What's Affecting Markets Today

Nikkei rebounds after Mondays falls

Asia-Pacific markets extended gains on Wednesday, following Wall Street’s recovery from a three-day losing streak. Japanese stocks led the region, with the Nikkei 225 climbing 2.8% and the Topix rising over 4%, driven by a rebound that saw the Nikkei post its strongest day since October 2008, surging 10.2% on Tuesday. Major Japanese trading houses continued their upward momentum, with Marubeni jumping 11% and Softbank Group gaining 8%. Canon Inc. led tech stocks, up more than 12%.

In a speech, Bank of Japan Deputy Governor Uchida Shinichi emphasized the need for continued monetary easing amidst volatile financial markets. The Ministry of Finance revealed record yen-buying interventions on April 29 and May 1, selling $44.19 billion in total.

Elsewhere, Hong Kong’s Hang Seng rose over 1%, and South Korea’s Kospi gained more than 2.5%, with Samsung Electronics up 4.5% after its HBM3E chips cleared Nvidia’s AI processor tests.

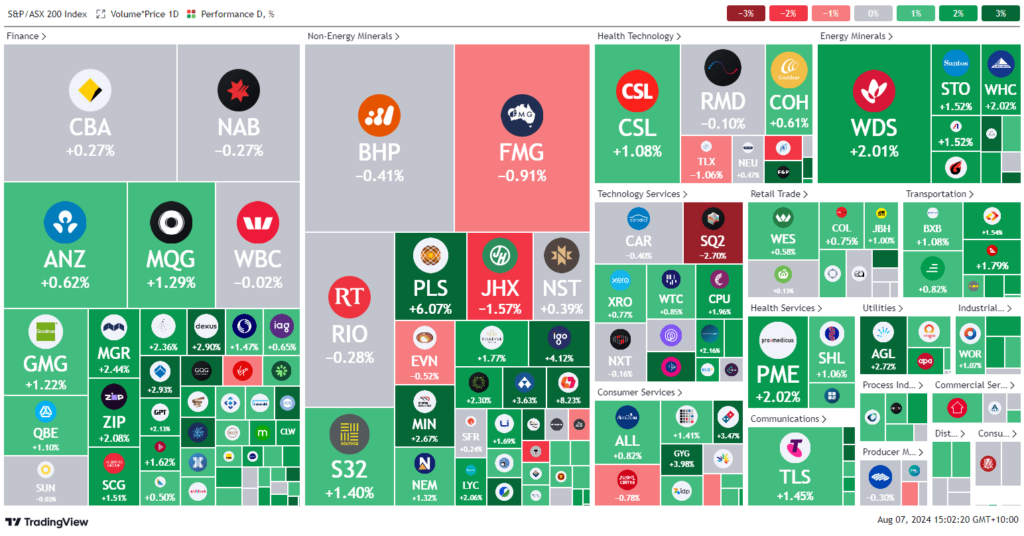

ASX Stocks

ASX 200 - 7,713.9 (+0.4%)

Key Highlights:

Australian shares rose in early afternoon trading, buoyed by positive sentiment from Wall Street and Asia as investors reassess market and interest rate outlooks. The S&P/ASX 200 gained 0.6%, or 42.9 points, to 7723.5, reversing a 0.3% loss at the open. This follows a 0.4% rebound in the previous session after Monday’s sharp sell-off.

Optimism grew after a Bank of Japan official indicated no imminent rate hikes amid market instability. The Reserve Bank of Australia kept rates at 4.35%, though traders are betting on potential easing by year-end.

All 11 ASX sectors were in the green, led by energy. Mining stocks had a volatile session, mirroring iron ore prices, with Rio Tinto, BHP, and Fortescue declining. Goodman Group and GPT advanced in the property sector, while Woodside shares surged 2.2% after a major U.S. acquisition. Fisher & Paykel Healthcare rose 3.6%, and Arcadium Lithium jumped 7.5% on positive operational news.

Leaders

LTM Arcadium Lithium Plc (+7.48%)

TUA Tuas Ltd (+6.07%)

PLS Pilbara Minerals Ltd (+5.89%)

SLX SILEX Systems Ltd (+5.69%)

WA1 WA1 Resources Ltd (+4.57%)

Laggards

QAL Qualitas Ltd (-4.66%)

DRO Droneshield Ltd (-3.66%)

BFL BSP Financial Group Ltd (-3.52%)

SPR Spartan Resources Ltd (-3.10%)

CSC Capstone Copper Corp (-3.06%)