.

The consumer discretionary sector gained 1.2%, with Wesfarmers up 1.2% and Aristocrat Leisure advancing 2%. Utilities saw a 2.5% rise in APA Group after the Australian Energy Regulator’s decision to maintain light regulation for its South West Queensland Pipeline.

However, weaker commodity prices weighed on the market. Energy stocks dropped 2.3%, as oil prices fell over 4% following subdued stimulus measures from China. Woodside Energy declined 2.6%, and Santos fell 2.1%. Mining stocks also lagged, with BHP and Rio Tinto down 1.7% and 3.3%, respectively, as iron ore prices dropped. Mineral Resources fell 8% following a JPMorgan downgrade on lithium price forecasts.

Leaders

ZIP ZIP Co Ltd (+6.62%)

SNZ Summerset Group Holdings Ltd (+4.82%)

VSL Vulcan Steel Ltd (+4.79%)

KLS Kelsian Group Ltd (+4.51%)

SQ2 Block Inc (+4.32%)

Laggards

MIN Mineral Resources Ltd (-7.38%)

MSB Mesoblast Ltd (-6.14%)

WA1 WA1 Resources Ltd (-5.71%)

LTR Liontown Resources Ltd (-5.39%)

PLS Pilbara Minerals Ltd (-5.33%)